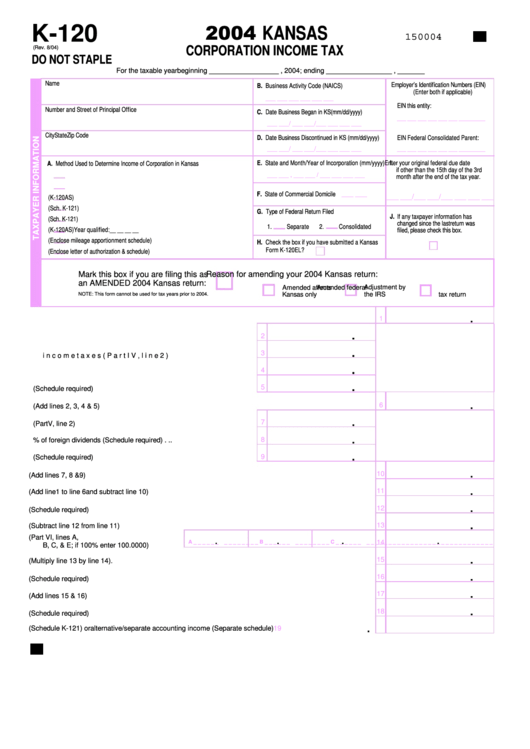

Form K-120 - Kansas Corporation Income Tax - 2004

ADVERTISEMENT

KANSAS

K-120

150004

(Rev. 8/04)

CORPORATION INCOME TAX

DO NOT STAPLE

For the taxable year beginning __________________ , 2004; ending _________________ , _______

Name

Employer’s Identification Numbers (EIN)

B. Business Activity Code (NAICS)

(Enter both if applicable)

___ ___ ___ ___ ___ ___

EIN this entity:

Number and Street of Principal Office

C. Date Business Began in KS (mm/dd/yyyy)

___ ___ ___ ___ ___ ___ ___ ___ ___

___ ___ / ___ ___/___ ___ ___ ___

City

State

Zip Code

D. Date Business Discontinued in KS (mm/dd/yyyy)

EIN Federal Consolidated Parent:

___ ___ / ___ ___/___ ___ ___ ___

___ ___ ___ ___ ___ ___ ___ ___ ___

E. State and Month/Year of Incorporation (mm/yyyy)

I.

Enter your original federal due date

A. Method Used to Determine Income of Corporation in Kansas

if other than the 15th day of the 3rd

___ ___ , ___ ___ / ___ ___ ___ ___

1.

Activity wholly within Kansas - Single entity

month after the end of the tax year.

2.

Activity wholly within Kansas - Consolidated

___ ___

F. State of Commercial Domicile

___ ___/___ ___/

___ ___ ___ ___

3.

Single entity apportionment method (K-120AS)

4.

Combined income method - Single corporation filing (Sch. K-121)

G. Type of Federal Return Filed

J.

If any taxpayer information has

5.

Combined income method - Multiple corporation filing (Sch. K-121)

changed since the last return was

1.

Separate

2.

Consolidated

6.

Qualified elective two-factor (K-120AS) Year qualified: __ __ __ __

filed, please check this box.

7.

Common carrier mileage (Enclose mileage apportionment schedule)

H. Check the box if you have submitted a Kansas

Form K-120EL?

8.

Alternative or separate accounting (Enclose letter of authorization & schedule)

Mark this box if you are filing this as

Reason for amending your 2004 Kansas return:

an AMENDED 2004 Kansas return:

Adjustment by

Amended affects

Amended federal

Kansas only

the IRS

tax return

NOTE: This form cannot be used for tax years prior to 2004.

.

1

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1. Federal taxable income

. . . . . . . . . . . . . . . . . . . . . . . . .

.

.

2. Total state and municipal interest

2

3. Taxes on or measured by income or fees or payments in lieu of

.

.

3

income taxes (Part IV, line 2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

.

4

. . . . . . . . . . . . . . . . . . . . . . .

4. Federal net operating loss deduction

.

.

5

. . . . .

5. Other additions to federal taxable income (Schedule required)

.

6

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Total additions to federal taxable income (Add lines 2, 3, 4 & 5)

.

7

. . . . . . . . . .

7. Interest on U.S. government obligations (Part V, line 2)

.

8

8. IRC Section 78 and 80% of foreign dividends (Schedule required) . . .

.

9

9. Other subtractions from federal taxable income (Schedule required)

.

10

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Total subtractions from federal taxable income (Add lines 7, 8 & 9)

.

. . . . . . . . . . . . . . . . . . . . . . .

11

11. Net income before apportionment (Add line 1 to line 6 and subtract line 10)

.

12

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Nonbusiness income -- Total company (Schedule required)

.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Apportionable business income (Subtract line 12 from line 11)

13

14. Average percent to Kansas (Part VI, lines A,

.

.

.

.

A __ __ __

__ __ __ __ B __ __ __

__ __ __ __

C __ __ __

__ __ __ __

14

___ ___ ___

___ ___ ___ ___

. . . . . . . .

B, C, & E; if 100% enter 100.0000)

.

15

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Amount to Kansas (Multiply line 13 by line 14).

.

16

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Nonbusiness income - Kansas (Schedule required)

.

17

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Kansas net income before NOL deduction (Add lines 15 & 16)

.

18

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Kansas net operating loss deduction (Schedule required)

.

. . . . . . .

19. Combined report (Schedule K-121) or alternative/separate accounting income (Separate schedule)

19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4