Sample Salary Redirection/reduction Agreement Form

ADVERTISEMENT

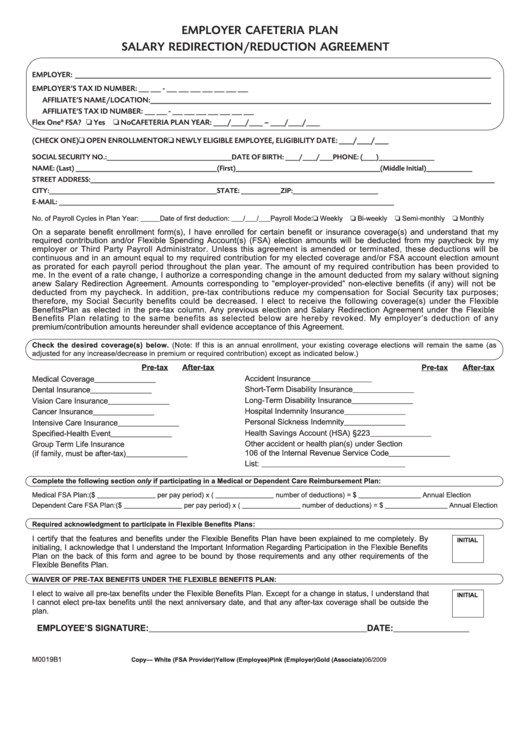

EMPLOYER CAFETERIA PLAN

SALARY REDIRECTION/REDUCTION AGREEMENT

EMPLOYER: __________________________________________________________________________________________________________________________

EMPLOYER’S TAX ID NUMBER: ___ ___ - ___ ___ ___ ___ ___ ___ ___

AFFILIATE’S NAME/LOCATION: ____________________________________________________________________________________________________

AFFILIATE’S TAX ID NUMBER: ___ ___ - ___ ___ ___ ___ ___ ___ ___

Flex One

®

FSA? J Yes J No

CAFETERIA PLAN YEAR: ____/____/____ – ____/____/____

(CHECK ONE) J OPEN ENROLLMENT OR J NEWLY ELIGIBLE EMPLOYEE, ELIGIBILITY DATE: ____/____/____

SOCIAL SECURITY NO.: ______________________________________

DATE OF BIRTH: ____/____/____ PHONE: (____)_________________

NAME: (Last) ___________________________________________

(First) ____________________________________________

(Middle Initial)______________

STREET ADDRESS: ___________________________________________________________________________________________________________________________

CITY:___________________________________________________

STATE: ____________ ZIP:__________________________

E-MAIL: ______________________________________________________________________________________________________

No. of Payroll Cycles in Plan Year: _____ Date of first deduction: ___/___/___ Payroll Mode: J Weekly

J Bi-weekly

J Semi-monthly

J Monthly

On a separate benefit enrollment form(s), I have enrolled for certain benefit or insurance coverage(s) and understand that my

required contribution and/or Flexible Spending Account(s) (FSA) election amounts will be deducted from my paycheck by my

employer or Third Party Payroll Administrator. Unless this agreement is amended or terminated, these deductions will be

continuous and in an amount equal to my required contribution for my elected coverage and/or FSA account election amount

as prorated for each payroll period throughout the plan year. The amount of my required contribution has been provided to

me. In the event of a rate change, I authorize a corresponding change in the amount deducted from my salary without signing

a new Salary Redirection Agreement. Amounts corresponding to “employer-provided” non-elective benefits (if any) will not be

deducted from my paycheck. In addition, pre-tax contributions reduce my compensation for Social Security tax purposes;

therefore, my Social Security benefits could be decreased. I elect to receive the following coverage(s) under the Flexible

Benefits Plan as elected in the pre-tax column. Any previous election and Salary Redirection Agreement under the Flexible

Benefits Plan relating to the same benefits as selected below are hereby revoked. My employer’s deduction of any

premium/contribution amounts hereunder shall evidence acceptance of this Agreement.

Check the desired coverage(s) below. (Note: If this is an annual enrollment, your existing coverage elections will remain the same (as

adjusted for any increase/decrease in premium or required contribution) except as indicated below.)

Pre-tax

After-tax

Pre-tax

After-tax

Accident Insurance

_______

_______

Medical Coverage

_______

_______

Short-Term Disability Insurance

_______

_______

Dental Insurance

_______

_______

Long-Term Disability Insurance

_______

_______

Vision Care Insurance

_______

_______

Hospital Indemnity Insurance

_______

_______

Cancer Insurance

_______

_______

Personal Sickness Indemnity

_______

_______

Intensive Care Insurance

_______

_______

Health Savings Account (HSA) §223

_______

_______

Specified-Health Event

_______

_______

Other accident or health plan(s) under Section

Group Term Life Insurance

106 of the Internal Revenue Service Code

_______

_______

(if family, must be after-tax)

_______

_______

List:

Complete the following section only if participating in a Medical or Dependent Care Reimbursement Plan:

Medical FSA Plan:

($ _______________ per pay period) x ( _______________ number of deductions) = $ ________________ Annual Election

Dependent Care FSA Plan: ($ _______________ per pay period) x ( _______________ number of deductions) = $ ________________ Annual Election

Required acknowledgment to participate in Flexible Benefits Plans:

I certify that the features and benefits under the Flexible Benefits Plan have been explained to me completely. By

INITIAL

initialing, I acknowledge that I understand the Important Information Regarding Participation in the Flexible Benefits

Plan on the back of this form and agree to be bound by those requirements and any other requirements of the

Flexible Benefits Plan.

WAIVER OF PRE-TAX BENEFITS UNDER THE FLEXIBLE BENEFITS PLAN:

I elect to waive all pre-tax benefits under the Flexible Benefits Plan. Except for a change in status, I understand that

INITIAL

I cannot elect pre-tax benefits until the next anniversary date, and that any after-tax coverage shall be outside the

plan.

EMPLOYEE’S SIGNATURE: ______________________________________________

DATE:________________

M0019B1

Copy — White (FSA Provider)

Yellow (Employee)

Pink (Employer)

Gold (Associate)

06/2009

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2