Form Ri Sp-01 - Personal Income Tax Credit For Qualifying Surviving Spouse

ADVERTISEMENT

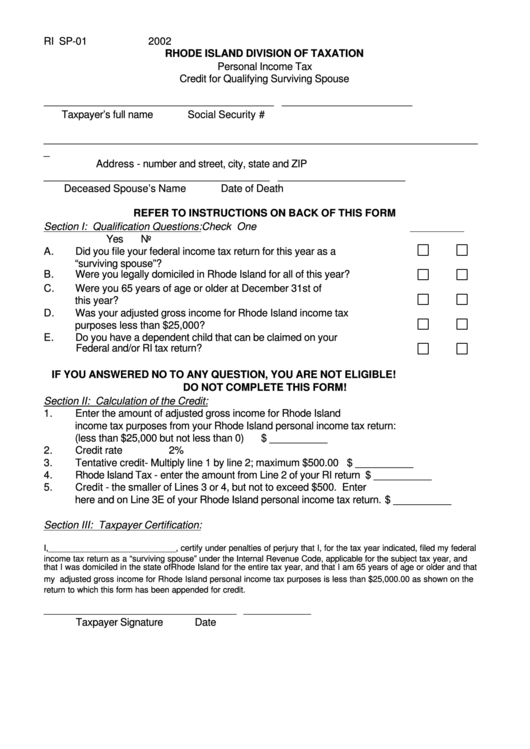

RI SP-01

2002

RHODE ISLAND DIVISION OF TAXATION

Personal Income Tax

Credit for Qualifying Surviving Spouse

____________________________________________

_________________________

Taxpayer’s full name

Social Security #

___________________________________________________________________________

_

Address - number and street, city, state and ZIP

_______________________________________

______________________

Deceased Spouse’s Name

Date of Death

REFER TO INSTRUCTIONS ON BACK OF THIS FORM

Section I: Qualification Questions:

Check One

Yes

No

A.

Did you file your federal income tax return for this year as a

“surviving spouse”?

B.

Were you legally domiciled in Rhode Island for all of this year?

C.

Were you 65 years of age or older at December 31st of

this year?

D.

Was your adjusted gross income for Rhode Island income tax

purposes less than $25,000?

E.

Do you have a dependent child that can be claimed on your

Federal and/or RI tax return?

IF YOU ANSWERED NO TO ANY QUESTION, YOU ARE NOT ELIGIBLE!

DO NOT COMPLETE THIS FORM!

Section II: Calculation of the Credit:

1.

Enter the amount of adjusted gross income for Rhode Island

income tax purposes from your Rhode Island personal income tax return:

(less than $25,000 but not less than 0)

$ __________

2.

Credit rate

2%

3.

Tentative credit- Multiply line 1 by line 2; maximum $500.00

$ __________

4.

Rhode Island Tax - enter the amount from Line 2 of your RI return

$ __________

5.

Credit - the smaller of Lines 3 or 4, but not to exceed $500. Enter

here and on Line 3E of your Rhode Island personal income tax return. $ __________

Section III: Taxpayer Certification:

I,____________________________, certify under penalties of perjury that I, for the tax year indicated, filed my federal

income tax return as a “surviving spouse” under the Internal Revenue Code, applicable for the subject tax year, and

that I was domiciled in the state of Rhode Island for the entire tax year, and that I am 65 years of age or older and that

my adjusted gross income for Rhode Island personal income tax purposes is less than $25,000.00 as shown on the

return to which this form has been appended for credit.

___________________________________________

_______________

Taxpayer Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1