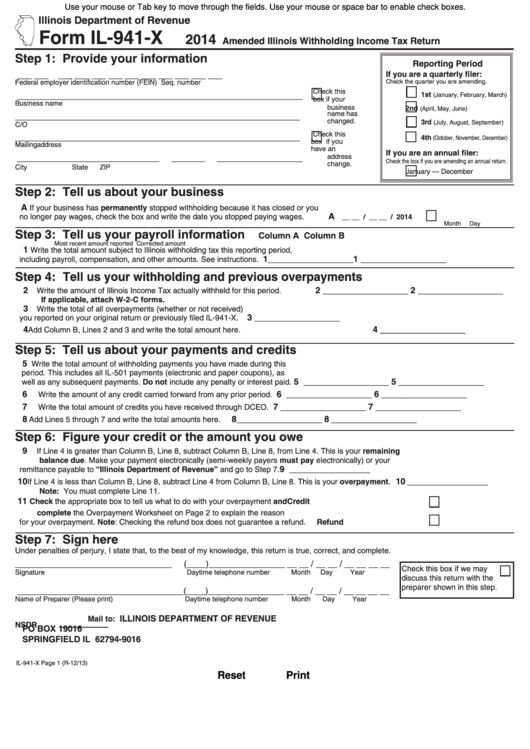

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Form IL-941-X

2014

Amended Illinois Withholding Income Tax Return

Step 1: Provide your information

Reporting Period

If you are a quarterly filer:

___ ___

___ ___ ___ ___ ___ ___ ___

___ ___ ___

Check the quarter you are amending.

Federal employer identification number (FEIN)

Seq. number

Check this

1st

____________________________________________________________

(January, February, March)

box if your

Business name

business

2nd

(April, May, June)

name has

____________________________________________________________

changed.

3rd

(July, August, September)

C/O

Check this

____________________________________________________________

4th

(October, November, December)

box if you

Mailing address

have an

If you are an annual filer:

address

______________________________

_______

__________________

Check the box if you are amending an annual return.

change.

City

State

ZIP

January — December

Step 2: Tell us about your business

A

If your business has permanently stopped withholding because it has closed or you

A

no longer pay wages, check the box and write the date you stopped paying wages.

__ __ / __ __ / 2014

Month

Day

Step 3: Tell us your payroll information

Column A

Column B

Most recent amount reported

Corrected amount

1

Write the total amount subject to Illinois withholding tax this reporting period,

1 __________________ 1 __________________

including payroll, compensation, and other amounts. See instructions.

Step 4: Tell us your withholding and previous overpayments

2

2 __________________

2 __________________

Write the amount of Illinois Income Tax actually withheld for this period.

If applicable, attach W-2-C forms.

3

Write the total of all overpayments (whether or not received)

3 __________________

you reported on your original return or previously filed IL-941-X.

4

4 __________________

Add Column B, Lines 2 and 3 and write the total amount here.

Step 5: Tell us about your payments and credits

5

Write the total amount of withholding payments you have made during this

period. This includes all IL-501 payments (electronic and paper coupons), as

5 __________________ 5 __________________

well as any subsequent payments. Do not include any penalty or interest paid.

6

6 __________________ 6 __________________

Write the amount of any credit carried forward from any prior period.

7

7 __________________

7 __________________

Write the total amount of credits you have received through DCEO.

8

8 __________________ 8 __________________

Add Lines 5 through 7 and write the total amounts here.

Step 6: Figure your credit or the amount you owe

9

If Line 4 is greater than Column B, Line 8, subtract Column B, Line 8, from Line 4. This is your remaining

balance due. Make your payment electronically (semi-weekly payers must pay electronically) or your

9 _________________

remittance payable to “Illinois Department of Revenue” and go to Step 7.

10

10 _________________

If Line 4 is less than Column B, Line 8, subtract Line 4 from Column B, Line 8. This is your overpayment.

Note: You must complete Line 11.

11

Check the appropriate box to tell us what to do with your overpayment and

Credit

complete the Overpayment Worksheet on Page 2 to explain the reason

for your overpayment. Note: Checking the refund box does not guarantee a refund.

Refund

Step 7: Sign here

Under penalties of perjury, I state that, to the best of my knowledge, this return is true, correct, and complete.

_________________________________

(____)________________ __ __ / __ __ / __ __ __ __

Check this box if we may

Signature

Daytime telephone number

Month

Day

Year

discuss this return with the

preparer shown in this step.

___________________________________(____)________________ __ __ / __ __ / __ __ __ __

Name of Preparer (Please print)

Daytime telephone number

Month

Day

Year

ILLINOIS DEPARTMENT OF REVENUE

Mail to:

NS

DR

PO BOX 19016

SPRINGFIELD IL 62794-9016

IL-941-X Page 1 (R-12/13)

Reset

Print

1

1 2

2