Form Ct-1120k - Business Tax Credit Summary (2000)

ADVERTISEMENT

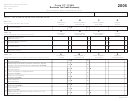

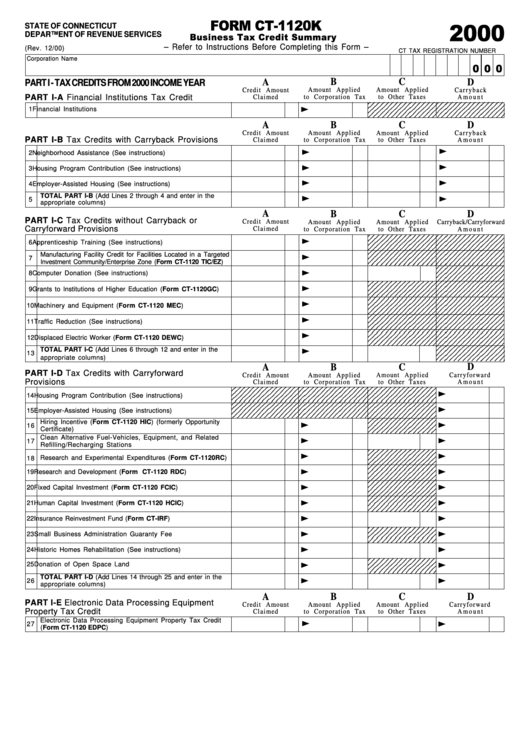

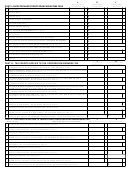

FORM CT-1120K

2000

STATE OF CONNECTICUT

DEPARTMENT OF REVENUE SERVICES

Business Tax Credit Summary

– Refer to Instructions Before Completing this Form –

(Rev. 12/00)

CT TAX REGISTRATION NUMBER

Corporation Name

0 0 0

A

B

C

D

PART I - TAX CREDITS FROM 2000 INCOME YEAR

Amount Applied

Amount Applied

Credit Amount

Carryback

PART I-A Financial Institutions Tax Credit

Claimed

to Corporation Tax

to Other Taxes

A m o u n t

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1

Financial Institutions

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

A

B

C

D

Credit Amount

Amount Applied

Amount Applied

Carryback

PART I-B Tax Credits with Carryback Provisions

Claimed

to Corporation Tax

to Other Taxes

A m o u n t

<

<

2

Neighborhood Assistance (See instructions)

<

<

3

Housing Program Contribution (See instructions)

<

<

4

Employer-Assisted Housing (See instructions)

<

<

TOTAL PART I-B (Add Lines 2 through 4 and enter in the

5

appropriate columns)

A

B

C

D

PART I-C Tax Credits without Carryback or

Credit Amount

Amount Applied

Amount Applied

Carryback/Carryforward

Carryforward Provisions

Claimed

to Corporation Tax

to Other Taxes

A m o u n t

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

6

Apprenticeship Training (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

Manufacturing Facility Credit for Facilities Located in a Targeted

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Investment Community/Enterprise Zone (Form CT-1120 TIC/EZ)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

8

Computer Donation (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

9

Grants to Institutions of Higher Education (Form CT-1120GC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

10 Machinery and Equipment (Form CT-1120 MEC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

11 Traffic Reduction (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

12 Displaced Electric Worker (Form CT-1120 DEWC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

TOTAL PART I-C (Add Lines 6 through 12 and enter in the

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

13

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

appropriate columns)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

D

A

B

C

PART I-D Tax Credits with Carryforward

Credit Amount

Amount Applied

Amount Applied

Carryforward

Provisions

to Other Taxes

A m o u n t

Claimed

to Corporation Tax

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

14 Housing Program Contribution (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

15 Employer-Assisted Housing (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0 1 2 3 4

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

Hiring Incentive (Form CT-1120 HIC) (formerly Opportunity

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

16

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

Certificate)

<

<

Clean Alternative Fuel-Vehicles, Equipment, and Related

17

Refilling/Recharging Stations

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

18 Research and Experimental Expenditures (Form CT-1120RC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

19 Research and Development (Form CT-1120 RDC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

20 Fixed Capital Investment (Form CT-1120 FCIC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

21 Human Capital Investment (Form CT-1120 HCIC)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

22 Insurance Reinvestment Fund (Form CT-IRF)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

23 Small Business Administration Guaranty Fee

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

24 Historic Homes Rehabilitation (See instructions)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

25 Donation of Open Space Land

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6

<

<

TOTAL PART I-D (Add Lines 14 through 25 and enter in the

26

appropriate columns)

A

B

C

D

PART I-E Electronic Data Processing Equipment

Credit Amount

Amount Applied

Amount Applied

Carryforward

Property Tax Credit

Claimed

to Corporation Tax

to Other Taxes

A m o u n t

<

<

Electronic Data Processing Equipment Property Tax Credit

27

(Form CT-1120 EDPC)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2