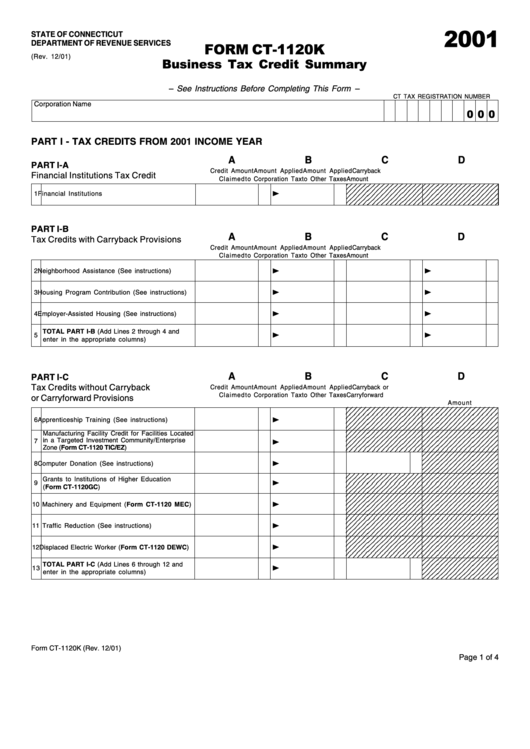

Form Ct-1120k - Business Tax Credit Summary (2001)

ADVERTISEMENT

2001

STATE OF CONNECTICUT

FORM CT-1120K

DEPARTMENT OF REVENUE SERVICES

(Rev. 12/01)

Business Tax Credit Summary

– See Instructions Before Completing This Form –

CT TAX REGISTRATION NUMBER

Corporation Name

0 0 0

PART I - TAX CREDITS FROM 2001 INCOME YEAR

A

B

C

D

PART I-A

Credit Amount

Amount Applied

Amount Applied

Carryback

Financial Institutions Tax Credit

Claimed

to Corporation Tax

to Other Taxes

Amount

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 Financial Institutions

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

PART I-B

A

B

C

D

Tax Credits with Carryback Provisions

Credit Amount

Amount Applied

Amount Applied

Carryback

Claimed

to Corporation Tax

to Other Taxes

Amount

2 Neighborhood Assistance (See instructions)

3 Housing Program Contribution (See instructions)

4 Employer-Assisted Housing (See instructions)

TOTAL PART I-B (Add Lines 2 through 4 and

5

enter in the appropriate columns)

A

B

C

D

PART I-C

Tax Credits without Carryback

Credit Amount

Amount Applied

Amount Applied

Carryback or

Claimed

to Corporation Tax

to Other Taxes

Carryforward

or Carryforward Provisions

Amount

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

6 Apprenticeship Training (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

Manufacturing Facility Credit for Facilities Located

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

in a Targeted Investment Community/Enterprise

7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

Zone (Form CT-1120 TIC/EZ)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

8 Computer Donation (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

Grants to Institutions of Higher Education

9

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

(Form CT-1120GC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

10 Machinery and Equipment (Form CT-1120 MEC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

11 Traffic Reduction (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

12 Displaced Electric Worker (Form CT-1120 DEWC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

TOTAL PART I-C (Add Lines 6 through 12 and

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

13

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

enter in the appropriate columns)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8

Form CT-1120K (Rev. 12/01)

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4