Form Ct-706 - Connecticut Estate Tax Return - Connecticut Department Of Revenue Services

ADVERTISEMENT

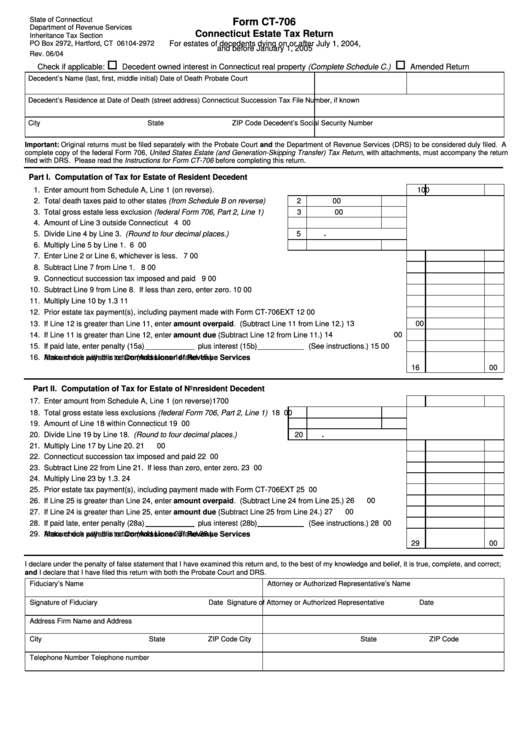

State of Connecticut

Form CT-706

Department of Revenue Services

Connecticut Estate Tax Return

Inheritance Tax Section

For estates of decedents dying on or after July 1, 2004,

PO Box 2972, Hartford, CT 06104-2972

and before January 1, 2005

Rev. 06/04

Check if applicable:

Decedent owned interest in Connecticut real property (Complete Schedule C.)

Amended Return

Decedent’s Name (last, first, middle initial)

Date of Death

Probate Court

Decedent’s Residence at Date of Death (street address)

Connecticut Succession Tax File Number, if known

City

State

ZIP Code

Decedent’s Social Security Number

Important: Original returns must be filed separately with the Probate Court and the Department of Revenue Services (DRS) to be considered duly filed. A

complete copy of the federal Form 706, United States Estate (and Generation-Skipping Transfer) Tax Return, with attachments, must accompany the return

filed with DRS. Please read the Instructions for Form CT-706 before completing this return.

Part I. Computation of Tax for Estate of Resident Decedent

1. Enter amount from Schedule A, Line 1 (on reverse).

1

00

2. Total death taxes paid to other states (from Schedule B on reverse)

2

00

3. Total gross estate less exclusion (federal Form 706, Part 2, Line 1)

3

00

4. Amount of Line 3 outside Connecticut

4

00

5. Divide Line 4 by Line 3. (Round to four decimal places.)

5

.

6. Multiply Line 5 by Line 1.

6

00

7. Enter Line 2 or Line 6, whichever is less.

7

00

8. Subtract Line 7 from Line 1.

8

00

9. Connecticut succession tax imposed and paid

9

00

10. Subtract Line 9 from Line 8. If less than zero, enter zero.

10

00

11. Multiply Line 10 by 1.3

11

12. Prior estate tax payment(s), including payment made with Form CT-706EXT

12

00

13

00

13. If Line 12 is greater than Line 11, enter amount overpaid. (Subtract Line 11 from Line 12.)

14

00

14. If Line 11 is greater than Line 12, enter amount due (Subtract Line 12 from Line 11.)

15. If paid late, enter penalty (15a)

plus interest (15b)

(See instructions.)

15

00

16. Amount due with this return (Add Lines 14 and 15.)

Make check payable to: Commissioner of Revenue Services

16

00

Part II. Computation of Tax for Estate of Nonresident Decedent

17. Enter amount from Schedule A, Line 1 (on reverse)

17

00

18. Total gross estate less exclusions (federal Form 706, Part 2, Line 1)

18

00

19. Amount of Line 18 within Connecticut

19

00

20. Divide Line 19 by Line 18. (Round to four decimal places.)

20

.

21. Multiply Line 17 by Line 20.

21

00

22. Connecticut succession tax imposed and paid

22

00

23. Subtract Line 22 from Line 21. If less than zero, enter zero.

23

00

24. Multiply Line 23 by 1.3.

24

25. Prior estate tax payment(s), including payment made with Form CT-706EXT

25

00

26

00

26. If Line 25 is greater than Line 24, enter amount overpaid. (Subtract Line 24 from Line 25.)

27

00

27. If Line 24 is greater than Line 25, enter amount due (Subtract Line 25 from Line 24.)

28. If paid late, enter penalty (28a)

plus interest (28b)

(See instructions.)

28

00

29. Amount due with this return (Add Lines 27 and 28.).

Make check payable to: Commissioner of Revenue Services

29

00

I declare under the penalty of false statement that I have examined this return and, to the best of my knowledge and belief, it is true, complete, and correct;

and I declare that I have filed this return with both the Probate Court and DRS.

Fiduciary’s Name

Attorney or Authorized Representative’s Name

Signature of Fiduciary

Date

Signature of Attorney or Authorized Representative

Date

Address

Firm Name and Address

City

State

ZIP Code

City

State

ZIP Code

Telephone Number

Telephone number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2