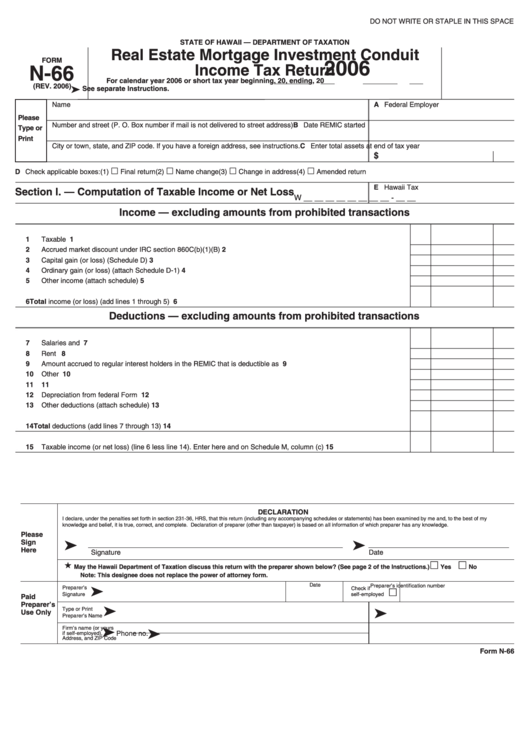

Form N-66 - Real Estate Mortgage Investment Conduit Income Tax Return - 2006

ADVERTISEMENT

DO NOT WRITE OR STAPLE IN THIS SPACE

STATE OF HAWAII — DEPARTMENT OF TAXATION

Real Estate Mortgage Investment Conduit

FORM

2006

Income Tax Return

N-66

For calendar year 2006 or short tax year beginning

, 20

, ending

, 20

(REV. 2006)

ä

See separate Instructions.

Name

A Federal Employer I.D. No.

Please

Number and street (P. O. Box number if mail is not delivered to street address)

B Date REMIC started

Type or

Print

City or town, state, and ZIP code. If you have a foreign address, see instructions.

C Enter total assets at end of tax year

$

£

£

£

£

D Check applicable boxes:

(1)

Final return

(2)

Name change

(3)

Change in address

(4)

Amended return

E Hawaii Tax I.D. No.

Section I. — Computation of Taxable Income or Net Loss

W __ __ __ __ __ __ __ __ - __ __

Income — excluding amounts from prohibited transactions

1

Taxable interest ................................................................................................................................................................

1

2

Accrued market discount under IRC section 860C(b)(1)(B) .............................................................................................

2

3

Capital gain (or loss) (Schedule D)...................................................................................................................................

3

4

Ordinary gain (or loss) (attach Schedule D-1) ..................................................................................................................

4

5

Other income (attach schedule) .......................................................................................................................................

5

6

Total income (or loss) (add lines 1 through 5) .................................................................................................................

6

Deductions — excluding amounts from prohibited transactions

7

Salaries and wages ..........................................................................................................................................................

7

8

Rent .................................................................................................................................................................................

8

9

Amount accrued to regular interest holders in the REMIC that is deductible as interest..................................................

9

10

Other interest....................................................................................................................................................................

10

11

Taxes................................................................................................................................................................................

11

12

Depreciation from federal Form 4562...............................................................................................................................

12

13

Other deductions (attach schedule)..................................................................................................................................

13

14

Total deductions (add lines 7 through 13)........................................................................................................................

14

15

Taxable income (or net loss) (line 6 less line 14). Enter here and on Schedule M, column (c)........................................

15

DECLARATION

I declare, under the penalties set forth in section 231-36, HRS, that this return (including any accompanying schedules or statements) has been examined by me and, to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Please

ä

ä

Sign

Here

Signature

Date

£

£

«

May the Hawaii Department of Taxation discuss this return with the preparer shown below? (See page 2 of the Instructions.)

Yes

No

Note: This designee does not replace the power of attorney form.

Date

ä

Preparer’s identification number

Preparer’s

Check if

£

Signature

self-employed

Paid

Preparer’s

ä

ä

Type or Print

Use Only

E.I. No.

Preparer’s Name

ä

Firm’s name (or yours

ä

if self-employed),

Phone no.

Address, and ZIP Code

Form N-66

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3