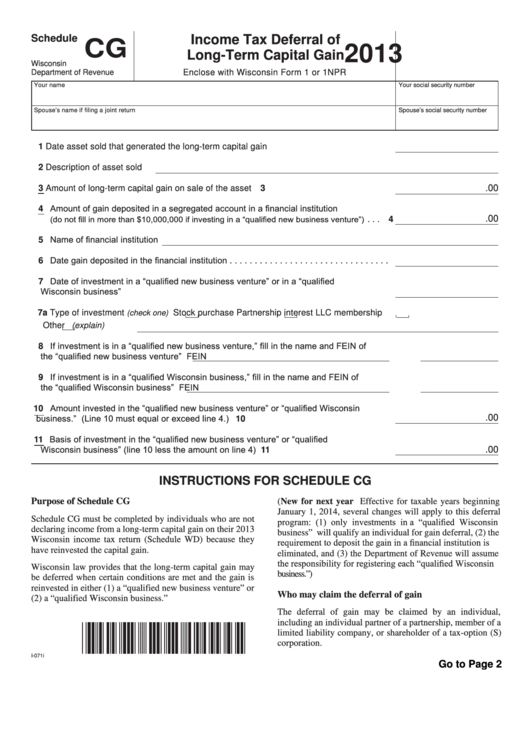

Schedule

Income Tax Deferral of

CG

2013

Long-Term Capital Gain

Wisconsin

Department of Revenue

Enclose with Wisconsin Form 1 or 1NPR

Your name

Your social security number

Spouse’s name if filing a joint return

Spouse’s social security number

1 Date asset sold that generated the long-term capital gain . . . . . . . . . . . . . . . . . . . . . . .

2 Description of asset sold

.00

3 Amount of long-term capital gain on sale of the asset . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Amount of gain deposited in a segregated account in a financial institution

(do not fill in more than $10,000,000 if investing in a “qualified new business venture”)

.00

. . . 4

5 Name of financial institution

6 Date gain deposited in the financial institution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Date of investment in a “qualified new business venture” or in a “qualified

Wisconsin business” . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7a Type of investment

Stock purchase

Partnership interest

LLC membership

(check one)

Other

(explain)

8 If investment is in a “qualified new business venture,” fill in the name and FEIN of

the “qualified new business venture”

FEIN

9 If investment is in a “qualified Wisconsin business,” fill in the name and FEIN of

the “qualified Wisconsin business”

FEIN

10 Amount invested in the “qualified new business venture” or “qualified Wisconsin

business.” (Line 10 must equal or exceed line 4.) . . . . . . . . . . . . . . . . . . . . . . . . . . 10

.00

11 Basis of investment in the “qualified new business venture” or “qualified

Wisconsin business” (line 10 less the amount on line 4) . . . . . . . . . . . . . . . . . . . . . . 11

.00

INSTRUCTIONS FOR SCHEDULE CG

Purpose of Schedule CG

(New for next year Effective for taxable years beginning

January 1, 2014, several changes will apply to this deferral

Schedule CG must be completed by individuals who are not

program: (1) only investments in a “qualified Wisconsin

declaring income from a long-term capital gain on their 2013

business” will qualify an individual for gain deferral, (2) the

Wisconsin income tax return (Schedule WD) because they

requirement to deposit the gain in a financial institution is

have reinvested the capital gain.

eliminated, and (3) the Department of Revenue will assume

the responsibility for registering each “qualified Wisconsin

Wisconsin law provides that the long-term capital gain may

business.”)

be deferred when certain conditions are met and the gain is

reinvested in either (1) a “qualified new business venture” or

Who may claim the deferral of gain

(2) a “qualified Wisconsin business.”

The deferral of gain may be claimed by an individual,

including an individual partner of a partnership, member of a

limited liability company, or shareholder of a tax-option (S)

corporation.

I-071i

Go to Page 2

1

1 2

2