Form Ir - Income Tax Return - City Of Trenton - 2006 Page 2

ADVERTISEMENT

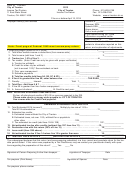

2006 City of Trenton tax form IR-Side Two

Income other than wages

A. Net profit or loss from business (attach Federal Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . A.________________

B. Rents, partnerships (attach Federal Schedule E and form K-1) . . . . . . . . . . . . . . . . . . . . . . . B.________________

C. Other income (attach Federal schedule or explanation) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . C.________________

D. Less prior years loss carry forward (limited to 3 years). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . D.________________

E. Net other taxable income (add lines A, B, C and D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . E.________________

Note: A business loss may not be used as a deduction from employee W-2 earnings.

F. Deductions and non-taxable income

1. _________________________________________________

$_________________

2. _________________________________________________

$_________________

3. Total deductions and other non-taxable income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . F3.________________

G. Total other taxable income (line E) less deductions (line F3) Enter on front page, line 2.

G.________________

CREDIT CARD PAYMENT:

1. Circle one:

VISA

MASTERCARD

2. Account number (16 digits) ______________________________________________

3. Expiration date: ______/______

4. Amount to be paid: $ _____________________

5. Your signature for authorization ___________________________________________

PENALTY AND INTEREST CHARGES:

Failure to pay tax due by April 16:

Interest: 2% per month

Penalty: 3% per month

*FILING DEADLINE:

Due to April 15 falling on a Sunday, the filing deadline has accordingly been extended to midnight, Monday, April 16.

EXTENSIONS: A request for extension must be filed prior to April 16. An extension is to provide additional time to

file, not to pay. Taxes must be paid in a timely manner.

OTHER IMPORTANT DATES:

4/16/2007

7/31/2007

10/31/2007

1/31/2008

PAY 1ST QUARTER

PAY 2ND QUARTER

PAY 3RD QUARTER

PAY 4TH QUARTER

2007 ESTIMATE

2007 ESTIMATE

2007 ESTIMATE

2007 ESTIMATE

TAX WITHHELD WORKSHEET:

Column 1

Column 2

Column 3

Column 4

Column 5

Qualifying wages:

Lesser of column 3

List all Cities except Trenton

(Medicare box on W2) Tax Withheld

Up to1.5% of column 2*

or column 4

Total allowed:

Carry total of Column 5 to line 5B, page 1.

*Credit:

Credit for other City tax withheld is limited to 1.5% of the income on which it has been withheld. Each W-2 stands

independently, and in cases where a W-2 has multiple City tax withholdings, each of the withholdings stands

independently.County taxes and school taxes are not considered city taxes under either City of Trenton or State of Ohio

law, and may not be considered as credit for City tax purposes.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2