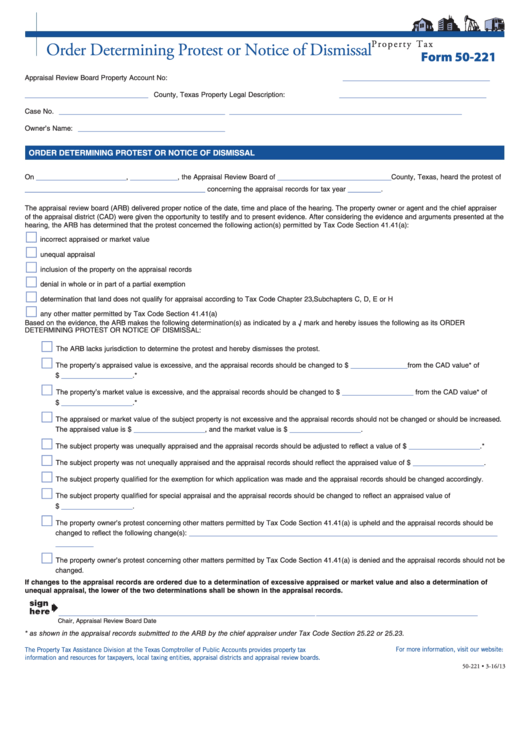

P r o p e r t y T a x

Order Determining Protest or Notice of Dismissal

Form 50-221

_______________________________

Appraisal Review Board

Property Account No:

__________________________

_______________________________

County, Texas

Property Legal Description:

___________________________________

_________________________________________________

Case No.

_______________________________

Owner’s Name:

ORDER DETERMINING PROTEST OR NOTICE OF DISMISSAL

___________________

__________

________________________

On

,

, the Appraisal Review Board of

County, Texas, heard the protest of

______________________________________

_______

concerning the appraisal records for tax year

.

The appraisal review board (ARB) delivered proper notice of the date, time and place of the hearing. The property owner or agent and the chief appraiser

of the appraisal district (CAD) were given the opportunity to testify and to present evidence. After considering the evidence and arguments presented at the

hearing, the ARB has determined that the protest concerned the following action(s) permitted by Tax Code Section 41.41(a):

£

incorrect appraised or market value

£

unequal appraisal

£

inclusion of the property on the appraisal records

£

denial in whole or in part of a partial exemption

£

determination that land does not qualify for appraisal according to Tax Code Chapter 23, Subchapters C, D, E or H

£

any other matter permitted by Tax Code Section 41.41(a)

Based on the evidence, the ARB makes the following determination(s) as indicated by a √ mark and hereby issues the following as its ORDER

DETERMINING PROTEST OR NOTICE OF DISMISSAL:

The ARB lacks jurisdiction to determine the protest and hereby dismisses the protest.

____________

The property’s appraised value is excessive, and the appraisal records should be changed to $

from the CAD value* of

_______________

$

.*

_______________

The property’s market value is excessive, and the appraisal records should be changed to $

from the CAD value* of

_______________

$

.*

The appraised or market value of the subject property is not excessive and the appraisal records should not be changed or should be increased.

_______________

_______________

The appraised value is $

, and the market value is $

.

_______________

The subject property was unequally appraised and the appraisal records should be adjusted to reflect a value of $

.*

_______________

The subject property was not unequally appraised and the appraisal records should reflect the appraised value of $

.

The subject property qualified for the exemption for which application was made and the appraisal records should be changed accordingly.

The subject property qualified for special appraisal and the appraisal records should be changed to reflect an appraised value of

_______________

$

.

The property owner’s protest concerning other matters permitted by Tax Code Section 41.41(a) is upheld and the appraisal records should be

_________________________________________________________________

changed to reflect the following change(s):

________

The property owner’s protest concerning other matters permitted by Tax Code Section 41.41(a) is denied and the appraisal records should not be

changed.

If changes to the appraisal records are ordered due to a determination of excessive appraised or market value and also a determination of

unequal appraisal, the lower of the two determinations shall be shown in the appraisal records.

______________________________________________________

__________________________________

Chair, Appraisal Review Board

Date

* as shown in the appraisal records submitted to the ARB by the chief appraiser under Tax Code Section 25.22 or 25.23.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxinfo/proptax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-221 • 3-16/13

1

1