Sales Tax Return Form

ADVERTISEMENT

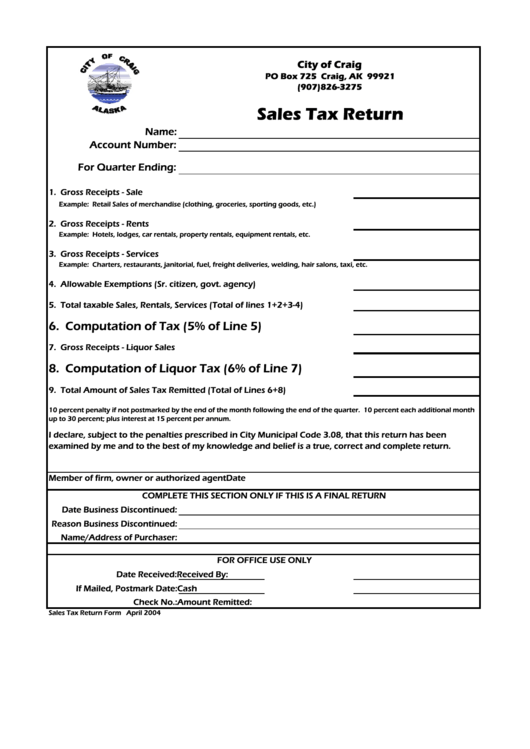

City of Craig

PO Box 725 Craig, AK 99921

(907)826-3275

Sales Tax Return

Name:

Account Number:

For Quarter Ending:

1. Gross Receipts - Sale

Example: Retail Sales of merchandise (clothing, groceries, sporting goods, etc.)

2. Gross Receipts - Rents

Example: Hotels, lodges, car rentals, property rentals, equipment rentals, etc.

3. Gross Receipts - Services

Example: Charters, restaurants, janitorial, fuel, freight deliveries, welding, hair salons, taxi, etc.

4. Allowable Exemptions (Sr. citizen, govt. agency)

5. Total taxable Sales, Rentals, Services (Total of lines 1+2+3-4)

6. Computation of Tax (5% of Line 5)

7. Gross Receipts - Liquor Sales

8. Computation of Liquor Tax (6% of Line 7)

9. Total Amount of Sales Tax Remitted (Total of Lines 6+8)

10 percent penalty if not postmarked by the end of the month following the end of the quarter. 10 percent each additional month

up to 30 percent; plus interest at 15 percent per annum.

I declare, subject to the penalties prescribed in City Municipal Code 3.08, that this return has been

examined by me and to the best of my knowledge and belief is a true, correct and complete return.

Member of firm, owner or authorized agent

Date

COMPLETE THIS SECTION ONLY IF THIS IS A FINAL RETURN

Date Business Discontinued:

Reason Business Discontinued:

Name/Address of Purchaser:

FOR OFFICE USE ONLY

Date Received:

Received By:

If Mailed, Postmark Date:

Cash

Check No.:

Amount Remitted:

Sales Tax Return Form April 2004

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1