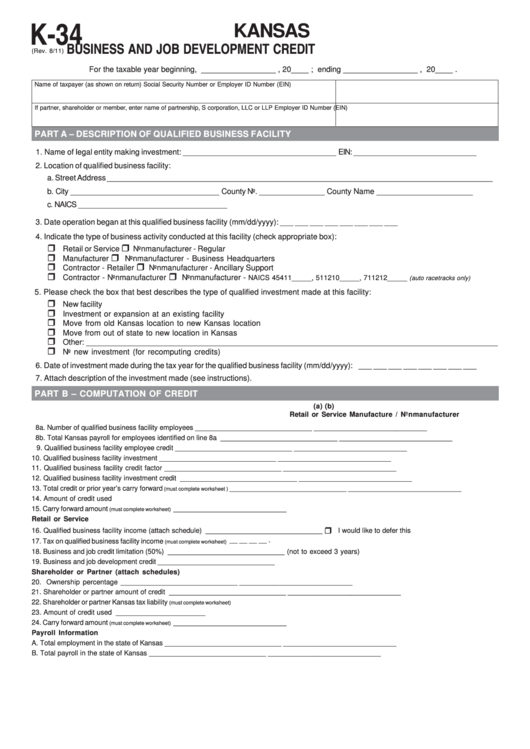

K-34

KANSAS

BUSINESS AND JOB DEVELOPMENT CREDIT

(Rev. 8/11)

For the taxable year beginning, _________________ , 20____ ; ending _________________ , 20____ .

Name of taxpayer (as shown on return)

Social Security Number or Employer ID Number (EIN)

If partner, shareholder or member, enter name of partnership, S corporation, LLC or LLP

Employer ID Number (EIN)

PART A – DESCRIPTION OF QUALIFIED BUSINESS FACILITY

1. Name of legal entity making investment: ___________________________________

EIN: ____________________________

2. Location of qualified business facility:

a. Street Address ________________________________________________________________________________________

b. City

__________________________________ County No. _______________

County Name ______________________

c. NAICS __________________________________

3. Date operation began at this qualified business facility (mm/dd/yyyy):

___ ___ ___ ___ ___ ___ ___ ___

4. Indicate the type of business activity conducted at this facility (check appropriate box):

ˆ

ˆ

Retail or Service

Nonmanufacturer - Regular

ˆ

ˆ

Manufacturer

Nonmanufacturer - Business Headquarters

ˆ

ˆ

Contractor - Retailer

Nonmanufacturer - Ancillary Support

ˆ

ˆ

Contractor - Nonmanufacturer

Nonmanufacturer -

NAICS 45411_____, 511210_____, 711212_____

(auto racetracks only)

5. Please check the box that best describes the type of qualified investment made at this facility:

ˆ

New facility

ˆ

Investment or expansion at an existing facility

ˆ

Move from old Kansas location to new Kansas location

ˆ

Move from out of state to new location in Kansas

ˆ

Other: ______________________________________________________________________________________________

ˆ

No new investment (for recomputing credits)

6. Date of investment made during the tax year for the qualified business facility (mm/dd/yyyy): ___ ___ ___ ___ ___ ___ ___ ___

7. Attach description of the investment made (see instructions).

PART B – COMPUTATION OF CREDIT

(a)

(b)

Retail or Service

Manufacture / Nonmanufacturer

8a. Number of qualified business facility employees ..........................

______________________________

_____________________________

8b. Total Kansas payroll for employees identified on line 8a ...............

______________________________

_____________________________

9. Qualified business facility employee credit ...................................

______________________________

_____________________________

10. Qualified business facility investment ...........................................

______________________________

_____________________________

11. Qualified business facility credit factor .........................................

______________________________

_____________________________

12. Qualified business facility investment credit .................................

______________________________

_____________________________

13. Total credit or prior year’s carry forward

.......

______________________________

_____________________________

(must complete worksheet )

14. Amount of credit used ...................................................................

_____________________________

15. Carry forward amount

....................................

_____________________________

(must complete worksheet)

Retail or Service

ˆ

16. Qualified business facility income (attach schedule) ....................

______________________________

I would like to defer this

credit to __ __ __ __ .

17. Tax on qualified business facility income

........

______________________________

(must complete worksheet)

18. Business and job credit limitation (50%) ........................................

______________________________

(not to exceed 3 years)

19. Business and job development credit ............................................

______________________________

Shareholder or Partner (attach schedules)

20. Ownership percentage .................................................................

______________________________

_____________________________

21. Shareholder or partner amount of credit .......................................

______________________________

_____________________________

22. Shareholder or partner Kansas tax liability

.....

______________________________

_____________________________

(must complete worksheet)

23. Amount of credit used ...................................................................

______________________________

_____________________________

24. Carry forward amount

....................................

_____________________________

(must complete worksheet)

Payroll Information

A.

Total employment in the state of Kansas .......................................

______________________________

_____________________________

B.

Total payroll in the state of Kansas ...............................................

______________________________

_____________________________

1

1 2

2 3

3