Form St-28v - Veterinarian Exemption Certificate - Kansas Department Of Revenue

ADVERTISEMENT

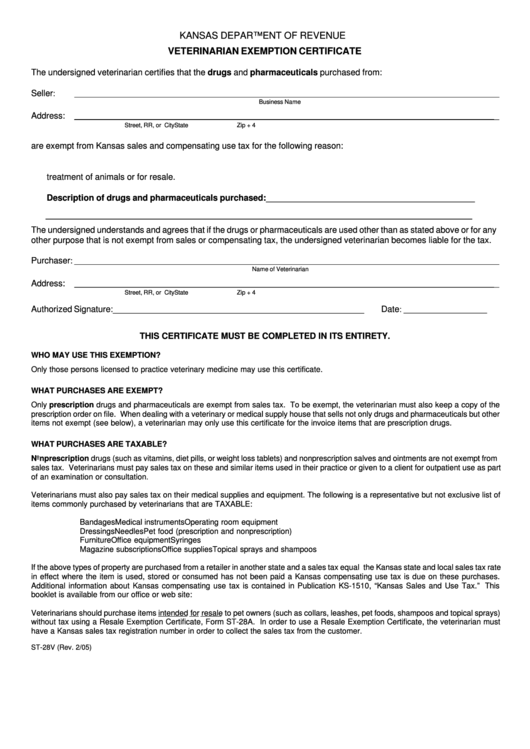

KANSAS DEPARTMENT OF REVENUE

VETERINARIAN EXEMPTION CERTIFICATE

The undersigned veterinarian certifies that the drugs and pharmaceuticals purchased from:

Seller

:

_________________________________________________________________________________________________

Business Name

Address:

_________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

are exempt from Kansas sales and compensating use tax for the following reason:

K.A.R. 92-19-42 exempts the sale of drugs and pharmaceuticals to veterinarians for use by them in the professional

treatment of animals or for resale.

Description of drugs and pharmaceuticals purchased: ____________________________________________

__________________________________________________________________________________________

The undersigned understands and agrees that if the drugs or pharmaceuticals are used other than as stated above or for any

other purpose that is not exempt from sales or compensating tax, the undersigned veterinarian becomes liable for the tax.

Purchaser

: _________________________________________________________________________________________________

Name of Veterinarian

Address:

_________________________________________________________________________________________________

Street, RR, or P.O. Box

City

State

Zip + 4

Authorized Signature: _____________________________________________________

Date

: ___________________

THIS CERTIFICATE MUST BE COMPLETED IN ITS ENTIRETY.

WHO MAY USE THIS EXEMPTION?

Only those persons licensed to practice veterinary medicine may use this certificate.

WHAT PURCHASES ARE EXEMPT?

Only prescription drugs and pharmaceuticals are exempt from sales tax. To be exempt, the veterinarian must also keep a copy of the

prescription order on file. When dealing with a veterinary or medical supply house that sells not only drugs and pharmaceuticals but other

items not exempt (see below), a veterinarian may only use this certificate for the invoice items that are prescription drugs.

WHAT PURCHASES ARE TAXABLE?

Nonprescription drugs (such as vitamins, diet pills, or weight loss tablets) and nonprescription salves and ointments are not exempt from

sales tax. Veterinarians must pay sales tax on these and similar items used in their practice or given to a client for outpatient use as part

of an examination or consultation.

Veterinarians must also pay sales tax on their medical supplies and equipment. The following is a representative but not exclusive list of

items commonly purchased by veterinarians that are TAXABLE:

Bandages

Medical instruments

Operating room equipment

Dressings

Needles

Pet food (prescription and nonprescription)

Furniture

Office equipment

Syringes

Magazine subscriptions

Office supplies

Topical sprays and shampoos

If the above types of property are purchased from a retailer in another state and a sales tax equal the Kansas state and local sales tax rate

in effect where the item is used, stored or consumed has not been paid a Kansas compensating use tax is due on these purchases.

Additional information about Kansas compensating use tax is contained in Publication KS-1510, “Kansas Sales and Use Tax.” This

booklet is available from our office or web site:

Veterinarians should purchase items intended for resale to pet owners (such as collars, leashes, pet foods, shampoos and topical sprays)

without tax using a Resale Exemption Certificate, Form ST-28A. In order to use a Resale Exemption Certificate, the veterinarian must

have a Kansas sales tax registration number in order to collect the sales tax from the customer.

ST-28V (Rev. 2/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1