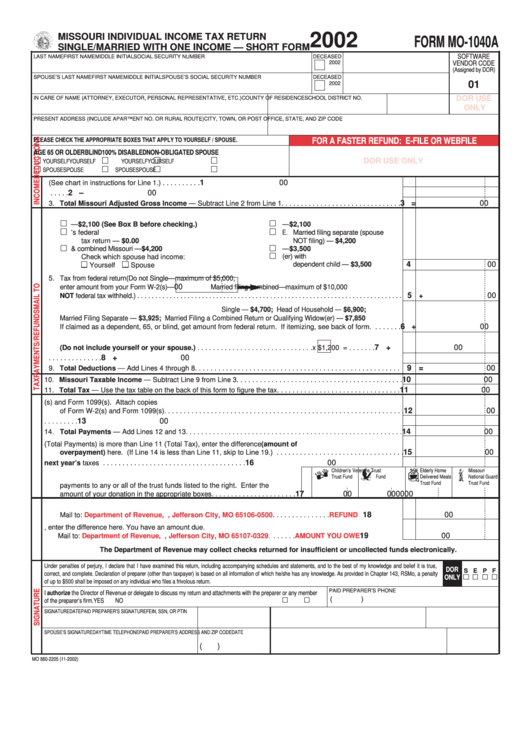

Form Mo-1040a - Missouri Individual Income Tax Return Single/married With One Income - 2002

ADVERTISEMENT

2002

MISSOURI INDIVIDUAL INCOME TAX RETURN

FORM MO-1040A

SINGLE/MARRIED WITH ONE INCOME — SHORT FORM

SOFTWARE

LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEASED

SOCIAL SECURITY NUMBER

2002

VENDOR CODE

(Assigned by DOR)

SPOUSE’S LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEASED

SPOUSE’S SOCIAL SECURITY NUMBER

01

2002

DOR USE

IN CARE OF NAME (ATTORNEY, EXECUTOR, PERSONAL REPRESENTATIVE, ETC.)

COUNTY OF RESIDENCE

SCHOOL DISTRICT NO.

ONLY

PRESENT ADDRESS (INCLUDE APARTMENT NO. OR RURAL ROUTE)

CITY, TOWN, OR POST OFFICE, STATE, AND ZIP CODE

PLEASE CHECK THE APPROPRIATE BOXES THAT APPLY TO YOURSELF / SPOUSE.

FOR A FASTER REFUND: E-FILE OR WEBFILE

AGE 65 OR OLDER

BLIND

100% DISABLED

NON-OBLIGATED SPOUSE

DOR USE ONLY

YOURSELF

YOURSELF

YOURSELF

YOURSELF

SPOUSE

SPOUSE

SPOUSE

SPOUSE

1

00

1. Federal adjusted gross income from your 2002 federal return (See chart in instructions for Line 1.) . . . . . . . . . .

2 –

00

2. Any state income tax refund included in your 2002 federal income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 =

00

3. Total Missouri Adjusted Gross Income — Subtract Line 2 from Line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Mark your filing status box below and enter the appropriate exemption amount on Line 4.

A. Single — $2,100 (See Box B before checking.)

D. Married filing separate — $2,100

B. Claimed as a dependent on another person’s federal

E. Married filing separate (spouse

tax return — $0.00

NOT filing) — $4,200

C. Married filing joint federal & combined Missouri — $4,200

F. Head of household — $3,500

G. Qualifying widow(er) with

Check which spouse had income:

dependent child — $3,500

4

00

Yourself

Spouse

5. Tax from federal return (Do not

Single—maximum of $5,000;

00

enter amount from your Form W-2(s)—

Married filing combined—maximum of $10,000

5

00

NOT federal tax withheld.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

+

6. Missouri standard deduction or itemized deductions Single — $4,700; Head of Household — $6,900;

Married Filing Separate — $3,925; Married Filing a Combined Return or Qualifying Widow(er) — $7,850

6 +

00

If claimed as a dependent, 65, or blind, get amount from federal return. If itemizing, see back of form. . . . . . . .

7. Number of dependents you claimed on your federal return

7 +

00

(Do not include yourself or your spouse.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

x $1,200 = . . . . . . .

8 +

00

8. Long-term care insurance deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9 =

00

9. Total Deductions — Add Lines 4 through 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

00

10. Missouri Taxable Income — Subtract Line 9 from Line 3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

00

11. Total Tax — Use the tax table on the back of this form to figure the tax. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Missouri tax withheld from your Form W-2(s) and Form 1099(s). Attach copies

12

00

of Form W-2(s) and Form 1099(s). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

00

13. Any Missouri estimated tax payments made for 2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

00

14. Total Payments — Add Lines 12 and 13. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. If Line 14 (Total Payments) is more than Line 11 (Total Tax), enter the difference (amount of

15

00

overpayment) here. (If Line 14 is less than Line 11, skip to Line 19.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

00

16. Amount from Line 15 that you want applied to next year’s taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Children’s

Veterans Trust

Elderly Home

Missouri

17. You may donate part of your overpaid amount or contribute additional

Trust Fund

Fund

Delivered Meals

National Guard

Trust Fund

Trust Fund

payments to any or all of the trust funds listed to the right. Enter the

17

00

00

00

00

amount of your donation in the appropriate boxes. . . . . . . . . . . . . . . . . . . . . .

18. Subtract Lines 16 and 17 from Line 15 and enter here. This is your refund.

18

00

Mail to:

Department of Revenue, P.O. Box 500, Jefferson City, MO 65106-0500.

. . . . . . . . . . . . .

.REFUND

19. If Line 14 is less than Line 11, enter the difference here. You have an amount due.

19

00

Mail to:

Department of Revenue, P.O. Box 329, Jefferson City, MO 65107-0329.

. . . . .

.AMOUNT YOU OWE

The Department of Revenue may collect checks returned for insufficient or uncollected funds electronically.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true,

DOR

S E P F

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which he/she has any knowledge. As provided in Chapter 143, RSMo, a penalty

ONLY

of up to $500 shall be imposed on any individual who files a frivolous return.

PAID PREPARER’S PHONE

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any member

(

)

of the preparer’s firm.

YES

NO

SIGNATURE

DATE

PAID PREPARER’S SIGNATURE

FEIN, SSN, OR PTIN

SPOUSE’S SIGNATURE

DAYTIME TELEPHONE

PAID PREPARER’S ADDRESS AND ZIP CODE

DATE

(

)

MO 860-2205 (11-2002)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2