Sales Tax Return Form

ADVERTISEMENT

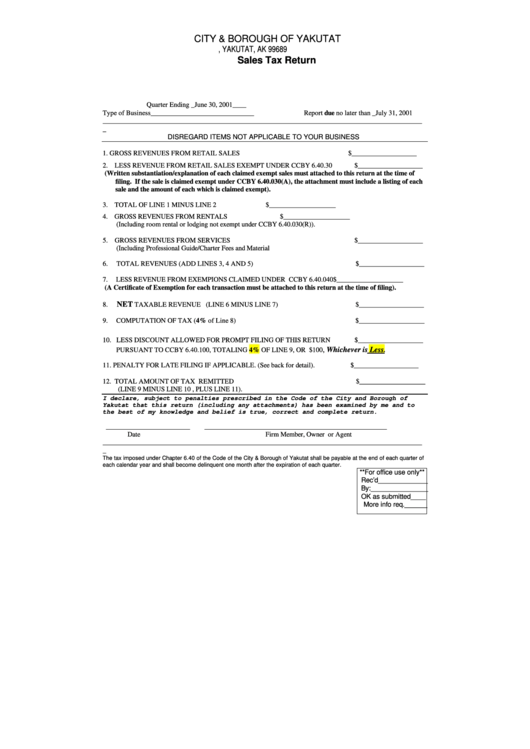

CITY & BOROUGH OF YAKUTAT

P.O. BOX 160, YAKUTAT, AK 99689

Sales Tax Return

Quarter Ending _June 30, 2001____

Type of Business______________________________

Report due no later than _July 31, 2001

___________________________________________________________________________________________

_

DISREGARD ITEMS NOT APPLICABLE TO YOUR BUSINESS

1.

GROSS REVENUES FROM RETAIL SALES

$___________________

2. LESS REVENUE FROM RETAIL SALES EXEMPT UNDER CCBY 6.40.30

$___________________

(Written substantiation/explanation of each claimed exempt sales must attached to this return at the time of

filing. If the sale is claimed exempt under CCBY 6.40.030(A), the attachment must include a listing of each

sale and the amount of each which is claimed exempt).

3. TOTAL OF LINE 1 MINUS LINE 2

$___________________

4. GROSS REVENUES FROM RENTALS

$___________________

(Including room rental or lodging not exempt under CCBY 6.40.030(R)).

5. GROSS REVENUES FROM SERVICES

$___________________

(Including Professional Guide/Charter Fees and Material

6.

TOTAL REVENUES (ADD LINES 3, 4 AND 5)

$___________________

7.

LESS REVENUE FROM EXEMPIONS CLAIMED UNDER CCBY 6.40.040

$___________________

(A Certificate of Exemption for each transaction must be attached to this return at the time of filing).

NET

8.

TAXABLE REVENUE (LINE 6 MINUS LINE 7)

$___________________

9.

COMPUTATION OF TAX (4% of Line 8)

$___________________

10. LESS DISCOUNT ALLOWED FOR PROMPT FILING OF THIS RETURN

$___________________

, Whichever is Less

PURSUANT TO CCBY 6.40.100, TOTALING 4% OF LINE 9, OR $100

.

11. PENALTY FOR LATE FILING IF APPLICABLE. (See back for detail).

$___________________

12. TOTAL AMOUNT OF TAX REMITTED

$___________________

(LINE 9 MINUS LINE 10 , PLUS LINE 11).

I declare, subject to penalties prescribed in the Code of the City and Borough of

Yakutat that this return (including any attachments) has been examined by me and to

the best of my knowledge and belief is true, correct and complete return.

________________________

____________________________________________________

Date

Firm Member, Owner or Agent

___________________________________________________________________________________________

_

The tax imposed under Chapter 6.40 of the Code of the City & Borough of Yakutat shall be payable at the end of each quarter of

each calendar year and shall become delinquent one month after the expiration of each quarter.

**For office use only**

Rec’d_____________

By:_______________

OK as submitted____

More info req.______

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1