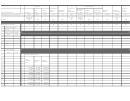

Form Rp-6607 - Part 4 Of Assessor'S Report Page 2

ADVERTISEMENT

RP-6607 (2/2000)

Veterans

Senior Citizens

Residential

Americans

Solar or

Maximum

Improve-

with

Historic

Business

Physically

Wind

Pro

Change

Income

Sliding

Medical &

ment

Disabled

Disabilities

Barns

Investment

Energy

Type of Exemption:

Service

Rata

in Level

for 50%

Scale

Prescription

Real Property Tax Law Section:

458-a

458-5

458-5

421-f

459

459-a

467(1)(a)

467(1)(b)

467(1)

483(b)

485(b)

487

A,B,C,D,E

Percent

Dollar

Percent

F,G,H, or

or

Amount

or

Indicate:

N/A

Y/N

Y/N

Y/N

Y/N

N/A

or N/A

Y/N

Y/N

Y/N

N/A

Y/N

Municipal Corporations

A

B

C

D

E

F

G

H

I

J

K

L

1

City/Town/Village

2

County

Non-Assessing Villages

Name

Code

3

4

5

6

7

School Districts

Name

Code

8

458-a Veteran Service

9

Non-

10

Combat

Service

Combat

Zone

Disability

11

Zone

12

13

A

$12,000

$8,000

$40,000

14

B

$9,000

$6,000

$30,000

15

C

$6,000

$4,000

$20,000

16

D

$15,000

$10,000

$50,000

17

E

$18,000

$12,000

$60,000

18

F

$21,000

$14,000

$70,000

19

G

$24,000

$16,000

$80,000

20

H

$27,000

$18,000

$90,000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2