Schedule Bio Template - Application And Credit Certificate Of Income Tax Credit Biodiesel

ADVERTISEMENT

*0600010219*

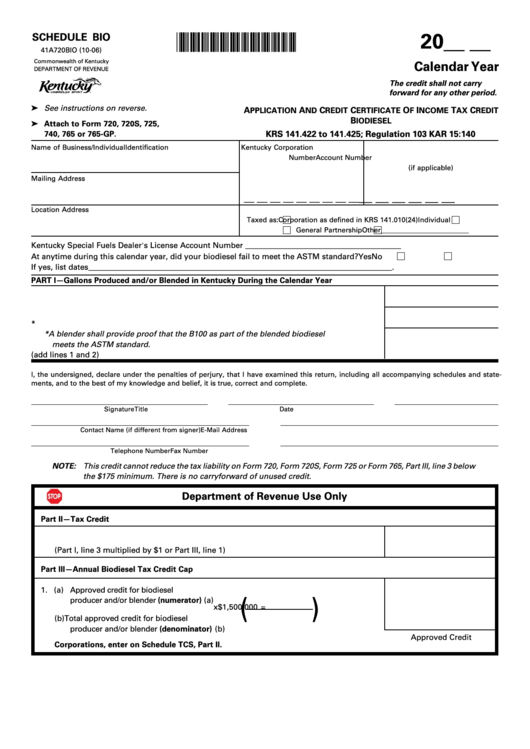

SCHEDULE BIO

20__ __

41A720BIO (10-06)

Commonwealth of Kentucky

Calendar Year

DEPARTMENT OF REVENUE

The credit shall not carry

forward for any other period.

➤ See instructions on reverse.

A

A

C

C

O

I

T

C

PPLICATION

ND

REDIT

ERTIFICATE

F

NCOME

AX

REDIT

B

IODIESEL

➤ Attach to Form 720, 720S, 725,

KRS 141.422 to 141.425; Regulation 103 KAR 15:140

740, 765 or 765-GP.

Name of Business/Individual

Identification

Kentucky Corporation

Number

Account Number

(if applicable)

Mailing Address

__ __ __ __ __ __

__ __ __ __ __ __ __ __ __

Location Address

Taxed as:

Corporation as defined in KRS 141.010(24)

Individual

General Partnership

Other _________________________

Kentucky Special Fuels Dealer's License Account Number ________________________________________

At anytime during this calendar year, did your biodiesel fail to meet the ASTM standard?

Yes

No

If yes, list dates ______________________________________________________________________________ .

PART I—Gallons Produced and/or Blended in Kentucky During the Calendar Year

1. Number of gallons of B100 biodiesel produced meeting ASTM standard ............................. 1

2. Number of gallons of B100 biodiesel blended with diesel* ..................................................... 2

* A blender shall provide proof that the B100 as part of the blended biodiesel

meets the ASTM standard.

3. Total biodiesel produced and/or blended (add lines 1 and 2) .................................................. 3

I, the undersigned, declare under the penalties of perjury, that I have examined this return, including all accompanying schedules and state-

ments, and to the best of my knowledge and belief, it is true, correct and complete.

Signature

Title

Date

Contact Name (if different from signer)

E-Mail Address

Telephone Number

Fax Number

NOTE: This credit cannot reduce the tax liability on Form 720, Form 720S, Form 725 or Form 765, Part III, line 3 below

the $175 minimum. There is no carryforward of unused credit.

Department of Revenue Use Only

Part II—Tax Credit

1. Biodiesel tax credit approved by Department of Revenue

(Part I, line 3 multiplied by $1 or Part III, line 1) ................................................................... 1

Part III—Annual Biodiesel Tax Credit Cap

1. (a) Approved credit for biodiesel

producer and/or blender (numerator) ........... (a)

(

)

x

$1,500,000 =

(b) Total approved credit for biodiesel

producer and/or blender (denominator) ...... (b)

Approved Credit

Corporations, enter on Schedule TCS, Part II.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1