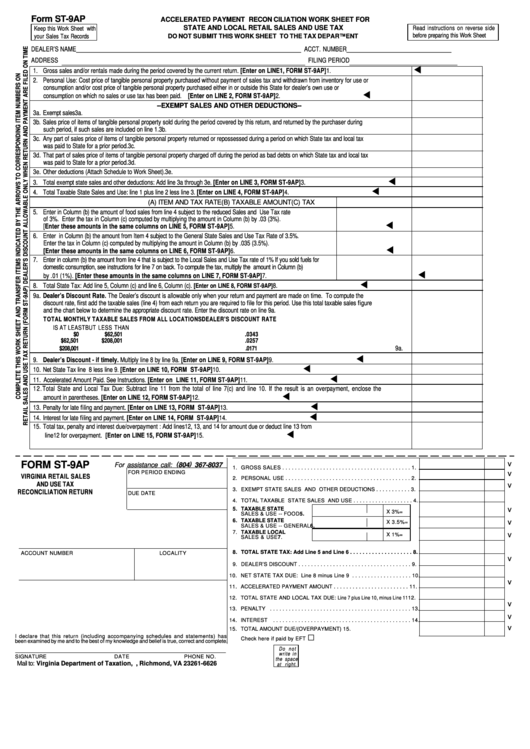

Form St-9ap - Accelerated Payment Reconciliation Work Sheet For State And Local Retail Sales And Use Tax

ADVERTISEMENT

Form ST-9AP

ACCELERATED PAYMENT RECONCILIATION WORK SHEET FOR

Read instructions on reverse side

Keep this Work Sheet with

STATE AND LOCAL RETAIL SALES AND USE TAX

before preparing this Work Sheet

your Sales Tax Records

DO NOT SUBMIT THIS WORK SHEET TO THE TAX DEPARTMENT

DEALER’S NAME _________________________________________________________________________ ACCT. NUMBER __________________________________

ADDRESS _______________________________________________________________________________ FILING PERIOD ___________________________________

t

1. Gross sales and/or rentals made during the period covered by the current return. [Enter on LINE1, FORM ST-9AP]

1.

2. Personal Use: Cost price of tangible personal property purchased without payment of sales tax and withdrawn from inventory for use or

consumption and/or cost price of tangible personal property purchased either in or outside this State for dealer’s own use or

t

consumption on which no sales or use tax has been paid. [Enter on LINE 2, FORM ST-9AP]

2.

--EXEMPT SALES AND OTHER DEDUCTIONS--

3a. Exempt sales

3a.

3b. Sales price of items of tangible personal property sold during the period covered by this return, and returned by the purchaser during

such period, if such sales are included on line 1.

3b.

3c. Any part of sales price of items of tangible personal property returned or repossessed during a period on which State tax and local tax

was paid to State for a prior period.

3c.

3d. That part of sales price of items of tangible personal property charged off during the period as bad debts on which State tax and local tax

was paid to State for a prior period.

3d.

3e. Other deductions (Attach Schedule to Work Sheet).

3e.

t

3. Total exempt state sales and other deductions: Add line 3a through 3e. [Enter on LINE 3, FORM ST-9AP]

3.

t

4. Total Taxable State Sales and Use: line 1 plus line 2 less line 3. [Enter on LINE 4, FORM ST-9AP]

4.

(A) ITEM AND TAX RATE

(B) TAXABLE AMOUNT

(C) TAX

5. Enter in Column (b) the amount of food sales from line 4 subject to the reduced Sales and Use Tax rate

of 3%. Enter the tax in Column (c) computed by multiplying the amount in Column (b) by .03 (3%).

t

[Enter these amounts in the same columns on LINE 5, FORM ST-9AP]

5.

6. Enter in Column (b) the amount from Item 4 subject to the General State Sales and Use Tax Rate of 3.5%.

Enter the tax in Column (c) computed by multiplying the amount in Column (b) by .035 (3.5%).

t

[Enter these amounts in the same columns on LINE 6, FORM ST-9AP]

6.

7. Enter in column (b) the amount from line 4 that is subject to the Local Sales and Use Tax rate of 1% If you sold fuels for

domestic consumption, see instructions for line 7 on back. To compute the tax, multiply the amount in Column (b)

t

by .01 (1%). [Enter these amounts in the same columns on LINE 7, FORM ST-9AP]

7.

t

8. Total State Tax: Add line 5, Column (c) and line 6, Column (c).

8.

[Enter on LINE 8, FORM ST-9AP]

9a. Dealer’s Discount Rate. The Dealer’s discount is allowable only when your return and payment are made on time. To compute the

discount rate, first add the taxable sales (line 4) from each return you are required to file for this period. Use this total taxable sales figure

and the chart below to determine the appropriate discount rate. Enter the discount rate on line 9a.

TOTAL MONTHLY TAXABLE SALES FROM ALL LOCATIONS

DEALER’S DISCOUNT RATE

IS AT LEAST

BUT LESS THAN

$0

$62,501

.0343

$62,501

$208,001

.0257

$208,001

.0171

9a.

t

9. Dealer’s Discount - if timely. Multiply line 8 by line 9a. [Enter on LINE 9, FORM ST-9AP]

9.

t

10. Net State Tax line 8 less line 9. [Enter on LINE 10, FORM ST-9AP]

10.

t

11. Accelerated Amount Paid. See Instructions. [Enter on LINE 11, FORM ST-9AP]

11.

12. Total State and Local Tax Due: Subtract line 11 from the total of line 7(c) and line 10. If the result is an overpayment, enclose the

t

amount in parentheses. [Enter on LINE 12, FORM ST-9AP]

12.

t

13. Penalty for late filing and payment. [Enter on LINE 13, FORM ST-9AP]

13.

t

14. Interest for late filing and payment. [Enter on LINE 14, FORM ST-9AP]

14.

15. Total tax, penalty and interest due/overpayment : Add lines12, 13, and 14 for amount due or deduct line 13 from

t

line12 for overpayment. [Enter on LINE 15, FORM ST-9AP]

15.

v

FORM ST-9AP

(

)

For assistance call:

804

367-8037

1. GROSS SALES . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1.

v

FOR PERIOD ENDING

VIRGINIA RETAIL SALES

2. PERSONAL USE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2.

AND USE TAX

v

3. EXEMPT STATE SALES AND OTHER DEDUCTIONS

. . . . . . . . . . . 3.

RECONCILIATION RETURN

DUE DATE

4. TOTAL TAXABLE STATE SALES AND USE . . . . . . . . . . . . . . . . . . . 4.

v

5. TAXABLE STATE

X 3%

=

SALES & USE -- FOOD

5.

v

6. TAXABLE STATE

X 3.5% =

SALES & USE -- GENERAL

6.

7. TAXABLE LOCAL

v

X 1%

=

SALES & USE

7.

8. TOTAL STATE TAX: Add Line 5 and Line 6 . . . . . . . . . . . . . . . . . . . . 8.

ACCOUNT NUMBER

LOCALITY

v

9. DEALER’S DISCOUNT . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9.

10. NET STATE TAX DUE: Line 8 minus Line 9 . . . . . . . . . . . . . . . . . . . 10.

v

11. ACCELERATED PAYMENT AMOUNT . . . . . . . . . . . . . . . . . . . . . . . . 11.

12. TOTAL STATE AND LOCAL TAX DUE: Line 7 plus Line 10, minus Line 11 12.

v

13. PENALTY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

v

14. INTEREST

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

v

15. TOTAL AMOUNT DUE/(OVERPAYMENT) ........................................... 15.

£

I declare that this return (including accompanying schedules and statements) has

Check here if paid by EFT

been examined by me and to the best of my knowledge and belief is true, correct and complete.

D o n o t

write in

SIGNATURE

DATE

PHONE NO.

the space

Mail to : Virginia Department of Taxation, P.O. Box 26626 , Richmond, VA 23261-6626

at right.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1