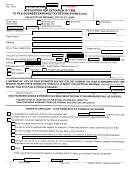

Form E-234 - Earnings Tax Return Page 2

Download a blank fillable Form E-234 - Earnings Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form E-234 - Earnings Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

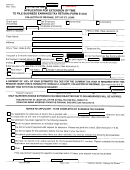

SECTION A-1 - BUSINESS EXPENSE DEDUCTIONS (See Instruction Sheet)

ITEM

AMOUNT

ITEM

AMOUNT

1. Car and Truck Expense

8. Rent

2. Commissions

9. Repairs

10. Taxes (Except Federal, State and

3. Depreciation

Local Income Taxes)

4. Dues and Publications

11. Utilities and Telephone

5. Insurance

12. Wages and Salaries

6. Legal and Professional

13. Other Deductions (Attach list)

(

)

Section A

TOTAL - Enter on line 6

7. Office Expense and Supplies

On Front

SECTION B WORKSHEET - BUSINESS ALLOCATION OF TAXABLE NET PROFIT (See Instruction Sheet)

(1)

(2)

(3)

ALL FACTORS APPLICABLE TO OPERATIONS MUST BE USED

Within & Without

Within

Percentage Col. 2

All columns (1-2-3) must be completed.

St. Louis

St. Louis

to Col. 1

1. (a) Average Value of Real and tangible Personal

Property, including inventory.

(b) Gross Receipts

(c) Wages, Salaries (Except Officers)

TOTAL PERCENTAGE %

2. ALLOCATION PERCENTAGE:

Total of Percentages divided by number of factors used_______________________________________%. Enter this percent on line 8a. SECTION B ON FRONT.

SECTION B-1 - PARTNER’S SHARE OF NET PROFIT (See Instruction Sheet)

Non-resident partners show allocation % from Section B. Partners who are residents of St. Louis are subject to tax on their full

share of net profit and cannot allocate

.

(1) Share of

(2) Allocation

(3) Taxable

PARTNER:

Net Profit

Percentage

Income

Name

FEIN/SSN

Home Address

Zip

Name

FEIN/SSN

Zip

Home Address

(Attach list if necessary)

TOTAL–Enter Total of Column 3 on Front, Line 9

SECTION C-1 PAYROLL EXPENSE TAX CREDIT CALCULATION (SEE INSTRUCTION).

1.

QUARTERLY PAYROLL EXPENSE TAX PAID (FROM LINE 3; FORM P-10)

1ST QTR________________2ND QTR________________3RD QTR_______________4TH QTR__________________

2.

TOTAL P-10 TAX PAID_________________x 20%_________________

3.

TAX AMOUNT DUE FROM LINE 10; SECTION C (REVERSE SIDE)_________________x 25%___________________

4.

TAX CREDIT (ON LINE 11 REVERSE SIDE); USE THE LOWER FIGURE BETWEEN LINES 2 & 3 (ABOVE)

RETURN COMPLETE FORM - DO NOT DETACH

COUPON INSTRUCTIONS

WRITE AMOUNT OF CHECK ON PAYMENT COUPON. IF YOUR RETURN IS GENERATED BY A COMPUTERIZED TAX

PROGRAM. PLEASE SEND THIS REMITTANCE FORM WITH YOUR RETURN.

This return to be filed with Collector of Revenue, City of St. Louis, Earnings Tax Dept., 410 City Hall, 1200 Market St.,

St. Louis, Missouri 63103, on or before April 15th of the year following the calendar year for which tax is due, or within

105 days of the close of your fiscal year.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2