Form 211-T - Schedule Of Earnings Outside Of Fayette County - 2000

ADVERTISEMENT

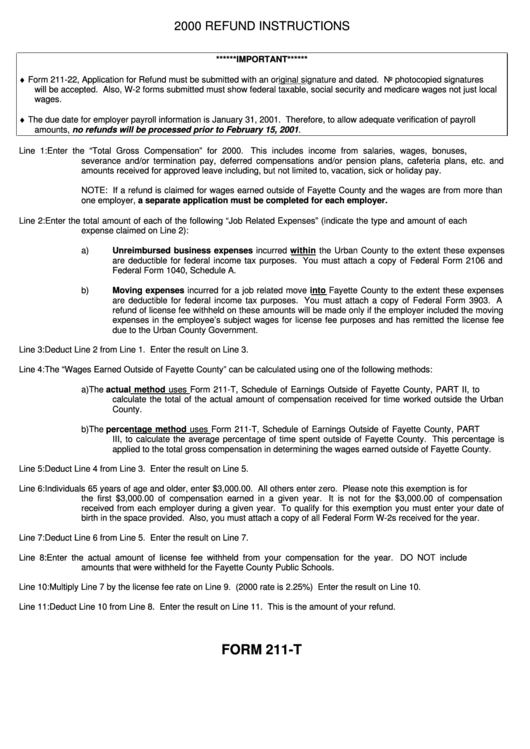

2000 REFUND INSTRUCTIONS

******IMPORTANT******

♦

Form 211-22, Application for Refund must be submitted with an original signature and dated. No photocopied signatures

will be accepted. Also, W-2 forms submitted must show federal taxable, social security and medicare wages not just local

wages.

♦

The due date for employer payroll information is January 31, 2001. Therefore, to allow adequate verification of payroll

amounts, no refunds will be processed prior to February 15, 2001.

Line 1:

Enter the “Total Gross Compensation” for 2000.

This includes income from salaries, wages, bonuses,

severance and/or termination pay, deferred compensations and/or pension plans, cafeteria plans, etc. and

amounts received for approved leave including, but not limited to, vacation, sick or holiday pay.

NOTE: If a refund is claimed for wages earned outside of Fayette County and the wages are from more than

one employer, a separate application must be completed for each employer.

Line 2:

Enter the total amount of each of the following “Job Related Expenses” (indicate the type and amount of each

expense claimed on Line 2):

a)

Unreimbursed business expenses incurred within the Urban County to the extent these expenses

are deductible for federal income tax purposes. You must attach a copy of Federal Form 2106 and

Federal Form 1040, Schedule A.

b)

Moving expenses incurred for a job related move into Fayette County to the extent these expenses

are deductible for federal income tax purposes. You must attach a copy of Federal Form 3903. A

refund of license fee withheld on these amounts will be made only if the employer included the moving

expenses in the employee’s subject wages for license fee purposes and has remitted the license fee

due to the Urban County Government.

Line 3:

Deduct Line 2 from Line 1. Enter the result on Line 3.

Line 4:

The “Wages Earned Outside of Fayette County” can be calculated using one of the following methods:

a)

The actual method uses Form 211-T, Schedule of Earnings Outside of Fayette County, PART II, to

calculate the total of the actual amount of compensation received for time worked outside the Urban

County.

b)

The percentage method uses Form 211-T, Schedule of Earnings Outside of Fayette County, PART

III, to calculate the average percentage of time spent outside of Fayette County. This percentage is

applied to the total gross compensation in determining the wages earned outside of Fayette County.

Line 5:

Deduct Line 4 from Line 3. Enter the result on Line 5.

Line 6:

Individuals 65 years of age and older, enter $3,000.00. All others enter zero. Please note this exemption is for

the first $3,000.00 of compensation earned in a given year. It is not for the $3,000.00 of compensation

received from each employer during a given year. To qualify for this exemption you must enter your date of

birth in the space provided. Also, you must attach a copy of all Federal Form W-2s received for the year.

Line 7:

Deduct Line 6 from Line 5. Enter the result on Line 7.

Line 8:

Enter the actual amount of license fee withheld from your compensation for the year. DO NOT include

amounts that were withheld for the Fayette County Public Schools.

Line 10:

Multiply Line 7 by the license fee rate on Line 9. (2000 rate is 2.25%) Enter the result on Line 10.

Line 11:

Deduct Line 10 from Line 8. Enter the result on Line 11. This is the amount of your refund.

FORM 211-T

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3