Form St-36 - Kansas Retailers' Sales Tax Return Page 2

ADVERTISEMENT

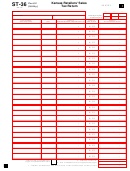

ST-36

Part lll

Kansas Retailers' Sales

Tax Return

454103

(Rev. 7/03)

Business Name

Tax Account Number

EIN

Taxing Jurisdiction

(Column 1)

(Column 2)

(Column 3)

(Column 4)

(Column 5)

(Column 6)

(Column 7)

Name of

Code

Gross Sales

Merchandise

Part II (Non-Utility)

Net Sales

Combined

Net Tax

City/County

Consumed By You

Deductions

Tax Rate %

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

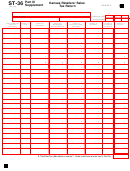

8. Total Net Tax (Part lll).

Total Number of supplemental

.

pages included with this return.

9. Sum of additional Part lll supplemental pages.

.

10. Total Tax (Add lines 8 and 9. Enter result here and on line 1, Part I).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4