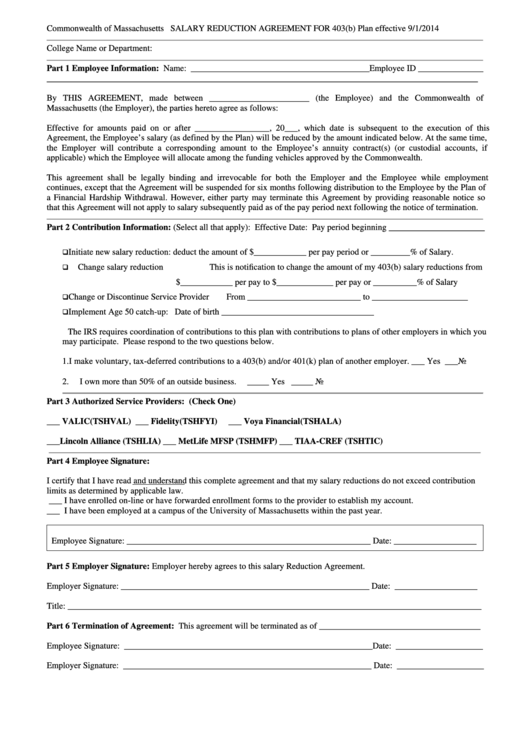

Salary Reduction Agreement Form For 403(B) Plan

ADVERTISEMENT

Commonwealth of Massachusetts

SALARY REDUCTION AGREEMENT FOR 403(b) Plan effective 9/1/2014

College Name or Department:

Part 1 Employee Information: Name: _________________________________________Employee ID _______________

___________________________________________________________________________________________________

By THIS AGREEMENT, made between _______________________ (the Employee) and the Commonwealth of

Massachusetts (the Employer), the parties hereto agree as follows:

Effective for amounts paid on or after _________________, 20___, which date is subsequent to the execution of this

Agreement, the Employee’s salary (as defined by the Plan) will be reduced by the amount indicated below. At the same time,

the Employer will contribute a corresponding amount to the Employee’s annuity contract(s) (or custodial accounts, if

applicable) which the Employee will allocate among the funding vehicles approved by the Commonwealth.

This agreement shall be legally binding and irrevocable for both the Employer and the Employee while employment

continues, except that the Agreement will be suspended for six months following distribution to the Employee by the Plan of

a Financial Hardship Withdrawal. However, either party may terminate this Agreement by providing reasonable notice so

that this Agreement will not apply to salary subsequently paid as of the pay period next following the notice of termination.

Part 2 Contribution Information: (Select all that apply): Effective Date: Pay period beginning ______________________

Initiate new salary reduction: deduct the amount of $____________ per pay period or _________% of Salary.

Change salary reduction

This is notification to change the amount of my 403(b) salary reductions from

$____________ per pay to $_____________ per pay or __________% of Salary

Change or Discontinue Service Provider

From __________________________ to ______________________

Implement Age 50 catch-up:

Date of birth ___________________________________

The IRS requires coordination of contributions to this plan with contributions to plans of other employers in which you

may participate. Please respond to the two questions below.

1. I make voluntary, tax-deferred contributions to a 403(b) and/or 401(k) plan of another employer. ___ Yes ___No

2.

I own more than 50% of an outside business.

_____ Yes _____ No

Part 3 Authorized Service Providers: (Check One)

___ VALIC(TSHVAL)

___ Fidelity(TSHFYI)

___ Voya Financial(TSHALA)

___Lincoln Alliance (TSHLIA)

___ MetLife MFSP (TSHMFP)

___ TIAA-CREF (TSHTIC)

Part 4 Employee Signature:

I certify that I have read and understand this complete agreement and that my salary reductions do not exceed contribution

limits as determined by applicable law.

___ I have enrolled on-line or have forwarded enrollment forms to the provider to establish my account.

___ I have been employed at a campus of the University of Massachusetts within the past year.

Employee Signature: ________________________________________________________ Date: ___________________

Part 5 Employer Signature: Employer hereby agrees to this salary Reduction Agreement.

Employer Signature: _________________________________________________________ Date: ___________________

Title: _______________________________________________________________________________________________

Part 6 Termination of Agreement: This agreement will be terminated as of _____________________________________

Employee Signature: _________________________________________________________Date: ____________________

Employer Signature: _________________________________________________________ Date: ____________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1