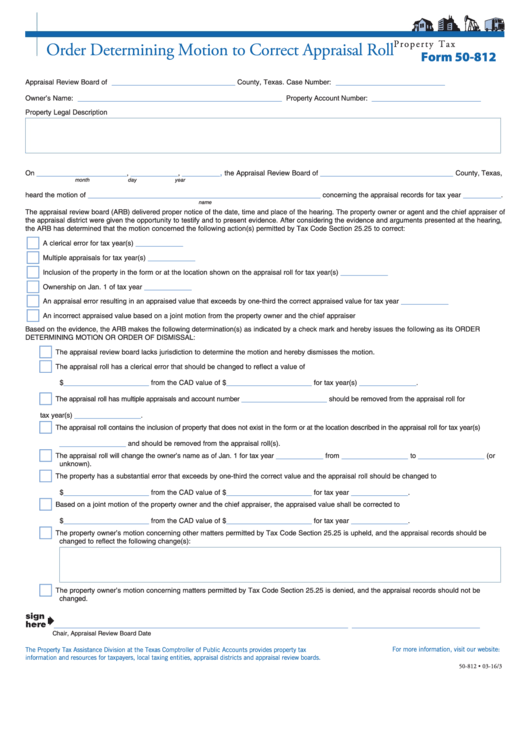

P r o p e r t y T a x

Order Determining Motion to Correct Appraisal Roll

Form 50-812

__________________________

_______________________

Appraisal Review Board of

County, Texas.

Case Number:

___________________________________________

_______________________

Owner’s Name:

Property Account Number:

Property Legal Description

___________________

__________

________,

____________________________

On

,

,

the Appraisal Review Board of

County, Texas,

month

day

year

_________________________________________________

________

heard the motion of

concerning the appraisal records for tax year

.

name

The appraisal review board (ARB) delivered proper notice of the date, time and place of the hearing. The property owner or agent and the chief appraiser of

the appraisal district were given the opportunity to testify and to present evidence. After considering the evidence and arguments presented at the hearing,

the ARB has determined that the motion concerned the following action(s) permitted by Tax Code Section 25.25 to correct:

__________

A clerical error for tax year(s)

__________

Multiple appraisals for tax year(s)

__________

Inclusion of the property in the form or at the location shown on the appraisal roll for tax year(s)

__________

Ownership on Jan. 1 of tax year

__________

An appraisal error resulting in an appraised value that exceeds by one-third the correct appraised value for tax year

An incorrect appraised value based on a joint motion from the property owner and the chief appraiser

Based on the evidence, the ARB makes the following determination(s) as indicated by a check mark and hereby issues the following as its ORDER

DETERMINING MOTION OR ORDER OF DISMISSAL:

The appraisal review board lacks jurisdiction to determine the motion and hereby dismisses the motion.

The appraisal roll has a clerical error that should be changed to reflect a value of

__________________

__________________

____________

$

from the CAD value of $

for tax year(s)

.

__________________

The appraisal roll has multiple appraisals and account number

should be removed from the appraisal roll for

______________

tax year(s)

.

The appraisal roll contains the inclusion of property that does not exist in the form or at the location described in the appraisal roll for tax year(s)

______________

and should be removed from the appraisal roll(s).

__________

______________

______________

The appraisal roll will change the owner’s name as of Jan. 1 for tax year

from

to

(or

unknown).

The property has a substantial error that exceeds by one-third the correct value and the appraisal roll should be changed to

__________________

__________________

____________

$

from the CAD value of $

for tax year

.

Based on a joint motion of the property owner and the chief appraiser, the appraised value shall be corrected to

__________________

__________________

____________

$

from the CAD value of $

for tax year

.

The property owner’s motion concerning other matters permitted by Tax Code Section 25.25 is upheld, and the appraisal records should be

changed to reflect the following change(s):

The property owner’s motion concerning matters permitted by Tax Code Section 25.25 is denied, and the appraisal records should not be

changed.

______________________________________________________________

___________________________

Chair, Appraisal Review Board

Date

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

comptroller.texas.gov/taxinfo/proptax

50-812 • 03-16/3

1

1