Form Ri-1099pt - Rhode Island Pass-Through Withholding With - 2013

ADVERTISEMENT

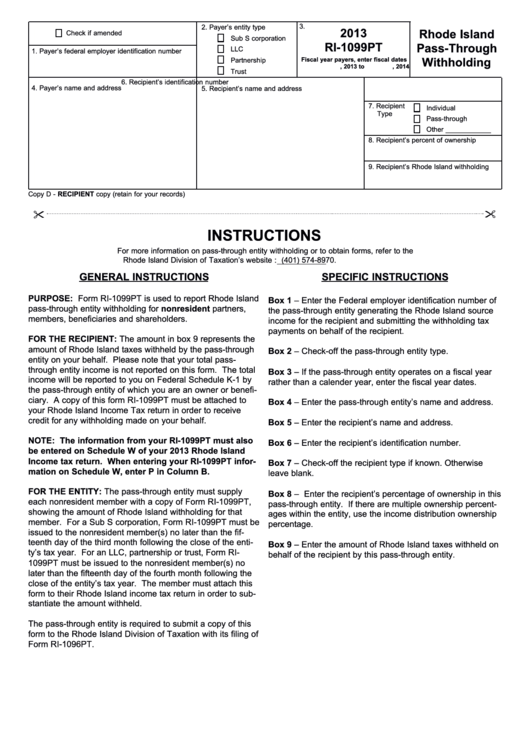

3.

2. Payer’s entity type

2013

Rhode Island

Check if amended

Sub S corporation

RI-1099PT

Pass-Through

LLC

1. Payer’s federal employer identification number

Partnership

Fiscal year payers, enter fiscal dates

Withholding

, 2013 to

, 2014

Trust

6. Recipient’s identification number

4. Payer’s name and address

5. Recipient’s name and address

7. Recipient

Individual

Type

Pass-through

Other ____________

8. Recipient’s percent of ownership

9. Recipient’s Rhode Island withholding

Copy D - RECIPIENT copy (retain for your records)

"

INSTRUCTIONS

For more information on pass-through entity withholding or to obtain forms, refer to the

Rhode Island Division of Taxation’s website : or call (401) 574-8970.

GENERAL INSTRUCTIONS

SPECIFIC INSTRUCTIONS

PURPOSE: Form RI-1099PT is used to report Rhode Island

Box 1 – Enter the Federal employer identification number of

pass-through entity withholding for nonresident partners,

the pass-through entity generating the Rhode Island source

members, beneficiaries and shareholders.

income for the recipient and submitting the withholding tax

payments on behalf of the recipient.

FOR THE RECIPIENT: The amount in box 9 represents the

amount of Rhode Island taxes withheld by the pass-through

Box 2 – Check-off the pass-through entity type.

entity on your behalf. Please note that your total pass-

through entity income is not reported on this form. The total

Box 3 – If the pass-through entity operates on a fiscal year

income will be reported to you on Federal Schedule K-1 by

rather than a calender year, enter the fiscal year dates.

the pass-through entity of which you are an owner or benefi-

ciary. A copy of this form RI-1099PT must be attached to

Box 4 – Enter the pass-through entity’s name and address.

your Rhode Island Income Tax return in order to receive

credit for any withholding made on your behalf.

Box 5 – Enter the recipient’s name and address.

NOTE: The information from your RI-1099PT must also

Box 6 – Enter the recipient’s identification number.

be entered on Schedule W of your 2013 Rhode Island

Income tax return. When entering your RI-1099PT infor-

Box 7 – Check-off the recipient type if known. Otherwise

mation on Schedule W, enter P in Column B.

leave blank.

FOR THE ENTITY: The pass-through entity must supply

Box 8 – Enter the recipient’s percentage of ownership in this

each nonresident member with a copy of Form RI-1099PT,

pass-through entity. If there are multiple ownership percent-

showing the amount of Rhode Island withholding for that

ages within the entity, use the income distribution ownership

member. For a Sub S corporation, Form RI-1099PT must be

percentage.

issued to the nonresident member(s) no later than the fif-

teenth day of the third month following the close of the enti-

Box 9 – Enter the amount of Rhode Island taxes withheld on

ty’s tax year. For an LLC, partnership or trust, Form RI-

behalf of the recipient by this pass-through entity.

1099PT must be issued to the nonresident member(s) no

later than the fifteenth day of the fourth month following the

close of the entity’s tax year. The member must attach this

form to their Rhode Island income tax return in order to sub-

stantiate the amount withheld.

The pass-through entity is required to submit a copy of this

form to the Rhode Island Division of Taxation with its filing of

Form RI-1096PT.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1