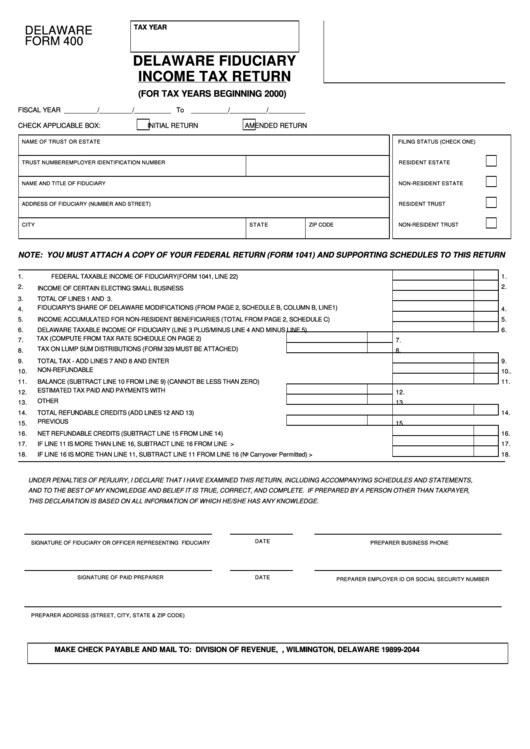

Form 400 - Delaware Fiduciary Income Tax Return

ADVERTISEMENT

TAX YEAR

DELAWARE

FORM 400

DELAWARE FIDUCIARY

INCOME TAX RETURN

(FOR TAX YEARS BEGINNING 2000)

FISCAL YEAR _________/_________/__________ To

__________/__________/__________

CHECK APPLICABLE BOX:

INITIAL RETURN

AMENDED RETURN

NAME OF TRUST OR ESTATE

FILING STATUS (CHECK ONE)

TRUST NUMBER

EMPLOYER IDENTIFICATION NUMBER

RESIDENT ESTATE

NAME AND TITLE OF FIDUCIARY

NON-RESIDENT ESTATE

ADDRESS OF FIDUCIARY (NUMBER AND STREET)

RESIDENT TRUST

CITY

STATE

ZIP CODE

NON-RESIDENT TRUST

NOTE: YOU MUST ATTACH A COPY OF YOUR FEDERAL RETURN (FORM 1041) AND SUPPORTING SCHEDULES TO THIS RETURN

1.

FEDERAL TAXABLE INCOME OF FIDUCIARY(FORM 1041, LINE 22)......................................................................................................

1.

2.

2.

INCOME OF CERTAIN ELECTING SMALL BUSINESS TRUSTS...............................................................................................................

3.

TOTAL OF LINES 1 AND 2.................................................................................................................................................................................

3.

FIDUCIARY'S SHARE OF DELAWARE MODIFICATIONS (FROM PAGE 2, SCHEDULE B, COLUMN B, LINE1)............................

4.

4.

5.

INCOME ACCUMULATED FOR NON-RESIDENT BENEFICIARIES (TOTAL FROM PAGE 2, SCHEDULE C)..................................

5.

6.

DELAWARE TAXABLE INCOME OF FIDUCIARY (LINE 3 PLUS/MINUS LINE 4 AND MINUS LINE 5)................................

6.

TAX (COMPUTE FROM TAX RATE SCHEDULE ON PAGE 2)..................................................

7.

7.

TAX ON LUMP SUM DISTRIBUTIONS (FORM 329 MUST BE ATTACHED)...........................

8.

8.

9.

TOTAL TAX - ADD LINES 7 AND 8 AND ENTER HERE......................................................................................................................

9.

NON-REFUNDABLE CREDITS........................................................................................................................................................................

10.

10..

11.

BALANCE (SUBTRACT LINE 10 FROM LINE 9) (CANNOT BE LESS THAN ZERO).............................................................

11.

ESTIMATED TAX PAID AND PAYMENTS WITH EXTENSIONS.................................................

12.

12.

OTHER PAYMENTS.........................................................................................................................

13.

13.

14.

TOTAL REFUNDABLE CREDITS (ADD LINES 12 AND 13)........................................................................................................................

14.

PREVIOUS REFUNDS...................................................................................................................

15.

15.

16.

NET REFUNDABLE CREDITS (SUBTRACT LINE 15 FROM LINE 14).....................................................................................................

16.

17.

IF LINE 11 IS MORE THAN LINE 16, SUBTRACT LINE 16 FROM LINE 11.....................................................................PAY IN FULL>

17.

18.

IF LINE 16 IS MORE THAN LINE 11, SUBTRACT LINE 11 FROM LINE 16 (No Carryover Permitted).............................REFUND>

18.

UNDER PENALTIES OF PERJURY, I DECLARE THAT I HAVE EXAMINED THIS RETURN, INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS,

AND TO THE BEST OF MY KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT, AND COMPLETE. IF PREPARED BY A PERSON OTHER THAN TAXPAYER,

THIS DECLARATION IS BASED ON ALL INFORMATION OF WHICH HE/SHE HAS ANY KNOWLEDGE.

DATE

SIGNATURE OF FIDUCIARY OR OFFICER REPRESENTING FIDUCIARY

PREPARER BUSINESS PHONE

SIGNATURE OF PAID PREPARER

DATE

PREPARER EMPLOYER ID OR SOCIAL SECURITY NUMBER

PREPARER ADDRESS (STREET, CITY, STATE & ZIP CODE)

MAKE CHECK PAYABLE AND MAIL TO: DIVISION OF REVENUE, P.O. BOX 2044, WILMINGTON, DELAWARE 19899-2044

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2