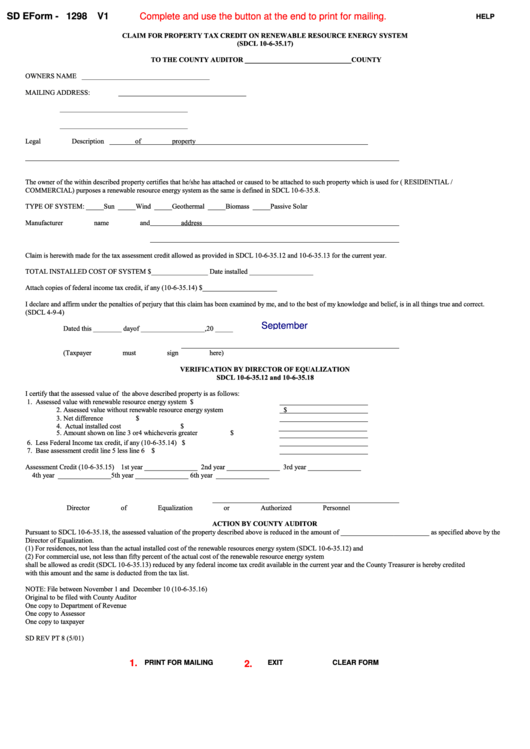

SD EForm - 1298

V1

Complete and use the button at the end to print for mailing.

HELP

CLAIM FOR PROPERTY TAX CREDIT ON RENEWABLE RESOURCE ENERGY SYSTEM

(SDCL 10-6-35.17)

TO THE COUNTY AUDITOR ______________________________COUNTY

OWNERS NAME

____________________________________

MAILING ADDRESS:

____________________________________

____________________________________

____________________________________

Legal Description of property

The owner of the within described property certifies that he/she has attached or caused to be attached to such property which is used for ( RESIDENTIAL /

COMMERCIAL) purposes a renewable resource energy system as the same is defined in SDCL 10-6-35.8.

TYPE OF SYSTEM: _____Sun _____Wind _____Geothermal _____Biomass _____Passive Solar

Manufacturer name and address

Claim is herewith made for the tax assessment credit allowed as provided in SDCL 10-6-35.12 and 10-6-35.13 for the current year.

TOTAL INSTALLED COST OF SYSTEM $________________ Date installed __________________

Attach copies of federal income tax credit, if any (10-6-35.14) $_____________________

I declare and affirm under the penalties of perjury that this claim has been examined by me, and to the best of my knowledge and belief, is in all things true and correct.

(SDCL 4-9-4)

September

Dated this ________ day of __________________, 20 _____

(Taxpayer must sign here)

VERIFICATION BY DIRECTOR OF EQUALIZATION

SDCL 10-6-35.12 and 10-6-35.18

I certify that the assessed value of the above described property is as follows:

1. Assessed value with renewable resource energy system

$

2. Assessed value without renewable resource energy system

$

3. Net difference

$

4. Actual installed cost

$

5. Amount shown on line 3 or 4 whichever is greater

$

6. Less Federal Income tax credit, if any (10-6-35.14)

$

7. Base assessment credit line 5 less line 6

$

Assessment Credit (10-6-35.15)

1st year _______________ 2nd year _______________ 3rd year _______________

4th year _______________5th year _______________ 6th year _______________

Director of Equalization or Authorized Personnel

ACTION BY COUNTY AUDITOR

Pursuant to SDCL 10-6-35.18, the assessed valuation of the property described above is reduced in the amount of _________________________ as specified above by the

Director of Equalization.

(1) For residences, not less than the actual installed cost of the renewable resources energy system (SDCL 10-6-35.12) and

(2) For commercial use, not less than fifty percent of the actual cost of the renewable resource energy system

shall be allowed as credit (SDCL 10-6-35.13) reduced by any federal income tax credit available in the current year and the County Treasurer is hereby credited

with this amount and the same is deducted from the tax list.

NOTE: File between November 1 and December 10 (10-6-35.16)

Original to be filed with County Auditor

One copy to Department of Revenue

One copy to Assessor

One copy to taxpayer

SD REV PT 8 (5/01)

1.

PRINT FOR MAILING

2.

EXIT

CLEAR FORM

1

1