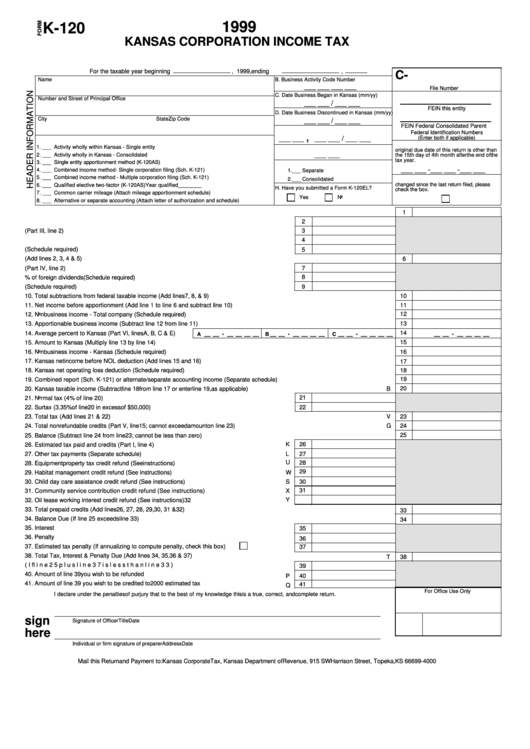

Form K-120 - Kansas Corporation Income Tax - 1999

ADVERTISEMENT

1999

K-120

KANSAS CORPORATION INCOME TAX

For the taxable year beginning

, 1999, ending

,

C-

Name

B. Business Activity Code Number

___ ___ ___ ___

File Number

C. Date Business Began in Kansas (mm/yy)

Number and Street of Principal Office

___ ___ / ___ ___

FEIN this entity

D. Date Business Discontinued in Kansas (mm/yy)

City

State

Zip Code

___ ___ / ___ ___

FEIN Federal Consolidated Parent

E. State and Month/Year of Incorporation

Federal Identification Numbers

,

___ ___

___ ___ / ___ ___

(Enter both if applicable)

A. Method Used to Determine Income of Corporation in Kansas

I. Enter your original federal due date if the

1. ___

Activity wholly within Kansas - Single entity

F. State of Commercial Domicile

original due date of this return is other than

___ ___

2. ___

Activity wholly in Kansas - Consolidated

the 15th day of 4th month after the end of the

tax year.

3. ___

Single entity apportionment method (K-120AS)

G. Type of Federal Return Filed

___ ___ - ___ ___ - ___ ___

4. ___

Combined income method - Single corporation filing (Sch. K-121)

1. ___ Separate

5. ___

Combined income method - Multiple corporation filing (Sch. K-121)

2. ___ Consolidated

J. If any information in this header has

changed since the last return filed, please

6. ___

Qualified elective two-factor (K-120AS) Year qualified ________

H. Have you submitted a Form K-120EL?

check the box.

7. ___

Common carrier mileage (Attach mileage apportionment schedule)

Yes

No

8. ___

Alternative or separate accounting (Attach letter of authorization and schedule)

1. Federal taxable income

1

2

2. Total state and municipal interest

3

3. Taxes on or measured by income or fees or payments in lieu of income taxes (Part III, line 2)

4

4. Federal net operating loss deduction

5. Other additions to federal taxable income (Schedule required)

5

6. Total additions to federal taxable income (Add lines 2, 3, 4 & 5)

6

7. Interest on obligations of the U.S. (Part IV, line 2)

7

8

8. IRC Section 78 and 80% of foreign dividends (Schedule required)

9. Other subtractions from federal taxable income (Schedule required)

9

10

10. Total subtractions from federal taxable income (Add lines 7, 8, & 9)

11. Net income before apportionment (Add line 1 to line 6 and subtract line 10)

11

12

12. Nonbusiness income - Total company (Schedule required)

13

13. Apportionable business income (Subtract line 12 from line 11)

_ _ . _ _ _ _

_ _ . _ _ _ _

_ _ . _ _ _ _

_ _ . _ _ _ _

14. Average percent to Kansas (Part VI, lines A, B, C & E)

14

A

B

C

15. Amount to Kansas (Multiply line 13 by line 14)

15

16. Nonbusiness income - Kansas (Schedule required)

16

17. Kansas net income before NOL deduction (Add lines 15 and 16)

17

18. Kansas net operating loss deduction (Schedule required)

18

19

19. Combined report (Sch. K-121) or alternate/separate accounting income (Separate schedule)

20

20. Kansas taxable income (Subtract line 18 from line 17 or enter line 19, as applicable)

B

21

21. Normal tax (4% of line 20)

22

22. Surtax (3.35% of line 20 in excess of $50,000)

23. Total tax (Add lines 21 & 22)

V

23

24. Total nonrefundable credits (Part V, line 15; cannot exceed amount on line 23)

G

24

25

25. Balance (Subtract line 24 from line 23; cannot be less than zero)

K

26

26. Estimated tax paid and credits (Part I, line 4)

27. Other tax payments (Separate schedule)

L

27

U

28

28. Equipment property tax credit refund (See instructions)

29

29. Habitat management credit refund (See instructions)

W

30

30. Child day care assistance credit refund (See instructions)

S

31

31. Community service contribution credit refund (See instructions)

X

Y

32. Oil lease working interest credit refund (See instructions)

32

33. Total prepaid credits (Add lines 26, 27, 28, 29, 30, 31 & 32)

33

34. Balance Due (If line 25 exceeds line 33)

34

35. Interest

35

36. Penalty

36

37. Estimated tax penalty (If annualizing to compute penalty, check this box)

37

38. Total Tax, Interest & Penalty Due (Add lines 34, 35, 36 & 37)

T

38

39. Overpayment (If line 25 plus line 37 is less than line 33)

39

40. Amount of line 39 you wish to be refunded

40

P

41. Amount of line 39 you wish to be credited to 2000 estimated tax

41

Q

For Office Use Only

I declare under the penalties of purjury that to the best of my knowledge this is a true, correct, and complete return.

sign

Signature of Officer

Title

Date

here

Individual or firm signature of preparer

Address

Date

Mail this Return and Payment to: Kansas Corporate Tax, Kansas Department of Revenue, 915 SW Harrison Street, Topeka, KS 66699-4000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2