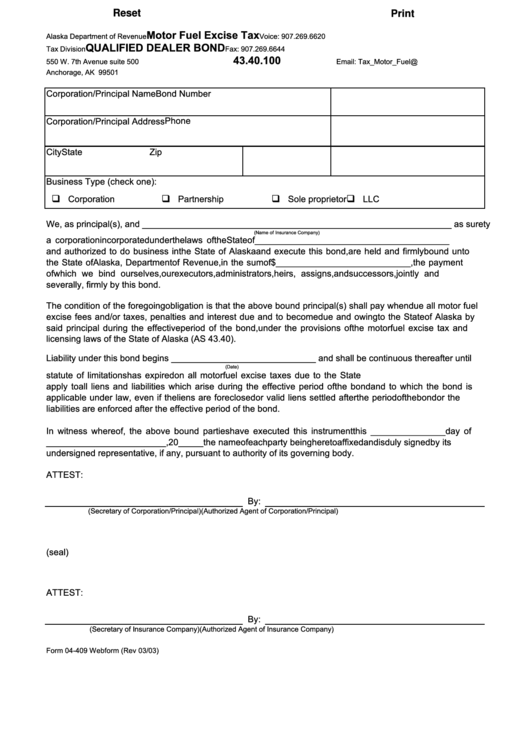

Reset

Print

Motor Fuel Excise Tax

Alaska Department of Revenue

Voice: 907.269.6620

QUALIFIED DEALER BOND

Tax Division

Fax: 907.269.6644

43.40.100

550 W. 7th Avenue suite 500

Email: Tax_Motor_Fuel@revenue.state.ak.us

Anchorage, AK 99501

Corporation/Principal Name

Bond Number

Phone

Corporation/Principal Address

City

State

Zip

Business Type (check one):

Corporation

Partnership

Sole proprietor

LLC

We, as principal(s), and ______________________________________________________________ as surety

(Name of Insurance Company)

a corporation incorporated under the laws of the State of _______________________________________

and authorized to do business in the State of Alaska and execute this bond, are held and firmly bound unto

the State of Alaska, Department of Revenue, in the sum of $___________________________, the payment

of which we bind ourselves, our executors, administrators, heirs, assigns, and successors, jointly and

severally, firmly by this bond.

The condition of the foregoing obligation is that the above bound principal(s) shall pay when due all motor fuel

excise fees and/or taxes, penalties and interest due and to become due and owing to the State of Alaska by

said principal during the effective period of the bond, under the provisions of the motor fuel excise tax and

licensing laws of the State of Alaska (AS 43.40).

Liability under this bond begins _____________________________ and shall be continuous thereafter until

(Date)

statute of limitations has expired on all motor fuel excise taxes due to the State of Alaska. The bond shall

apply to all liens and liabilities which arise during the effective period of the bond and to which the bond is

applicable under law, even if the liens are foreclosed or valid liens settled after the period of the bond or the

liabilities are enforced after the effective period of the bond.

In witness whereof, the above bound parties have executed this instrument this _______________ day of

________________________, 20_____ the name of each party being hereto affixed and is duly signed by its

undersigned representative, if any, pursuant to authority of its governing body.

ATTEST:

By:

(Secretary of Corporation/Principal)

(Authorized Agent of Corporation/Principal)

(seal)

ATTEST:

By:

(Secretary of Insurance Company)

(Authorized Agent of Insurance Company)

Form 04-409 Webform (Rev 03/03)

1

1