Form E-234 - Earnings Tax Return

Download a blank fillable Form E-234 - Earnings Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form E-234 - Earnings Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

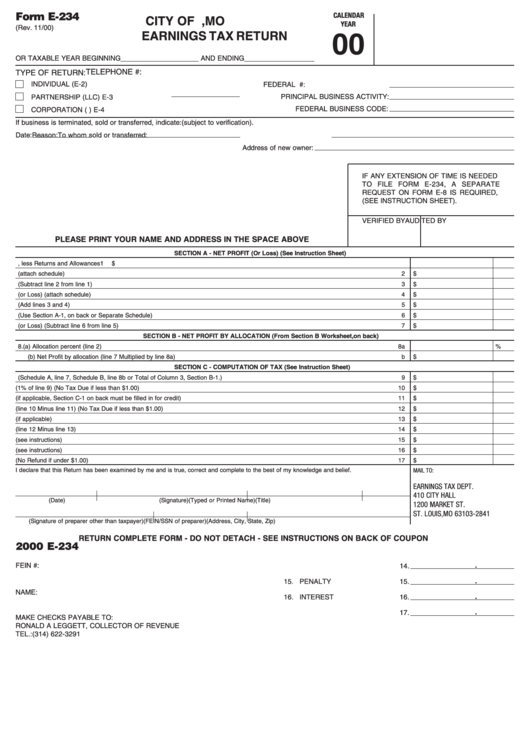

Form E-234

CALENDAR

CITY OF ST. LOUIS, MO

YEAR

(Rev. 11/00)

EARNINGS TAX RETURN

00

OR TAXABLE YEAR BEGINNING ____________________ AND ENDING__________________

TELEPHONE #:

TYPE OF RETURN:

INDIVIDUAL (E-2)

FEDERAL E.I. or SOCIAL SECURITY #:

PRINCIPAL BUSINESS ACTIVITY:

PARTNERSHIP (LLC) E-3

FEDERAL BUSINESS CODE:

CORPORATION (SUB.S. OR C) E-4

If business is terminated, sold or transferred, indicate: (subject to verification).

Date:

Reason:

To whom sold or transferred:

Address of new owner:

IF ANY EXTENSION OF TIME IS NEEDED

TO FILE FORM E-234, A SEPARATE

REQUEST ON FORM E-8 IS REQUIRED,

(SEE INSTRUCTION SHEET).

VERIFIED BY

AUDITED BY

PLEASE PRINT YOUR NAME AND ADDRESS IN THE SPACE ABOVE

SECTION A - NET PROFIT (Or Loss) (See Instruction Sheet)

1. Gross Receipts or Transactions, less Returns and Allowances

1

$

2. Cost of goods sold (attach schedule)

2

$

3. Gross Profit (Subtract line 2 from line 1)

3

$

4. Other Income (or Loss) (attach schedule)

4

$

5. Total Gross Profit (Add lines 3 and 4)

5

$

6. Business Expenses (Use Section A-1, on back or Separate Schedule)

6

$

7. Net Profit (or Loss) (Subtract line 6 from line 5)

7

$

SECTION B - NET PROFIT BY ALLOCATION (From Section B Worksheet, on back)

8. (a) Allocation percent (line 2)

8a

%

(b) Net Profit by allocation (line 7 Multiplied by line 8a)

b

$

SECTION C - COMPUTATION OF TAX (See Instruction Sheet)

9. Taxable Net Profit (Schedule A, line 7, Schedule B, line 8b or Total of Column 3, Section B-1.)

9

$

10. Earnings Tax Due (1% of line 9) (No Tax Due if less than $1.00)

10

$

11. Payroll Expense Tax Credit (if applicable, Section C-1 on back must be filled in for credit)

11

$

12. Net Earnings Tax Due (line 10 Minus line 11) (No Tax Due if less than $1.00)

12

$

13. Less Amount Paid with Extension Request (if applicable)

13

$

14. Subtotal (line 12 Minus line 13)

14

$

15. Penalty (see instructions)

15

$

16. Interest (see instructions)

16

$

17. Amount Due or Refund (No Refund if under $1.00)

17

$

I declare that this Return has been examined by me and is true, correct and complete to the best of my knowledge and belief.

MAIL TO:

EARNINGS TAX DEPT.

410 CITY HALL

(Date)

(Signature)

(Typed or Printed Name)

(Title)

1200 MARKET ST.

ST. LOUIS, MO 63103-2841

(Signature of preparer other than taxpayer)

(FEIN/SSN of preparer)

(Address, City, State, Zip)

RETURN COMPLETE FORM - DO NOT DETACH - SEE INSTRUCTIONS ON BACK OF COUPON

2000 E-234

.

FEIN #:

14. NET TAX DUE

14.

.

15. PENALTY

15.

NAME:

.

16. INTEREST

16.

.

17. AMOUNT DUE

17.

MAKE CHECKS PAYABLE TO:

RONALD A LEGGETT, COLLECTOR OF REVENUE

TEL.: (314) 622-3291

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2