Schedule Gi Template - Tax Determination On Built-In Gains

ADVERTISEMENT

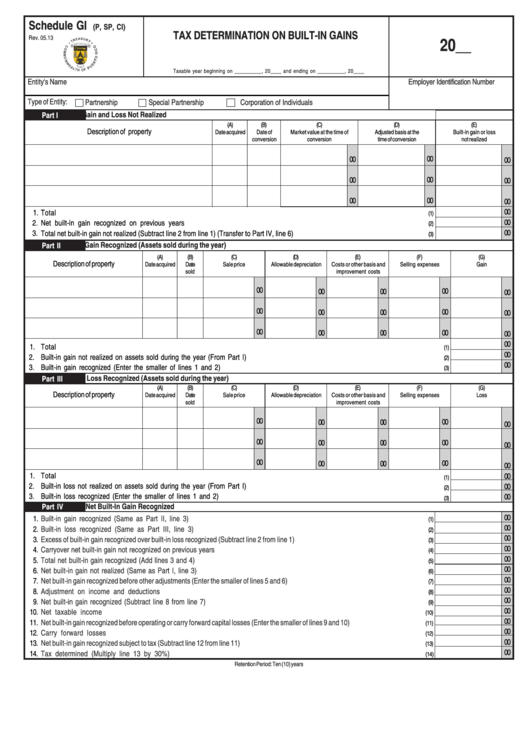

Schedule GI

(P, SP, CI)

TAX DETERMINATION ON BUILT-IN GAINS

Rev. 05.13

20__

Taxable year beginning on __________, 20____ and ending on __________, 20____

Entity's Name

Employer Identification Number

Type of Entity:

Partnership

Special Partnership

Corporation of Individuals

Built-In Gain and Loss Not Realized

Part I

(A)

(B)

(C)

(D)

(E)

Description of property

Date acquired

Date of

Market value at the time of

Adjusted basis at the

Built-in gain or loss

conversion

conversion

time of conversion

not realized

00

00

00

00

00

00

00

00

00

00

1.

Total ......................................................................................................................................................................................

(1)

00

2.

Net built-in gain recognized on previous years ..............................................................................................................................

(2)

00

3.

Total net built-in gain not realized (Subtract line 2 from line 1) (Transfer to Part IV, line 6) .....................................................................

(3)

Built-In Gain Recognized (Assets sold during the year)

Part II

(B)

(C)

(D)

(E)

(F)

(G)

(A)

Description of property

Date acquired

Date

Sale price

Allowable depreciation

Costs or other basis and

Selling expenses

Gain

sold

improvement costs

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

1.

Total ...............................................................................................................................................................................................

(1)

00

2.

Built-in gain not realized on assets sold during the year (From Part I) .......................................................................................................

(2)

00

3.

Built-in gain recognized (Enter the smaller of lines 1 and 2) .....................................................................................................................

(3)

Built-In Loss Recognized (Assets sold during the year)

Part III

(A)

(B)

(C)

(D)

(E)

(F)

(G)

Description of property

Date acquired

Date

Sale price

Allowable depreciation

Costs or other basis and

Selling expenses

Loss

sold

improvement costs

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

1.

Total ...............................................................................................................................................................................................

00

(1)

2.

Built-in loss not realized on assets sold during the year (From Part I) .......................................................................................................

00

(2)

3.

Built-in loss recognized (Enter the smaller of lines 1 and 2) ......................................................................................................................

00

(3)

Tax on Net Built-In Gain Recognized

Part IV

00

1.

Built-in gain recognized (Same as Part II, line 3) .............................................................................................................................

(1)

00

2.

Built-in loss recognized (Same as Part III, line 3) ..........................................................................................................................

(2)

00

3.

Excess of built-in gain recognized over built-in loss recognized (Subtract line 2 from line 1) ....................................................................

(3)

00

4.

Carryover net built-in gain not recognized on previous years ...............................................................................................................

(4)

00

5.

Total net built-in gain recognized (Add lines 3 and 4) ..........................................................................................................................

(5)

00

6.

Net built-in gain not realized (Same as Part I, line 3) .........................................................................................................................

(6)

00

7.

Net built-in gain recognized before other adjustments (Enter the smaller of lines 5 and 6) ........................................................................

(7)

00

8.

Adjustment on income and deductions .........................................................................................................................................

(8)

00

9.

Net built-in gain recognized (Subtract line 8 from line 7) ....................................................................................................................

(9)

00

10.

Net taxable income ...................................................................................................................................................................

(10)

00

11.

Net built-in gain recognized before operating or carry forward capital losses (Enter the smaller of lines 9 and 10) ......................................

(11)

00

12.

Carry forward losses ................................................................................................................................................................

(12)

00

13.

Net built-in gain recognized subject to tax (Subtract line 12 from line 11) ..................................................................................................

(13)

00

14.

Tax determined (Multiply line 13 by 30%) .......................................................................................................................................

(14)

Retention Period: Ten (10) years

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1