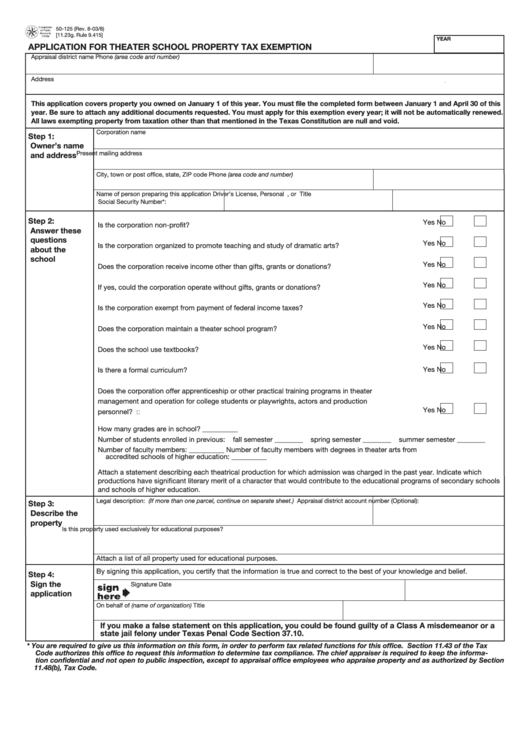

50-125 (Rev. 8-03/8)

[11.23g. Rule 9.415]

YEAR

APPLICATION FOR THEATER SCHOOL PROPERTY TAX EXEMPTION

Appraisal district name

Phone (area code and number)

Address

This application covers property you owned on January 1 of this year. You must file the completed form between January 1 and April 30 of this

year. Be sure to attach any additional documents requested. You must apply for this exemption every year; it will not be automatically renewed.

All laws exempting property from taxation other than that mentioned in the Texas Constitution are null and void.

Corporation name

Step 1:

Owner’s name

Present mailing address

and address

City, town or post office, state, ZIP code

Phone (area code and number)

Name of person preparing this application

Driver’s License, Personal I.D. Certificate, or

Title

Social Security Number*:

Step 2:

Yes

No

Is the corporation non-profit? ........................................................................................................................

Answer these

questions

Yes

No

Is the corporation organized to promote teaching and study of dramatic arts? ...........................................

about the

school

Yes

No

Does the corporation receive income other than gifts, grants or donations? ...............................................

Yes

No

If yes, could the corporation operate without gifts, grants or donations? ....................................................

Yes

No

Is the corporation exempt from payment of federal income taxes? .............................................................

Yes

No

Does the corporation maintain a theater school program? ...........................................................................

Yes

No

Does the school use textbooks? ...................................................................................................................

Yes

No

Is there a formal curriculum? .........................................................................................................................

Does the corporation offer apprenticeship or other practical training programs in theater

management and operation for college students or playwrights, actors and production

Yes

No

personnel? ......................

How many grades are in school? __________

Number of students enrolled in previous:

fall semester ________

spring semester ________

summer semester ________

Number of faculty members: __________ Number of faculty members with degrees in theater arts from

accredited schools of higher education: __________

Attach a statement describing each theatrical production for which admission was charged in the past year. Indicate which

productions have significant literary merit of a character that would contribute to the educational programs of secondary schools

and schools of higher education.

Legal description: (If more than one parcel, continue on separate sheet.)

Appraisal district account number (Optional):

Step 3:

Describe the

property

Is this property used exclusively for educational purposes?

Attach a list of all property used for educational purposes.

By signing this application, you certify that the information is true and correct to the best of your knowledge and belief.

Step 4:

Sign the

Signature

Date

application

On behalf of (name of organization)

Title

If you make a false statement on this application, you could be found guilty of a Class A misdemeanor or a

state jail felony under Texas Penal Code Section 37.10.

* You are required to give us this information on this form, in order to perform tax related functions for this office. Section 11.43 of the Tax

Code authorizes this office to request this information to determine tax compliance. The chief appraiser is required to keep the informa-

tion confidential and not open to public inspection, except to appraisal office employees who appraise property and as authorized by Section

11.48(b), Tax Code.

1

1