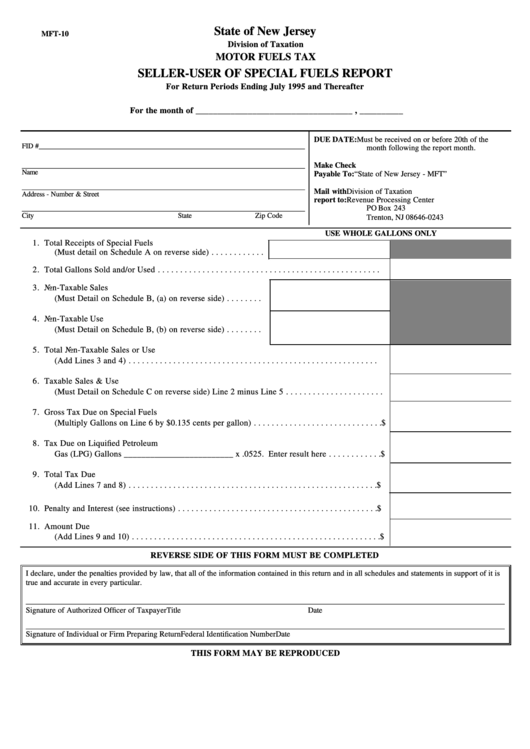

State of New Jersey

MFT-10

Division of Taxation

MOTOR FUELS TAX

SELLER-USER OF SPECIAL FUELS REPORT

For Return Periods Ending July 1995 and Thereafter

For the month of ____________________________________ , __________

DUE DATE:

Must be received on or before 20th of the

FID #___________________________________________________________________________

month following the report month.

Make Check

________________________________________________________________________________

Name

Payable To:

“State of New Jersey - MFT”

________________________________________________________________________________

Mail with

Division of Taxation

Address - Number & Street

report to:

Revenue Processing Center

PO Box 243

________________________________________________________________________________

City

State

Zip Code

Trenton, NJ 08646-0243

USE WHOLE GALLONS ONLY

1. Total Receipts of Special Fuels

(Must detail on Schedule A on reverse side) . . . . . . . . . . . .

2. Total Gallons Sold and/or Used . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Non-Taxable Sales

(Must Detail on Schedule B, (a) on reverse side) . . . . . . . .

4. Non-Taxable Use

(Must Detail on Schedule B, (b) on reverse side) . . . . . . . .

5. Total Non-Taxable Sales or Use

(Add Lines 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6. Taxable Sales & Use

(Must Detail on Schedule C on reverse side) Line 2 minus Line 5 . . . . . . . . . . . . . . . . . . . . . .

7. Gross Tax Due on Special Fuels

(Multiply Gallons on Line 6 by $0.135 cents per gallon) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

8. Tax Due on Liquified Petroleum

Gas (LPG) Gallons _________________________ x .0525. Enter result here . . . . . . . . . . . .

$

9. Total Tax Due

(Add Lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

10. Penalty and Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

11. Amount Due

(Add Lines 9 and 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

REVERSE SIDE OF THIS FORM MUST BE COMPLETED

I declare, under the penalties provided by law, that all of the information contained in this return and in all schedules and statements in support of it is

true and accurate in every particular.

___________________________________________________________________________________________________________________________

Signature of Authorized Officer of Taxpayer

Title

Date

___________________________________________________________________________________________________________________________

Signature of Individual or Firm Preparing Return

Federal Identification Number

Date

THIS FORM MAY BE REPRODUCED

1

1 2

2