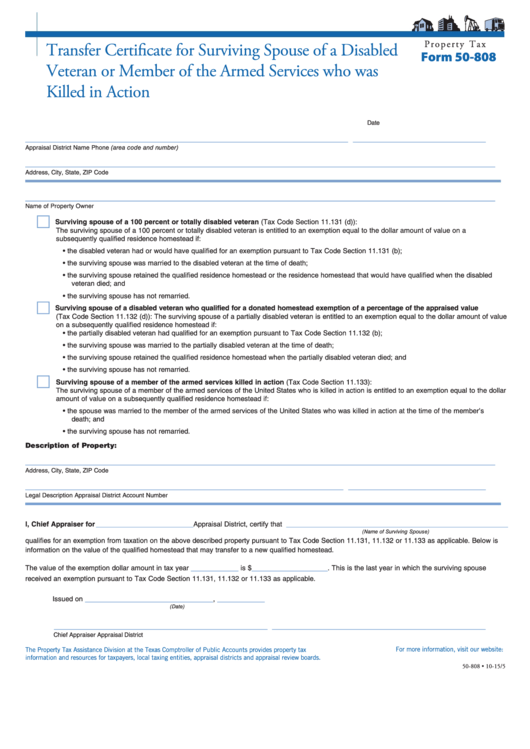

P r o p e r t y T a x

Transfer Certificate for Surviving Spouse of a Disabled

Form 50-808

Veteran or Member of the Armed Services who was

Killed in Action

____________________________

Date

____________________________________________________________________

____________________________

Appraisal District Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

___________________________________________________________________________________________________

Name of Property Owner

Surviving spouse of a 100 percent or totally disabled veteran (Tax Code Section 11.131 (d)):

The surviving spouse of a 100 percent or totally disabled veteran is entitled to an exemption equal to the dollar amount of value on a

subsequently qualified residence homestead if:

• the disabled veteran had or would have qualified for an exemption pursuant to Tax Code Section 11.131 (b);

• the surviving spouse was married to the disabled veteran at the time of death;

• the surviving spouse retained the qualified residence homestead or the residence homestead that would have qualified when the disabled

veteran died; and

• the surviving spouse has not remarried.

Surviving spouse of a disabled veteran who qualified for a donated homestead exemption of a percentage of the appraised value

(Tax Code Section 11.132 (d)): The surviving spouse of a partially disabled veteran is entitled to an exemption equal to the dollar amount of value

on a subsequently qualified residence homestead if:

• the partially disabled veteran had qualified for an exemption pursuant to Tax Code Section 11.132 (b);

• the surviving spouse was married to the partially disabled veteran at the time of death;

• the surviving spouse retained the qualified residence homestead when the partially disabled veteran died; and

• the surviving spouse has not remarried.

Surviving spouse of a member of the armed services killed in action (Tax Code Section 11.133):

The surviving spouse of a member of the armed services of the United States who is killed in action is entitled to an exemption equal to the dollar

amount of value on a subsequently qualified residence homestead if:

• the spouse was married to the member of the armed services of the United States who was killed in action at the time of the member’s

death; and

• the surviving spouse has not remarried.

Description of Property:

___________________________________________________________________________________________________

Address, City, State, ZIP Code

___________________________________________________________________

_____________________________

Legal Description

Appraisal District Account Number

I, Chief Appraiser for

_________________________

Appraisal District, certify that

_________________________________________________________

(Name of Surviving Spouse)

qualifies for an exemption from taxation on the above described property pursuant to Tax Code Section 11.131, 11.132 or 11.133 as applicable. Below is

information on the value of the qualified homestead that may transfer to a new qualified homestead.

__________

________________

The value of the exemption dollar amount in tax year

is $

. This is the last year in which the surviving spouse

received an exemption pursuant to Tax Code Section 11.131, 11.132 or 11.133 as applicable.

___________________________

__________

Issued on

,

(Date)

_____________________________________________

_____________________________________________

Chief Appraiser

Appraisal District

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxinfo/proptax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-808 • 10-15/5

1

1