Form 1040me - Schedule Nrh For Married Person Electing To File Single 2000

ADVERTISEMENT

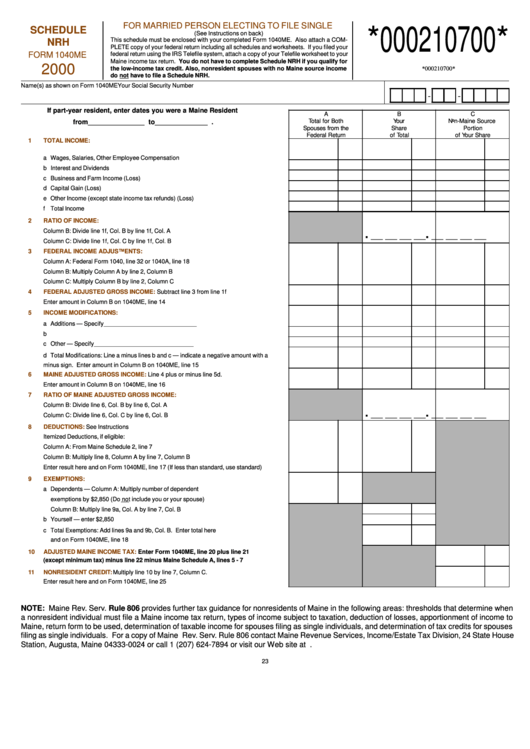

FOR MARRIED PERSON ELECTING TO FILE SINGLE

SCHEDULE

*000210700*

(See Instructions on back)

This schedule must be enclosed with your completed Form 1040ME. Also attach a COM-

NRH

PLETE copy of your federal return including all schedules and worksheets. If you filed your

FORM 1040ME

federal return using the IRS Telefile system, attach a copy of your Telefile worksheet to your

Maine income tax return. You do not have to complete Schedule NRH if you qualify for

2000

the low-income tax credit. Also, nonresident spouses with no Maine source income

*000210700*

do not have to file a Schedule NRH.

Name(s) as shown on Form 1040ME

Your Social Security Number

-

-

If part-year resident, enter dates you were a Maine Resident

A

B

C

Total for Both

Your

Non-Maine Source

from _______________ to ______________ .

Spouses from the

Share

Portion

Federal Return

of Total

of Your Share

1

TOTAL INCOME:

a Wages, Salaries, Other Employee Compensation ...........................................................

b Interest and Dividends .....................................................................................................

c Business and Farm Income (Loss) ..................................................................................

d Capital Gain (Loss) ..........................................................................................................

e Other Income (except state income tax refunds) (Loss) ...................................................

f Total Income ....................................................................................................................

2

RATIO OF INCOME:

Column B: Divide line 1f, Col. B by line 1f, Col. A

.

.

__ __ __ __

__ __ __ __

Column C: Divide line 1f, Col. C by line 1f, Col. B ................................................................

3

FEDERAL INCOME ADJUSTMENTS:

Column A: Federal Form 1040, line 32 or 1040A, line 18

Column B: Multiply Column A by line 2, Column B

Column C: Multiply Column B by line 2, Column C ..............................................................

4

FEDERAL ADJUSTED GROSS INCOME:

Subtract line 3 from line 1f

Enter amount in Column B on 1040ME, line 14 ...................................................................

5

INCOME MODIFICATIONS:

a Additions — Specify ____________________________

.........................................

b U.S. Government Bond interest .......................................................................................

c Other — Specify ______________________________

............................................

d Total Modifications: Line a minus lines b and c — indicate a negative amount with a

minus sign. Enter amount in Column B on 1040ME, line 15 ...............................................

6

MAINE ADJUSTED GROSS INCOME:

Line 4 plus or minus line 5d.

Enter amount in Column B on 1040ME, line 16 ...................................................................

7

RATIO OF MAINE ADJUSTED GROSS INCOME:

Column B: Divide line 6, Col. B by line 6, Col. A

.

.

__ __ __ __

__ __ __ __

Column C: Divide line 6, Col. C by line 6, Col. B ..................................................................

8

DEDUCTIONS:

See Instructions

Itemized Deductions, if eligible:

Column A: From Maine Schedule 2, line 7

Column B: Multiply line 8, Column A by line 7, Column B

Enter result here and on Form 1040ME, line 17 (If less than standard, use standard) .........

9

EXEMPTIONS:

a Dependents — Column A: Multiply number of dependent

exemptions by $2,850 (Do not include you or your spouse) .............................................

Column B: Multiply line 9a, Col. A by line 7, Col. B ..........................................................

b Yourself — enter $2,850 ..................................................................................................

c Total Exemptions: Add lines 9a and 9b, Col. B. Enter total here

and on Form 1040ME, line 18 .........................................................................................

10

ADJUSTED MAINE INCOME TAX:

Enter Form 1040ME, line 20 plus line 21

(except minimum tax) minus line 22 minus Maine Schedule A, lines 5 - 7 ....................

11

NONRESIDENT CREDIT:

Multiply line 10 by line 7, Column C.

Enter result here and on Form 1040ME, line 25 ..................................................................

NOTE: Maine Rev. Serv. Rule 806 provides further tax guidance for nonresidents of Maine in the following areas: thresholds that determine when

a nonresident individual must file a Maine income tax return, types of income subject to taxation, deduction of losses, apportionment of income to

Maine, return form to be used, determination of taxable income for spouses filing as single individuals, and determination of tax credits for spouses

filing as single individuals. For a copy of Maine Rev. Serv. Rule 806 contact Maine Revenue Services, Income/Estate Tax Division, 24 State House

Station, Augusta, Maine 04333-0024 or call 1 (207) 624-7894 or visit our Web site at

23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1