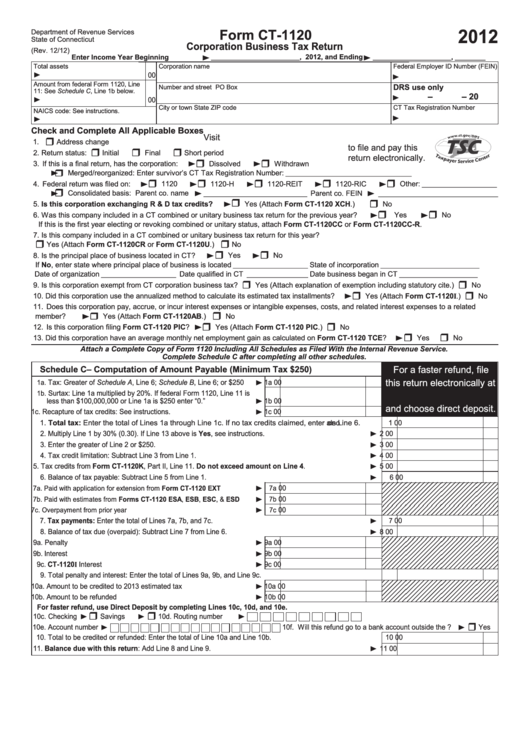

Form Ct-1120 - Corporation Business Tax Return - 2012

ADVERTISEMENT

2012

Form CT-1120

Department of Revenue Services

State of Connecticut

Corporation Business Tax Return

(Rev. 12/12)

Enter Income Year Beginning

, 2012, and Ending

,

__________________________

_______________________

_________

Total assets

Corporation name

Federal Employer ID Number (FEIN)

00

Amount from federal Form 1120, Line

DRS use only

Number and street

PO Box

11: See Schedule C, Line 1b below.

–

– 20

00

City or town

State

ZIP code

CT Tax Registration Number

NAICS code: See instructions.

Check and Complete All Applicable Boxes

Visit

1.

Address change

to file and pay this

2. Return status:

Initial

Final

Short period

return electronically.

3. If this is a final return, has the corporation:

Dissolved

Withdrawn

Merged/reorganized: Enter survivor’s CT Tax Registration Number:

_____________________________________

4. Federal return was filed on:

1120

1120-H

1120-REIT

1120-RIC

Other:

______________________

Consolidated basis: Parent co. name

Parent co. FEIN

________________________________

_____________________________________

5. Is this corporation exchanging R & D tax credits?

Yes (Attach Form CT-1120 XCH.)

No

6. Was this company included in a CT combined or unitary business tax return for the previous year?

Yes

No

If this is the first year electing or revoking combined or unitary status, attach Form CT-1120CC or Form CT-1120CC-R.

7. Is this company included in a CT combined or unitary business tax return for this year?

Yes (Attach Form CT-1120CR or Form CT-1120U.)

No

8. Is the principal place of business located in CT?

Yes

No

If No, enter state where principal place of business is located

State of incorporation

______________________

_____________________________

Date of organization

Date qualified in CT

Date business began in CT

______________________

__________________

_______________________

9. Is this corporation exempt from CT corporation business tax?

Yes (Attach explanation of exemption including statutory cite.)

No

10. Did this corporation use the annualized method to calculate its estimated tax installments?

Yes (Attach Form CT-1120I.)

No

11. Does this corporation pay, accrue, or incur interest expenses or intangible expenses, costs, and related interest expenses to a related

member?

Yes (Attach Form CT-1120AB.)

No

12. Is this corporation filing Form CT-1120 PIC?

Yes (Attach Form CT-1120 PIC.)

No

13. Did this corporation have an average monthly net employment gain as calculated on Form CT-1120 TCE?

Yes

No

Attach a Complete Copy of Form 1120 Including All Schedules as Filed With the Internal Revenue Service.

Complete Schedule C after completing all other schedules.

Schedule C – Computation of Amount Payable (Minimum Tax $250)

For a faster refund, file

this return electronically at

Tax: Greater of Schedule A, Line 6; Schedule B, Line 6; or $250 .......

1a

00

1a.

1b.

Surtax: Line 1a multiplied by 20%. If federal Form 1120, Line 11 is

less than $100,000,000 or Line 1a is $250 enter “0.” ..........................

1b

00

and choose direct deposit.

1c. Recapture of tax credits: See instructions. ..........................................

1c

00

1. Total tax: Enter the total of Lines 1a through Line 1c. If no tax credits claimed, enter also on Line 6. .........

1

00

2. M ultiply Line 1 by 30% (0.30). If Line 13 above is Yes, see instructions. ...................................................

2

00

3. E nter the greater of Line 2 or $250. ............................................................................................................

3

00

4. T ax credit limitation: Subtract Line 3 from Line 1. .......................................................................................

4

00

5. Tax credits from Form CT-1120K, Part II, Line 11. Do not exceed amount on Line 4. ...........................

5

00

6. B alance of tax payable: Subtract Line 5 from Line 1.

......................................................................................

6

00

00

7a. Paid with application for extension from Form CT-1120 EXT .................

7a

00

7b. Paid with estimates from Forms CT-1120 ESA, ESB, ESC, & ESD ........

7b

00

7c. Overpayment from prior year ...................................................................

7c

7. Tax payments: Enter the total of Lines 7a, 7b, and 7c.

....................................................................................

7

00

8. B alance of tax due (overpaid): Subtract Line 7 from Line 6. ......................................................................

8

00

9a. Penalty ................................................................................................

9a

00

9b. Interest ................................................................................................

9b

00

9c. CT-1120I Interest ................................................................................

9c

00

9. T otal penalty and interest: Enter the total of Lines 9a, 9b, and Line 9c. ...........................................................

9

00

10a. Amount to be credited to 2013 estimated tax ....................................

10a

00

10b. Amount to be refunded ......................................................................

10b

00

For faster refund, use Direct Deposit by completing Lines 10c, 10d, and 10e.

10c. C hecking

Savings

10d. Routing number

10e. Account number

10f. Will this refund go to a bank account outside the U.S.?

Yes

10. T otal to be credited or refunded: Enter the total of Line 10a and Line 10b.

10

00

.................................................................

11. Balance due with this return: Add Line 8 and Line 9. .............................................................................

11

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3