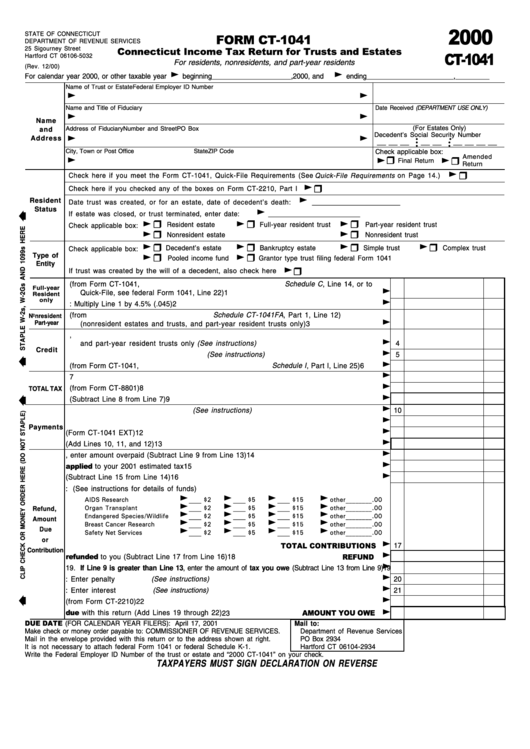

Form Ct-1041- Connecticut Income Tax Return For Trusts And Estates - 2000

ADVERTISEMENT

2000

STATE OF CONNECTICUT

FORM CT-1041

DEPARTMENT OF REVENUE SERVICES

Connecticut Income Tax Return for Trusts and Estates

25 Sigourney Street

CT-1041

Hartford CT 06106-5032

For residents, nonresidents, and part-year residents

(Rev. 12/00)

<

<

For calendar year 2000, or other taxable year

beginning _____________________ ,2000, and

ending _______________________ , _________

Name of Trust or Estate

Federal Employer ID Number

<

<

Name and Title of Fiduciary

Date Received (DEPARTMENT USE ONLY)

<

<

Name

(For Estates Only)

Address of Fiduciary

Number and Street

PO Box

and

<

<

Decedent’s Social Security Number

Address

•

•

__ __ __

__ __

__ __ __ __

•

•

•

•

City, Town or Post Office

State

ZIP Code

Check applicable box:

<

<

<

Amended

H

H

Final Return

Return

<

H

Check here if you meet the Form CT-1041, Quick-File Requirements (See Quick-File Requirements on Page 14.)

<

H

Check here if you checked any of the boxes on Form CT-2210, Part I

<

Resident

Date trust was created, or for an estate, date of decedent’s death:

________________________

<

Status

If estate was closed, or trust terminated, enter date:

_________________________

<

<

<

H

H

H

Resident estate

Full-year resident trust

Part-year resident trust

Check applicable box:

<

<

H

H

Nonresident estate

Nonresident trust

<

<

<

<

H

H

H

H

Decedent’s estate

Bankruptcy estate

Simple trust

Complex trust

Check applicable box:

<

<

H

H

Type of

Pooled income fund

Grantor type trust filing federal Form 1041

Entity

<

H

If trust was created by the will of a decedent, also check here

1. Connecticut taxable income of fiduciary (from Form CT-1041, Schedule C , Line 14, or to

<

Full-year

Quick-File, see federal Form 1041, Line 22)

1

Resident

<

only

2. Connecticut income tax: Multiply Line 1 by 4.5% (.045)

2

3. Allocated Connecticut income tax (from Schedule CT-1041FA , Part 1, Line 12)

Nonresident

<

Part-year

(nonresident estates and trusts, and part-year resident trusts only)

3

4. Credit for income tax paid to qualifying jurisdictions by resident estates and trusts,

<

and part-year resident trusts only (See instructions)

4

<

Credit

5. Subtract Line 4 from Line 2 or Line 3 (See instructions)

5

<

6. Connecticut alternative minimum tax (from Form CT-1041, Schedule I , Part I, Line 25)

6

<

7. Add Line 5 and Line 6

7

<

8. Adjusted net Connecticut minimum tax credit (from Form CT-8801)

8

TOTAL TAX

<

9. Connecticut income tax (Subtract Line 8 from Line 7)

9

<

10. Connecticut income tax withheld (See instructions)

10

<

11. All 2000 estimated tax payments and any overpayment applied from a prior year

11

<

Payments

12. Payments made with extension request (Form CT-1041 EXT)

12

<

13. Total payments (Add Lines 10, 11, and 12)

13

<

14. If Line 13 is greater than Line 9, enter amount overpaid (Subtract Line 9 from Line 13)

14

<

15. Amount of Line 14 you want to be applied to your 2001 estimated tax

15

<

16. Balance of overpayment (Subtract Line 15 from Line 14)

16

17. Amount of Line 16 you want to contribute to: (See instructions for details of funds)

<

<

<

<

AIDS Research

____ $2

____ $5

____ $15

other________.00

<

<

<

<

Organ Transplant

____ $2

____ $5

____ $15

other________.00

Refund,

<

<

<

<

Endangered Species/Wildlife

____ $2

____ $5

____ $15

other________.00

<

<

<

<

Amount

Breast Cancer Research

____ $2

____ $5

____ $15

other________.00

<

<

<

<

Due

Safety Net Services

____ $2

____ $5

____ $15

other________.00

<

or

TOTAL CONTRIBUTIONS

17

<

Contribution

18. Amount to be refunded to you (Subtract Line 17 from Line 16)

REFUND

18

<

19. If Line 9 is greater than Line 13, enter the amount of tax you owe (Subtract Line 13 from Line 9)

19

<

20. If late: Enter penalty (See instructions)

20

<

21. If late: Enter interest (See instructions)

21

<

22. Interest on underpayments of estimated tax (from Form CT-2210)

22

<

23. Amount due with this return (Add Lines 19 through 22)

AMOUNT YOU OWE

23

DUE DATE (FOR CALENDAR YEAR FILERS): April 17, 2001

Mail to:

Department of Revenue Services

Make check or money order payable to: COMMISSIONER OF REVENUE SERVICES.

Mail in the envelope provided with this return or to the address shown at right.

PO Box 2934

Hartford CT 06104-2934

It is not necessary to attach federal Form 1041 or federal Schedule K-1.

Write the Federal Employer ID Number of the trust or estate and “2000 CT-1041” on your check.

TAXPAYERS MUST SIGN DECLARATION ON REVERSE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2