Comptrolle r

50-119 (Rev. 8-03/9)

T

E

of Public

S

X

Accounts

[11.21 Rule 9.415]

YEAR

A

FORM

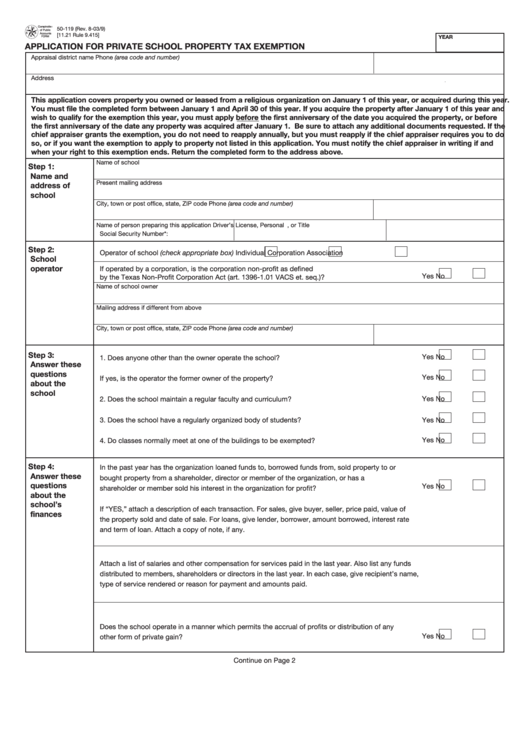

APPLICATION FOR PRIVATE SCHOOL PROPERTY TAX EXEMPTION

Appraisal district name

Phone (area code and number)

Address

This application covers property you owned or leased from a religious organization on January 1 of this year, or acquired during this year.

You must file the completed form between January 1 and April 30 of this year. If you acquire the property after January 1 of this year and

wish to qualify for the exemption this year, you must apply before the first anniversary of the date you acquired the property, or before

the first anniversary of the date any property was acquired after January 1. Be sure to attach any additional documents requested. If the

chief appraiser grants the exemption, you do not need to reapply annually, but you must reapply if the chief appraiser requires you to do

so, or if you want the exemption to apply to property not listed in this application. You must notify the chief appraiser in writing if and

when your right to this exemption ends. Return the completed form to the address above.

Name of school

Step 1:

Name and

Present mailing address

address of

school

City, town or post office, state, ZIP code

Phone (area code and number)

Name of person preparing this application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number*:

Step 2:

Operator of school (check appropriate box)

Individual

Corporation

Association

School

operator

If operated by a corporation, is the corporation non-profit as defined

Yes

No

by the Texas Non-Profit Corporation Act (art. 1396-1.01 VACS et. seq.)? ............................................

Name of school owner

Mailing address if different from above

City, town or post office, state, ZIP code

Phone (area code and number)

Step 3:

Yes

No

1. Does anyone other than the owner operate the school? ..................................................................

Answer these

questions

Yes

No

If yes, is the operator the former owner of the property? ..................................................................

about the

school

Yes

No

2. Does the school maintain a regular faculty and curriculum? ............................................................

3. Does the school have a regularly organized body of students? ........................................................

Yes

No

Yes

No

4. Do classes normally meet at one of the buildings to be exempted? ................................................

Step 4:

In the past year has the organization loaned funds to, borrowed funds from, sold property to or

Answer these

bought property from a shareholder, director or member of the organization, or has a

questions

Yes

No

shareholder or member sold his interest in the organization for profit? .................................................

about the

school’s

If “YES,” attach a description of each transaction. For sales, give buyer, seller, price paid, value of

finances

the property sold and date of sale. For loans, give lender, borrower, amount borrowed, interest rate

and term of loan. Attach a copy of note, if any.

Attach a list of salaries and other compensation for services paid in the last year. Also list any funds

distributed to members, shareholders or directors in the last year. In each case, give recipient’s name,

type of service rendered or reason for payment and amounts paid.

Does the school operate in a manner which permits the accrual of profits or distribution of any

Yes

No

other form of private gain? ......................................................................................................................

Continue on Page 2

1

1 2

2 3

3 4

4