Form Ct-709 - Connecticut Gift Tax Return - 2002

ADVERTISEMENT

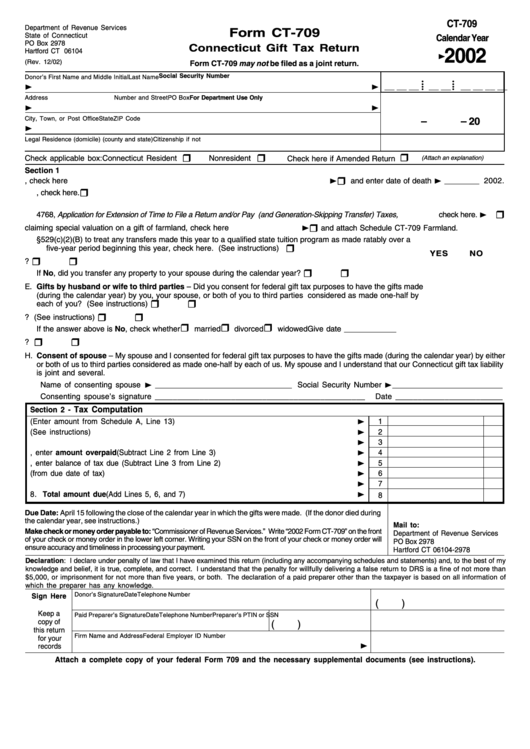

CT-709

Department of Revenue Services

Form CT-709

State of Connecticut

Calendar Year

PO Box 2978

Connecticut Gift Tax Return

2002

Hartford CT 06104

(Rev. 12/02)

Form CT-709 may not be filed as a joint return.

Social Security Number

Donor’s First Name and Middle Initial

Last Name

• •

• •

__ __ __

• •

__ __

• •

__ __ __ __

Address

Number and Street

PO Box

For Department Use Only

City, Town, or Post Office

State

ZIP Code

–

– 20

Legal Residence (domicile) (county and state)

Citizenship if not U.S.

Check applicable box:

Connecticut Resident

Nonresident

(Attach an explanation)

Check here if Amended Return

Section 1

A. 1. If the donor died during the calendar year for which this return is filed, check here

and enter date of death

________ 2002.

2. If the donor died during the calendar year for which this return is filed and no federal estate tax return is required to be filed, check here.

B. If the donor died during the calendar year for which this return is filed and a federal estate tax return extension was requested on federal Form

4768, Application for Extension of Time to File a Return and/or Pay U.S. Estate (and Generation-Skipping Transfer) Taxes, check here.

C. 1. If the donor is claiming special valuation on a gift of farmland, check here

and attach Schedule CT-709 Farmland.

2. If you elect under I.R.C. §529(c)(2)(B) to treat any transfers made this year to a qualified state tuition program as made ratably over a

five-year period beginning this year, check here. (See instructions)

YES

NO

D. Is your spouse a U.S. citizen? .......................................................................................................................................

If No, did you transfer any property to your spouse during the calendar year? .............................................................

E. Gifts by husband or wife to third parties – Did you consent for federal gift tax purposes to have the gifts made

(during the calendar year) by you, your spouse, or both of you to third parties considered as made one-half by

each of you? (See instructions) ...................................................................................................................................

F. Were you married to one another during the entire calendar year? (See instructions) ..............................................

If the answer above is No, check whether

married

divorced

widowed

Give date ____________

G. Will your spouse file a gift tax return for this calendar year? ........................................................................................

H. Consent of spouse – My spouse and I consented for federal gift tax purposes to have the gifts made (during the calendar year) by either

or both of us to third parties considered as made one-half by each of us. My spouse and I understand that our Connecticut gift tax liability

is joint and several.

Name of consenting spouse

_______________________________ Social Security Number

_________________________

Consenting spouse’s signature _______________________________________________

Date ________________________

Tax Computation

Section 2 -

1. Taxable gifts (Enter amount from Schedule A, Line 13) ...........................................................

1

2. Connecticut Gift Tax (See instructions) .......................................................................................

2

3. Payments made with extension request ....................................................................................

3

4. If Line 3 is greater than Line 2, enter amount overpaid (Subtract Line 2 from Line 3) .........

4

5. If Line 2 is greater than Line 3, enter balance of tax due (Subtract Line 3 from Line 2) ........

5

6. Interest (from due date of tax) ......................................................................................................

6

7. Penalty ............................................................................................................................................

7

8. Total amount due (Add Lines 5, 6, and 7) ..................................................................................

8

Due Date: April 15 following the close of the calendar year in which the gifts were made. (If the donor died during

the calendar year, see instructions.)

Mail to:

Make check or money order payable to: “Commissioner of Revenue Services.” Write “2002 Form CT-709” on the front

Department of Revenue Services

of your check or money order in the lower left corner. Writing your SSN on the front of your check or money order will

PO Box 2978

ensure accuracy and timeliness in processing your payment.

Hartford CT 06104-2978

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my

knowledge and belief, it is true, complete, and correct. I understand that the penalty for willfully delivering a false return to DRS is a fine of not more than

$5,000, or imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of

which the preparer has any knowledge.

Donor’s Signature

Date

Telephone Number

Sign Here

(

)

Keep a

Paid Preparer’s Signature

Date

Telephone Number

Preparer’s PTIN or SSN

copy of

(

)

this return

Firm Name and Address

Federal Employer ID Number

for your

records

Attach a complete copy of your federal Form 709 and the necessary supplemental documents (see instructions).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2