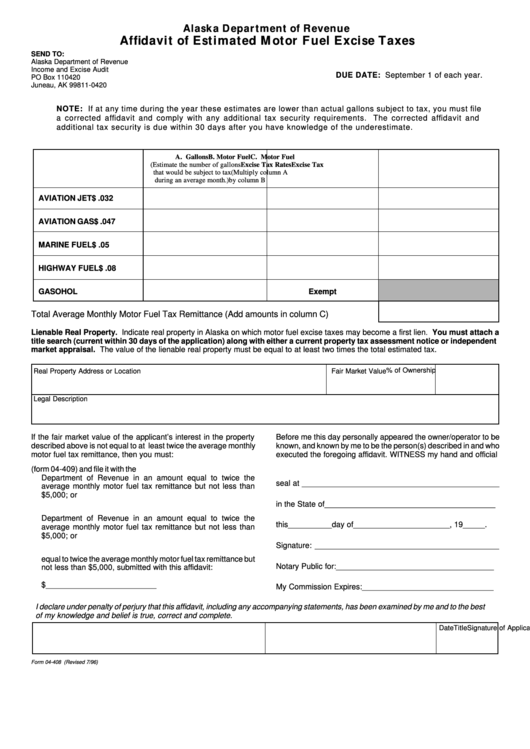

Alaska Department of Revenue

Affidavit of Estimated Motor Fuel Excise Taxes

SEND TO:

Alaska Department of Revenue

Income and Excise Audit

DUE DATE: September 1 of each year.

PO Box 110420

Juneau, AK 99811-0420

NOTE: If at any time during the year these estimates are lower than actual gallons subject to tax, you must file

a corrected affidavit and comply with any additional tax security requirements. The corrected affidavit and

additional tax security is due within 30 days after you have knowledge of the underestimate.

A. Gallons

B. Motor Fuel

C. Motor Fuel

(Estimate the number of gallons

Excise Tax Rates

Excise Tax

that would be subject to tax

(Multiply column A

during an average month.)

by column B

AVIATION JET

$ .032

AVIATION GAS

$ .047

MARINE FUEL

$ .05

HIGHWAY FUEL

$ .08

GASOHOL

Exempt

Total Average Monthly Motor Fuel Tax Remittance (Add amounts in column C) ...............

Lienable Real Property. Indicate real property in Alaska on which motor fuel excise taxes may become a first lien. You must attach a

title search (current within 30 days of the application) along with either a current property tax assessment notice or independent

market appraisal. The value of the lienable real property must be equal to at least two times the total estimated tax.

% of Ownership

Real Property Address or Location

Fair Market Value

Legal Description

If the fair market value of the applicant’s interest in the property

Before me this day personally appeared the owner/operator to be

described above is not equal to at least twice the average monthly

known, and known by me to be the person(s) described in and who

motor fuel tax remittance, then you must:

executed the foregoing affidavit. WITNESS my hand and official

a. Secure a Qualified Dealer Bond (form 04-409) and file it with the

Department of Revenue in an amount equal to twice the

seal at _____________________________________________

average monthly motor fuel tax remittance but not less than

$5,000; or

in the State of _______________________________________

b. File a letter of credit or certificate of deposit from a bank with the

Department of Revenue in an amount equal to twice the

this __________ day of ______________________ , 19_____.

average monthly motor fuel tax remittance but not less than

$5,000; or

Signature: __________________________________________

c. Deposit cash with the Department of Revenue in an amount

equal to twice the average monthly motor fuel tax remittance but

Notary Public for: ____________________________________

not less than $5,000, submitted with this affidavit:

$_________________________

My Commission Expires: ______________________________

I declare under penalty of perjury that this affidavit, including any accompanying statements, has been examined by me and to the best

of my knowledge and belief is true, correct and complete.

Signature of Applicant

Title

Date

Form 04-408 (Revised 7/96)

1

1