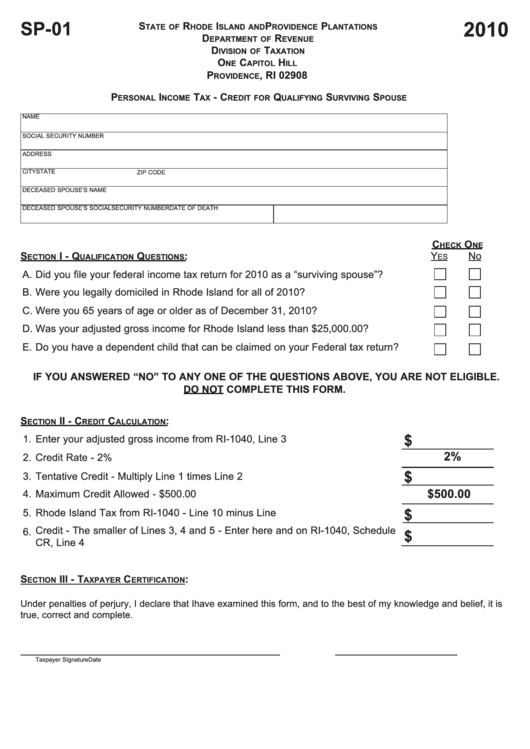

SP-01

S

R

I

P

P

2010

TATE OF

HODE

SLAND AND

ROVIDENCE

LANTATIONS

D

R

EPARTMENT OF

EVENUE

D

T

IVISION OF

AXATION

O

C

H

NE

APITOL

ILL

P

, RI 02908

ROVIDENCE

P

I

T

- C

Q

S

S

ERSONAL

NCOME

AX

REDIT FOR

UALIFYING

URVIVING

POUSE

NAME

SOCIAL SECURITY NUMBER

ADDRESS

CITY

STATE

ZIP CODE

DECEASED SPOUSE’S NAME

DECEASED SPOUSE’S SOCIAL SECURITY NUMBER

DATE OF DEATH

C

O

HECK

NE

S

I - Q

Q

:

Y

No

ECTION

UALIFICATION

UESTIONS

ES

A.

Did you file your federal income tax return for 2010 as a “surviving spouse”?

B.

Were you legally domiciled in Rhode Island for all of 2010?

C.

Were you 65 years of age or older as of December 31, 2010?

D.

Was your adjusted gross income for Rhode Island less than $25,000.00?

E.

Do you have a dependent child that can be claimed on your Federal tax return?

IF YOU ANSWERED “NO” TO ANY ONE OF THE QUESTIONS ABOVE, YOU ARE NOT ELIGIBLE.

DO NOT COMPLETE THIS FORM.

S

II - C

C

:

ECTION

REDIT

ALCULATION

$

1.

Enter your adjusted gross income from RI-1040, Line 3 ........................................

2%

2.

Credit Rate - 2% .....................................................................................................

$

3.

Tentative Credit - Multiply Line 1 times Line 2 ........................................................

$500.00

4.

Maximum Credit Allowed - $500.00 ........................................................................

5.

Rhode Island Tax from RI-1040 - Line 10 minus Line 11A .....................................

$

Credit - The smaller of Lines 3, 4 and 5 - Enter here and on RI-1040, Schedule

6.

$

CR, Line 4 ...............................................................................................................

S

III - T

C

:

ECTION

AXPAYER

ERTIFICATION

Under penalties of perjury, I declare that I have examined this form, and to the best of my knowledge and belief, it is

true, correct and complete.

Taxpayer SIgnature

Date

1

1 2

2