Form Op-284 Mvc - Monthly Schedule K For Connecticut Vendors To Report New York State And Local Sales And Use Tax

ADVERTISEMENT

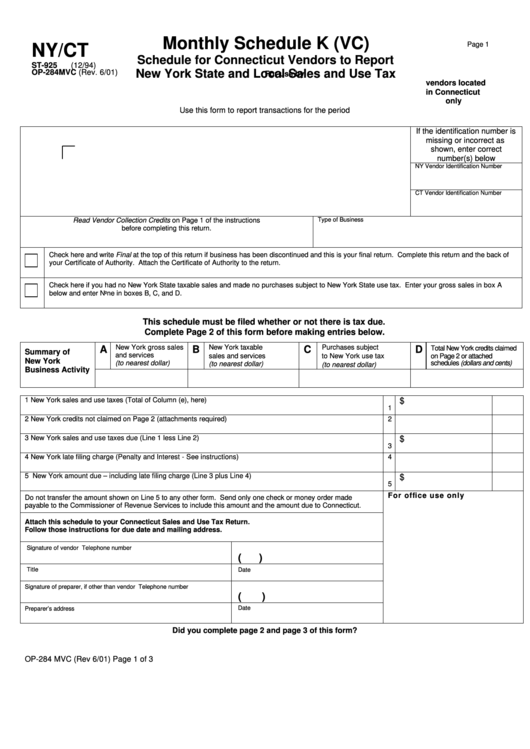

Monthly Schedule K (VC)

Page 1

NY/CT

Schedule for Connecticut Vendors to Report

ST-925

(12/94)

New York State and Local Sales and Use Tax

For use by

OP-284MVC (Rev. 6/01)

vendors located

in Connecticut

only

Use this form to report transactions for the period

If the identification number is

missing or incorrect as

shown, enter correct

number(s) below

NY Vendor Identification Number

CT Vendor Identification Number

Read Vendor Collection Credits on Page 1 of the instructions

Type of Business

before completing this return.

Check here and write Final at the top of this return if business has been discontinued and this is your final return. Complete this return and the back of

your Certificate of Authority. Attach the Certificate of Authority to the return.

Check here if you had no New York State taxable sales and made no purchases subject to New York State use tax. Enter your gross sales in box A

below and enter None in boxes B, C, and D.

This schedule must be filed whether or not there is tax due.

Complete Page 2 of this form before making entries below.

New York gross sales

New York taxable

Purchases subject

A

B

C

D

Total New York credits claimed

Summary of

and services

sales and services

to New York use tax

on Page 2 or attached

New York

schedules (dollars and cents)

(to nearest dollar)

(to nearest dollar)

(to nearest dollar)

Business Activity

1

New York sales and use taxes (Total of Column (e), here)...........................................................................................

$

1

2

New York credits not claimed on Page 2 (attachments required) .......................................................................

2

3

New York sales and use taxes due (Line 1 less Line 2) .....................................................................................

$

3

4

New York late filing charge (Penalty and Interest - See instructions) .................................................................

4

5

New York amount due – including late filing charge (Line 3 plus Line 4) ............................................................

$

5

For office use only

Do not transfer the amount shown on Line 5 to any other form. Send only one check or money order made

payable to the Commissioner of Revenue Services to include this amount and the amount due to Connecticut.

Attach this schedule to your Connecticut Sales and Use Tax Return.

Follow those instructions for due date and mailing address.

Signature of vendor

Telephone number

(

)

Title

Date

Signature of preparer, if other than vendor

Telephone number

(

)

Preparer’s address

Date

Did you complete page 2 and page 3 of this form?

OP-284 MVC (Rev 6/01)

Page 1 of 3

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3