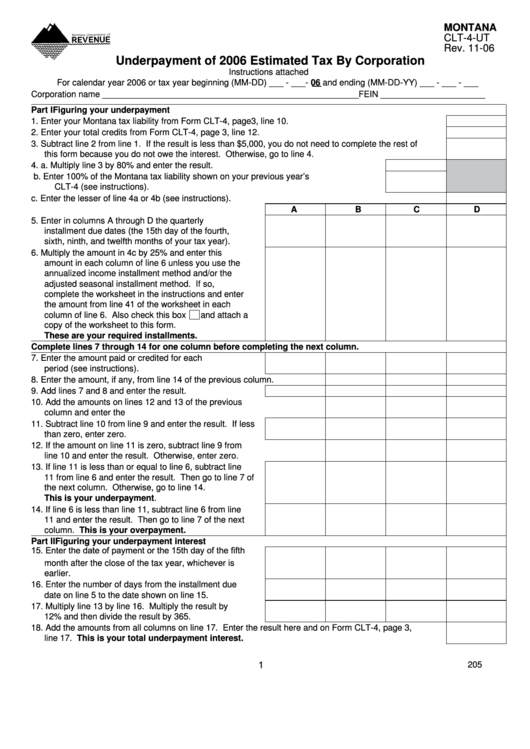

MonTAnA

CLT-4-UT

Rev. ��-06

Underpayment of 2006 Estimated Tax By Corporation

Instructions attached

For calendar year 2006 or tax year beginning (MM-DD) ___ - ___- 06 and ending (MM-DD-YY) ___ - ___ - ___

Corporation name ______________________________________________________ FEIN ______________________

Part I

Figuring your underpayment

�. Enter your Montana tax liability from Form CLT-4, page3, line �0. ........................................................... �.

2. Enter your total credits from Form CLT-4, page 3, line �2. ....................................................................... 2.

3. Subtract line 2 from line �. If the result is less than $5,000, you do not need to complete the rest of

this form because you do not owe the interest. Otherwise, go to line 4. ................................................... 3.

4. a. Multiply line 3 by 80% and enter the result. .............................................................. 4a.

b. Enter �00% of the Montana tax liability shown on your previous year’s

CLT-4 (see instructions). ............................................................................................ 4b.

c. Enter the lesser of line 4a or 4b (see instructions). .............................................................................4c.

A

B

C

D

5. Enter in columns A through D the quarterly

installment due dates (the �5th day of the fourth,

sixth, ninth, and twelfth months of your tax year). ..........5.

6. Multiply the amount in 4c by 25% and enter this

amount in each column of line 6 unless you use the

annualized income installment method and/or the

adjusted seasonal installment method. If so,

complete the worksheet in the instructions and enter

the amount from line 4� of the worksheet in each

column of line 6. Also check this box

and attach a

copy of the worksheet to this form.

These are your required installments. .......................6.

Complete lines 7 through 14 for one column before completing the next column.

7. Enter the amount paid or credited for each

period (see instructions). .................................................7.

8. Enter the amount, if any, from line �4 of the previous column. ...............8.

9. Add lines 7 and 8 and enter the result. ...........................9.

�0. Add the amounts on lines �2 and �3 of the previous

column and enter the result....................................................................�0.

��. Subtract line �0 from line 9 and enter the result. If less

than zero, enter zero. .................................................... ��.

�2. If the amount on line �� is zero, subtract line 9 from

line �0 and enter the result. Otherwise, enter zero. ..............................�2.

�3. If line �� is less than or equal to line 6, subtract line

�� from line 6 and enter the result. Then go to line 7 of

the next column. Otherwise, go to line �4.

This is your underpayment. .......................................�3.

�4. If line 6 is less than line ��, subtract line 6 from line

�� and enter the result. Then go to line 7 of the next

column. This is your overpayment. ..........................�4.

Part II

Figuring your underpayment interest

15. Enter the date of payment or the 15th day of the fifth

month after the close of the tax year, whichever is

earlier. ...........................................................................�5.

�6. Enter the number of days from the installment due

date on line 5 to the date shown on line �5. .................�6.

�7. Multiply line �3 by line �6. Multiply the result by

�2% and then divide the result by 365. .........................�7.

�8. Add the amounts from all columns on line �7. Enter the result here and on Form CLT-4, page 3,

line �7. This is your total underpayment interest. ............................................................................ �8.

�

205

1

1 2

2 3

3