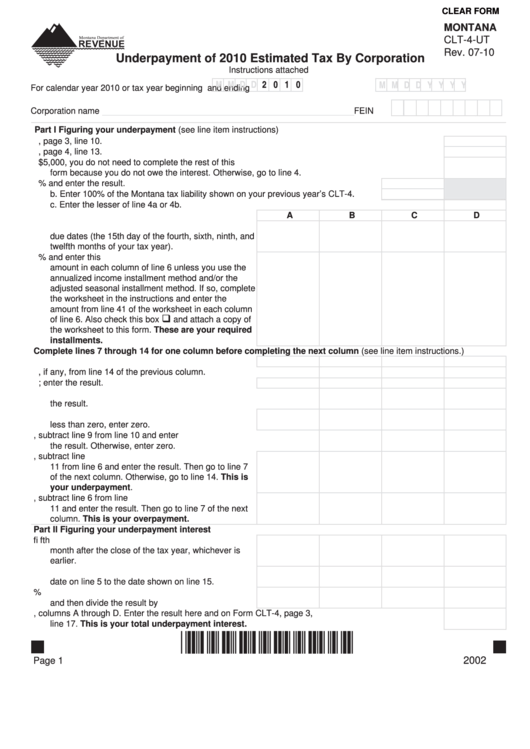

CLEAR FORM

MONTANA

CLT-4-UT

Rev. 07-10

Underpayment of 2010 Estimated Tax By Corporation

Instructions attached

M M D D

2 0 1 0

M M D D Y Y Y Y

For calendar year 2010 or tax year beginning

and ending

____________________________________________

Corporation name

FEIN

Part I

Figuring your underpayment (see line item instructions)

1. Enter your Montana tax liability from Form CLT-4, page 3, line 10. .......................................................1.

2. Enter your total credits from Form CLT-4, page 4, line 13. ....................................................................2.

3. Subtract line 2 from line 1. If the result is less than $5,000, you do not need to complete the rest of this

form because you do not owe the interest. Otherwise, go to line 4. .......................................................3.

4. a. Multiply line 3 by 80% and enter the result. ..........................................................4a.

b. Enter 100% of the Montana tax liability shown on your previous year’s CLT-4. .....4b.

c. Enter the lesser of line 4a or 4b. .....................................................................................................4c.

A

B

C

D

5. Enter in columns A through D the quarterly installment

due dates (the 15th day of the fourth, sixth, ninth, and

twelfth months of your tax year). .............................5.

6. Multiply the amount in 4c by 25% and enter this

amount in each column of line 6 unless you use the

annualized income installment method and/or the

adjusted seasonal installment method. If so, complete

the worksheet in the instructions and enter the

amount from line 41 of the worksheet in each column

of line 6. Also check this box

and attach a copy of

the worksheet to this form. These are your required

installments. ...........................................................6.

Complete lines 7 through 14 for one column before completing the next column (see line item instructions.)

7. Enter the amount paid or credited for each period ..7.

8. Enter the amount, if any, from line 14 of the previous column. ..........8.

9. Add lines 7 and 8; enter the result. ...........................9.

10. Add the amounts on lines 12 and 13 of the previous column and enter

the result. ..........................................................................................10.

11. Subtract line 10 from line 9 and enter the result. If

less than zero, enter zero. ...................................... 11.

12. If the amount on line 11 is zero, subtract line 9 from line 10 and enter

the result. Otherwise, enter zero. .....................................................12.

13. If line 11 is less than or equal to line 6, subtract line

11 from line 6 and enter the result. Then go to line 7

of the next column. Otherwise, go to line 14. This is

your underpayment. .............................................13.

14. If line 6 is less than line 11, subtract line 6 from line

11 and enter the result. Then go to line 7 of the next

column. This is your overpayment. ....................14.

Part II Figuring your underpayment interest

15. Enter the date of payment or the 15th day of the fi fth

month after the close of the tax year, whichever is

earlier. .....................................................................15.

16. Enter the number of days from the installment due

date on line 5 to the date shown on line 15. ...........16.

17. Multiply line 13 by line 16. Multiply the result by 12%

and then divide the result by 365............................17.

18. Add all amounts on line 17, columns A through D. Enter the result here and on Form CLT-4, page 3,

line 17. This is your total underpayment interest. ..........................................................................18.

*20020101*

2002

Page 1

1

1 2

2 3

3