Form K-74 - National Guard & Reserve Employer Credit - Kansas

ADVERTISEMENT

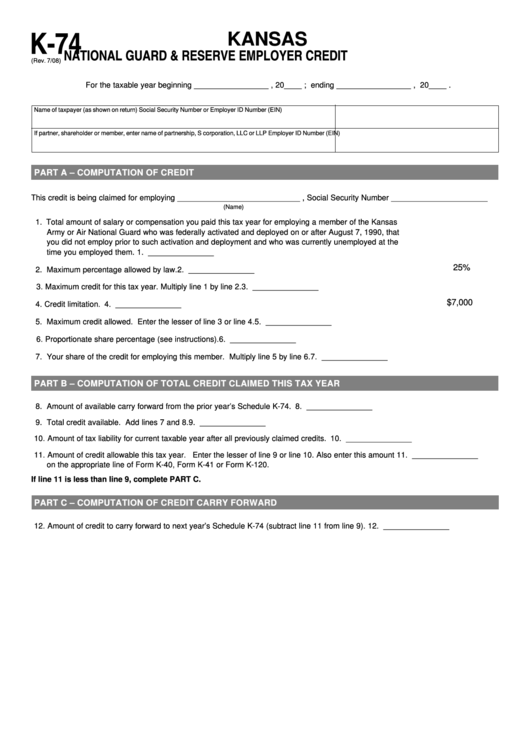

K-74

KANSAS

NATIONAL GUARD & RESERVE EMPLOYER CREDIT

(Rev. 7/08)

For the taxable year beginning _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – COMPUTATION OF CREDIT

This credit is being claimed for employing ____________________________ , Social Security Number ______________________

(Name)

1. Total amount of salary or compensation you paid this tax year for employing a member of the Kansas

Army or Air National Guard who was federally activated and deployed on or after August 7, 1990, that

you did not employ prior to such activation and deployment and who was currently unemployed at the

time you employed them.

1. _______________

25%

2. Maximum percentage allowed by law.

2. _______________

3. Maximum credit for this tax year. Multiply line 1 by line 2.

3. _______________

$7,000

4. Credit limitation.

4. _______________

5. Maximum credit allowed. Enter the lesser of line 3 or line 4.

5. _______________

6. Proportionate share percentage (see instructions).

6. _______________

7. Your share of the credit for employing this member. Multiply line 5 by line 6.

7. _______________

PART B – COMPUTATION OF TOTAL CREDIT CLAIMED THIS TAX YEAR

8. Amount of available carry forward from the prior year’s Schedule K-74.

8. _______________

9. Total credit available. Add lines 7 and 8.

9. _______________

10. Amount of tax liability for current taxable year after all previously claimed credits.

10. _______________

11. Amount of credit allowable this tax year. E nter the lesser of line 9 or line 10. Also enter this amount

11. _______________

on the appropriate line of Form K-40, Form K-41 or Form K-120.

If line 11 is less than line 9, complete PART C.

PART C – COMPUTATION OF CREDIT CARRY FORWARD

12. Amount of credit to carry forward to next year’s Schedule K-74 (subtract line 11 from line 9).

12. _______________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1