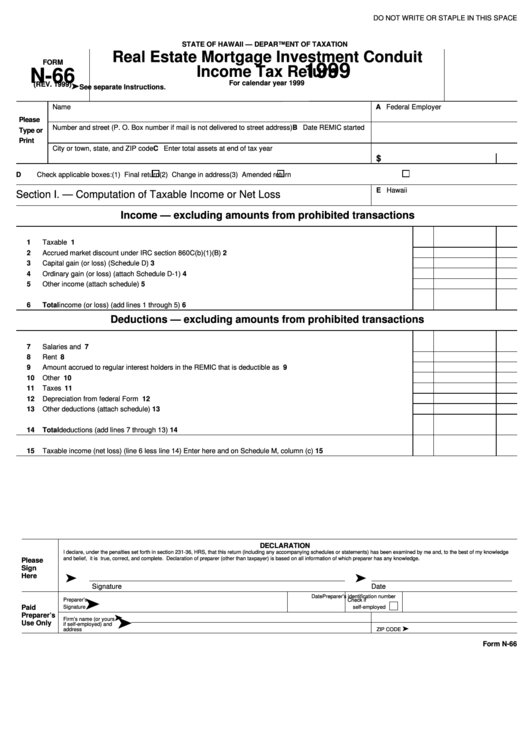

Form N-66 - Real Estate Mortgage Investment Conduit Income Tax Return - 1999

ADVERTISEMENT

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII — DEPARTMENT OF TAXATION

Real Estate Mortgage Investment Conduit

FORM

1999

Income Tax Return

N-66

For calendar year 1999

(REV. 1999)

See separate Instructions.

Name

A Federal Employer I.D. No.

Please

Number and street (P. O. Box number if mail is not delivered to street address)

B Date REMIC started

Type or

Print

City or town, state, and ZIP code

C Enter total assets at end of tax year

$

D

Check applicable boxes:

(1)

Final return

(2)

Change in address

(3)

Amended return

E Hawaii G.E./Use I.D. No.

Section I. — Computation of Taxable Income or Net Loss

Income — excluding amounts from prohibited transactions

1

Taxable interest ................................................................................................................................................................

1

2

Accrued market discount under IRC section 860C(b)(1)(B)..............................................................................................

2

3

Capital gain (or loss) (Schedule D) ...................................................................................................................................

3

4

Ordinary gain (or loss) (attach Schedule D-1)...................................................................................................................

4

5

Other income (attach schedule)........................................................................................................................................

5

6

Total income (or loss) (add lines 1 through 5) ..................................................................................................................

6

Deductions — excluding amounts from prohibited transactions

7

Salaries and wages...........................................................................................................................................................

7

8

Rent ..................................................................................................................................................................................

8

9

Amount accrued to regular interest holders in the REMIC that is deductible as interest ..................................................

9

10

Other interest ....................................................................................................................................................................

10

11

Taxes ................................................................................................................................................................................

11

12

Depreciation from federal Form 4562 ...............................................................................................................................

12

13

Other deductions (attach schedule) ..................................................................................................................................

13

14

Total deductions (add lines 7 through 13) ........................................................................................................................

14

15

Taxable income (net loss) (line 6 less line 14) Enter here and on Schedule M, column (c)..............................................

15

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of my knowledge

and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

Sign

Here

Signature

Date

Date

Preparer’s identification number

Preparer’s

Check if

Paid

Signature

self-employed

Preparer’s

Firm’s name (or yours

E.I. No.

Use Only

if self-employed) and

address

ZIP CODE

Form N-66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3