Application For Motor Vehicle Property Tax Exemption For Connecticut Resident Who Is A Member Of The Armed Forces Form

ADVERTISEMENT

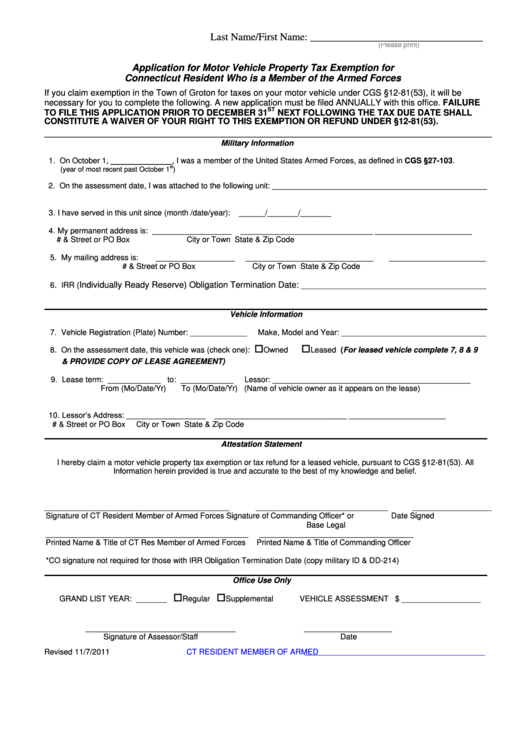

Last Name/First Name: _________________________________

(Please print)

Application for Motor Vehicle Property Tax Exemption for

Connecticut Resident Who is a Member of the Armed Forces

If you claim exemption in the Town of Groton for taxes on your motor vehicle under CGS §12-81(53), it will be

necessary for you to complete the following. A new application must be filed ANNUALLY with this office. FAILURE

ST

TO FILE THIS APPLICATION PRIOR TO DECEMBER 31

NEXT FOLLOWING THE TAX DUE DATE SHALL

CONSTITUTE A WAIVER OF YOUR RIGHT TO THIS EXEMPTION OR REFUND UNDER §12-81(53).

____________________________________________________________________________________________

Military Information

1. On October 1, ______________, I was a member of the United States Armed Forces, as defined in CGS §27-103.

st

(year of most recent past October 1

)

2. On the assessment date, I was attached to the following unit: _________________________________________________

3. I have served in this unit since (month /date/year):

______/_______/_______

4. My permanent address is: __________________

______________________________

______________________

# & Street or PO Box

City or Town

State & Zip Code

5. My mailing address is:

__________________

_____________________________

______________________

# & Street or PO Box

City or Town

State & Zip Code

Individually Ready Reserve) Obligation Termination Date:

6. IRR (

__________________________________________

Vehicle Information

7. Vehicle Registration (Plate) Number: _____________

Make, Model and Year: _________________________________

8. On the assessment date, this vehicle was (check one):

Owned

Leased (For leased vehicle complete 7, 8 & 9

& PROVIDE COPY OF LEASE AGREEMENT)

9. Lease term: ____________

to: ____________

Lessor: _____________________________________________

From (Mo/Date/Yr)

To (Mo/Date/Yr)

(Name of vehicle owner as it appears on the lease)

10. Lessor’s Address: __________________

______________________________

______________________

# & Street or PO Box

City or Town

State & Zip Code

Attestation Statement

I hereby claim a motor vehicle property tax exemption or tax refund for a leased vehicle, pursuant to CGS §12-81(53). All

Information herein provided is true and accurate to the best of my knowledge and belief.

__________________________________________

______________________________

__________________

Signature of CT Resident Member of Armed Forces

Signature of Commanding Officer* or

Date Signed

Base Legal

______________________________________________

___________________________________

Printed Name & Title of CT Res Member of Armed Forces

Printed Name & Title of Commanding Officer

*CO signature not required for those with IRR Obligation Termination Date (copy military ID & DD-214)

Office Use Only

GRAND LIST YEAR: _______

Regular

Supplemental

VEHICLE ASSESSMENT $ __________________

__________________________________

____________________

Signature of Assessor/Staff

Date

Revised 11/7/2011

CT RESIDENT MEMBER OF ARMED FORCES.doc

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1