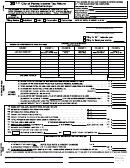

ADDITIONS — ADD TO THE EXTENT NOT INCLUDED IN FEDERAL ADJUSTED GROSS INCOME (LINE 1)

•

25

25 Add non-Ohio state or local government interest and dividends

.................................................................................

26 Add federal interest and dividends subject to state taxation (attach explanation) and add accumulation

26

distribution from a complex trust (attach Form IT-4970)

...............................................................................................

27

27 Pass-through entity addback

................................................................................................................................................

28

28 Add losses from the sale, exchange, or other disposition of Ohio Public Obligations

................................................

29

29 Add non-medical withdrawals or interest thereon from a medical savings account (see instructions and worksheet)

....

•

30

30 Total additions (add lines 25, 26, 27, 28 and 29)

...........................................................................................................

DEDUCTIONS — DEDUCT TO THE EXTENT INCLUDED IN FEDERAL ADJUSTED GROSS INCOME (LINE 1)

•

31 Deduct federal interest and dividends exempt from state taxation

31

..............................................................................

•

32 Deduct compensation earned in Ohio by full-year residents of neighboring states

..................................................

32

•

33 Deduct state or municipal income tax overpayments (from line 10 of Federal Form 1040)

....................................

33

•

34 Deduct disability and survivorship benefits

.....................................................................................................................

34

35 Deduct wage and salary expense not deducted due to the federal targeted jobs or the work opportunity tax credits

.....

35

•

36 Deduct social security old age benefits and some railroad benefits

............................................................................

36

37 Deduct interest earned from Ohio Public and Purchase Obligations and the gain from the sale

or disposition of Ohio Public Obligations

37

..........................................................................................................................

•

38 Deduct increased value of nonrefunded/used tuition credits or decreased value of refunded credits

.........................................

38

39 Deduct the refund or reimbursements of prior-year federal itemized deductions (from line 21 of Federal 1040)

..............

39

40 Deduct the repayment of income reported in a prior year

...............................................................................................

40

•

41 Deduct your self-employed health insurance costs (see instructions and worksheet)

............................................

41

•

42 Deduct funds deposited into and earnings of a medical savings account for eligible medical expenses (see worksheet)

..

42

43 Deduct the amount contributed to an Individual Development Account

.......................................................................

43

•

44 Total deductions (add lines 31 through 43)

....................................................................................................................

44

45 Net adjustments–If line 30 is GREATER than line 44 enter the difference here and on line 2 as a positive amount. If line 30

•

45

is LESS than line 44 enter the difference here and on line 2 as a negative amount

..................................................................

•

46

46 Retirement Income Credit (see instructions for credit table) (LIMIT $200)

...............................................................

•

47

47 Senior Citizen’s Credit (LIMIT $50 per return)

...............................................................................................................

•

48

48 Lump Sum Distribution Credit (you must be 65 years of age or older to claim this credit)

....................................

•

49

49 Child and Dependent Care Credit (see instructions and worksheet)

...........................................................................

•

50

50 Lump Sum Retirement Credit

............................................................................................................................................

•

51

51 Job Training Credit (see instructions and worksheet) (LIMIT $500)

..........................................................................

•

52 Ohio Political Contributions Credit

52

....................................................................................................................................

•

53 TOTAL CREDITS (add lines 46 through 52)—enter here and on line 7

53

......................................................................

•

54

54 Enter the portion of line 3 subjected to tax by other states or the District of Columbia while an Ohio resident

...............

55

55 Enter Ohio Adjusted Gross Income (line 3)

........................................................................................................................

%

56

56 Divide line 54 by line 55

........................................................................................................................................................

57 Multiply Line 56 by the amount on line 12

57

.........................................................................................................................

57a Enter the 1998 income tax less all related credits other than withholding and estimated tax payments and carry-

•

57a

forwards from previous years paid to other states or the District of Columbia

.................................................................

57b Enter the smaller of line 57 or line 57a. This is your Ohio Resident Tax Credit. Enter here and on line 13

57b

........................

List the state(s) other than Ohio with which you filed 1998 income tax returns.

•

58 Enter the portion of Ohio Adjusted Gross Income (line 3) that was not earned or received in Ohio

58

......................

59 Enter the Ohio Adjusted Gross Income (line 3)

.................................................................................................................

59

%

60 Divide line 58 by line 59

........................................................................................................................................................

60

61 Multiply line 60 by the amount on line 12. Enter here and on line 13

...........................................................................

61

1

1 2

2