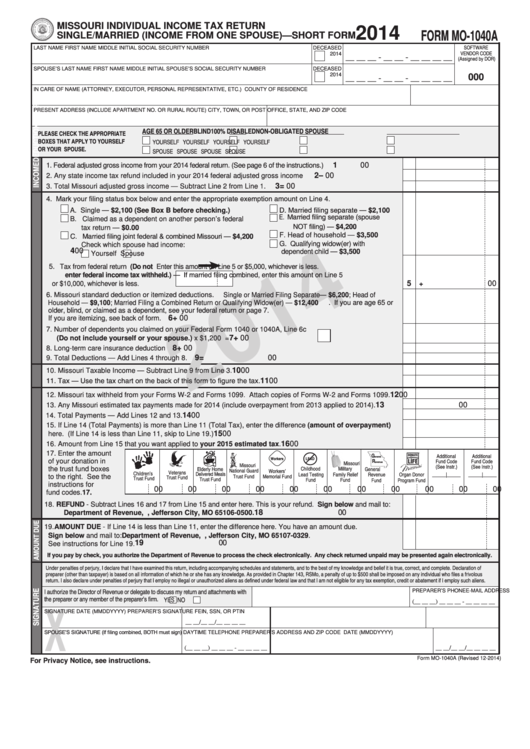

Form Mo-1040a - Missouri Individual Income Tax Return Single/married (Income From One Spouse) - 2014

ADVERTISEMENT

MISSOURI INDIVIDUAL INCOME TAX RETURN

2014

FORM MO-1040A

SINGLE/MARRIED (INCOME FROM ONE SPOUSE)—SHORT FORM

SOFTWARE

LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEASED

SOCIAL SECURITY NUMBER

VENDOR CODE

2014

__ __ __ - __ __ - __ __ __ __

(Assigned by DOR)

SPOUSE’S LAST NAME

FIRST NAME

MIDDLE INITIAL

DECEASED

SPOUSE’S SOCIAL SECURITY NUMBER

2014

000

__ __ __ - __ __ - __ __ __ __

IN CARE OF NAME (ATTORNEY, EXECUTOR, PERSONAL REPRESENTATIVE, ETC.)

COUNTY OF RESIDENCE

PRESENT ADDRESS (INCLUDE APARTMENT NO. OR RURAL ROUTE)

CITY, TOWN, OR POST OFFICE, STATE, AND ZIP CODE

AGE 65 OR OLDER

BLIND

100% DISABLED

NON-OBLIGATED SPOUSE

PLEASE CHECK THE APPROPRIATE

BOXES THAT APPLY TO YOURSELF

YOURSELF

YOURSELF

YOURSELF

YOURSELF

OR YOUR SPOUSE.

SPOUSE

SPOUSE

SPOUSE

SPOUSE

1

00

1. Federal adjusted gross income from your 2014 federal return. (See page 6 of the instructions.) ...................................

2 –

00

2. Any state income tax refund included in your 2014 federal adjusted gross income .............................................

3 =

00

3. Total Missouri adjusted gross income — Subtract Line 2 from Line 1. .................................................................

4. Mark your filing status box below and enter the appropriate exemption amount on Line 4.

D. Married filing separate — $2,100

A. Single — $2,100 (See Box B before checking.)

E. Married filing separate (spouse

B. Claimed as a dependent on another person’s federal

NOT filing) — $4,200

tax return — $0.00

C. Married filing joint federal & combined Missouri — $4,200

F. Head of household — $3,500

G. Qualifying widow(er) with

Check which spouse had income:

4

00

dependent child — $3,500

Yourself

Spouse

5. Tax from federal return (Do not

Enter this amount on Line 5 or $5,000, whichever is less.

enter federal income tax withheld.) —

If married filing combined, enter this amount on Line 5

5

00

or $10,000, whichever is less. ...........................................

+

6. Missouri standard deduction or itemized deductions. Single or Married Filing Separate— $6,200; Head of

Household — $9,100; Married Filing a Combined Return or Qualifying Widow(er) — $12,400. If you are age 65 or

older, blind, or claimed as a dependent, see your federal return or page 7.

6 +

00

If you are itemizing, see back of form. .....................................................................................................................

7. Number of dependents you claimed on your Federal Form 1040 or 1040A, Line 6c

7 +

00

(Do not include yourself or your spouse.) ...........................................................

x $1,200 = ..............

8 +

00

8. Long-term care insurance deduction ......................................................................................................................

9 =

00

9. Total Deductions — Add Lines 4 through 8. ...........................................................................................................

10

00

10. Missouri Taxable Income — Subtract Line 9 from Line 3. ......................................................................................

11. Tax — Use the tax chart on the back of this form to figure the tax. .......................................................................

11

00

12

00

12. Missouri tax withheld from your Forms W-2 and Forms 1099. Attach copies of Forms W-2 and Forms 1099. .....

13

00

13. Any Missouri estimated tax payments made for 2014 (include overpayment from 2013 applied to 2014). ............

14

00

14. Total Payments — Add Lines 12 and 13. ................................................................................................................

15. If Line 14 (Total Payments) is more than Line 11 (Total Tax), enter the difference (amount of overpayment)

15

00

here. (If Line 14 is less than Line 11, skip to Line 19.) ...........................................................................................

16

00

16. Amount from Line 15 that you want applied to your 2015 estimated tax. .............................................................

17. Enter the amount

G

Additional

Additional

eneral

Workers

LEAD

R

of your donation in

Fund Code

Fund Code

Missouri

evenue

Missouri

(See Instr.)

(See Instr.)

Military

Elderly Home

Childhood

General

the trust fund boxes

National Guard

Workers’

Veterans

Children’s

Delivered Meals

Lead Testing

Family Relief

Organ Donor

______|______

______|______

Revenue

Trust Fund

Memorial Fund

to the right. See the

Trust Fund

Trust Fund

Trust Fund

Fund

Fund

Fund

Program Fund

instructions for

00

00

00

00

00

00

00

00

00

00

00

fund codes. ........ 17.

18. REFUND - Subtract Lines 16 and 17 from Line 15 and enter here. This is your refund. Sign below and mail to:

18

00

Department of Revenue, P.O. Box 500, Jefferson City, MO 65106-0500. ........................................................

19. AMOUNT DUE - If Line 14 is less than Line 11, enter the difference here. You have an amount due.

Sign below and mail to: Department of Revenue, P.O. Box 329, Jefferson City, MO 65107-0329.

19

00

See instructions for Line 19. ...................................................................................................................................

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief it is true, correct, and complete. Declaration of

preparer (other than taxpayer) is based on all information of which he or she has any knowledge. As provided in Chapter 143, RSMo, a penalty of up to $500 shall be imposed on any individual who files a frivolous

return. I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or abatement if I employ such aliens.

I authorize the Director of Revenue or delegate to discuss my return and attachments with

E-MAIL ADDRESS

PREPARER’S PHONE

the preparer or any member of the preparer’s firm.

YES

NO

(__ __ __) __ __ __ - __ __ __ __

X

SIGNATURE

DATE (MMDDYYYY)

PREPARER’S SIGNATURE

FEIN, SSN, OR PTIN

__ __/__ __/__ __ __ __

SPOUSE’S SIGNATURE (If filing combined, BOTH must sign)

DAYTIME TELEPHONE

PREPARER’S ADDRESS AND ZIP CODE

DATE (MMDDYYYY)

(__ __ __) __ __ __ - __ __ __ __

__ __/__ __/__ __ __ __

Form MO-1040A (Revised 12-2014)

For Privacy Notice, see instructions.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2