Form St-28l - Aircraft Exemption Certificate - Kansas Depa Rtment Of Revenue

ADVERTISEMENT

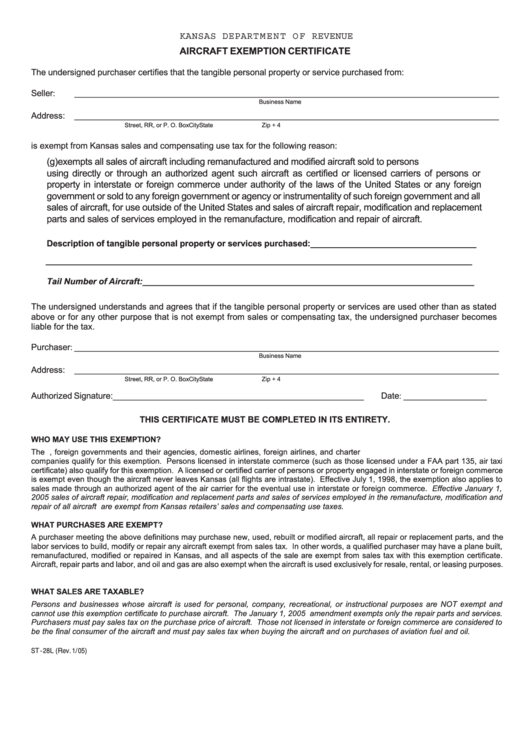

KANSAS DEPA RT M E N T OF REVENUE

AIRCRAFT EXEMPTION CERTIFICATE

The undersigned purchaser certifies that the tangible personal property or service purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

is exempt from Kansas sales and compensating use tax for the following reason:

K.S.A. 79-3606(g)exempts all sales of aircraft including remanufactured and modified aircraft sold to persons

using directly or through an authorized agent such aircraft as certified or licensed carriers of persons or

property in interstate or foreign commerce under authority of the laws of the United States or any foreign

government or sold to any foreign government or agency or instrumentality of such foreign government and all

sales of aircraft, for use outside of the United States and sales of aircraft repair, modification and replacement

parts and sales of services employed in the remanufacture, modification and repair of aircraft.

Description of tangible personal property or services purchased: ___________________________________

__________________________________________________________________________________________

Tail Number of Aircraft: ______________________________________________________________________

The undersigned understands and agrees that if the tangible personal property or services are used other than as stated

above or for any other purpose that is not exempt from sales or compensating tax, the undersigned purchaser becomes

liable for the tax.

Purchaser

: _________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P. O. Box

City

State

Zip + 4

Authorized Signature: _____________________________________________________

Date

: ___________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS EXEMPTION?

The U.S. government and any of its agencies, foreign governments and their agencies, domestic airlines, foreign airlines, and charter

companies qualify for this exemption. Persons licensed in interstate commerce (such as those licensed under a FAA part 135, air taxi

certificate) also qualify for this exemption. A licensed or certified carrier of persons or property engaged in interstate or foreign commerce

is exempt even though the aircraft never leaves Kansas (all flights are intrastate). Effective July 1, 1998, the exemption also applies to

sales made through an authorized agent of the air carrier for the eventual use in interstate or foreign commerce. Effective January 1,

2005 sales of aircraft repair, modification and replacement parts and sales of services employed in the remanufacture, modification and

repair of all aircraft are exempt from Kansas retailers’ sales and compensating use taxes.

WHAT PURCHASES ARE EXEMPT?

A purchaser meeting the above definitions may purchase new, used, rebuilt or modified aircraft, all repair or replacement parts, and the

labor services to build, modify or repair any aircraft exempt from sales tax. In other words, a qualified purchaser may have a plane built,

remanufactured, modified or repaired in Kansas, and all aspects of the sale are exempt from sales tax with this exemption certificate.

Aircraft, repair parts and labor, and oil and gas are also exempt when the aircraft is used exclusively for resale, rental, or leasing purposes.

WHAT SALES ARE TAXABLE?

Persons and businesses whose aircraft is used for personal, company, recreational, or instructional purposes are NOT exempt and

cannot use this exemption certificate to purchase aircraft. The January 1, 2005 amendment exempts only the repair parts and services.

Purchasers must pay sales tax on the purchase price of aircraft. Those not licensed in interstate or foreign commerce are considered to

be the final consumer of the aircraft and must pay sales tax when buying the aircraft and on purchases of aviation fuel and oil.

ST-28L (Rev. 1/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1